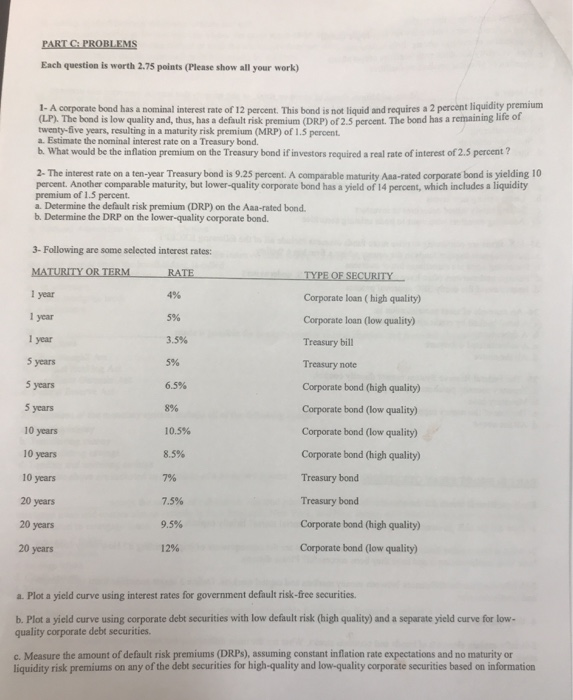

Question: PART C. PROBLEMS Each question is worth 2.75 points (Please show all your work) 1- A corporate boad has a nominal interest rate of 12

PART C. PROBLEMS Each question is worth 2.75 points (Please show all your work) 1- A corporate boad has a nominal interest rate of 12 percent. This bond is not liguid and requires a 2 percent liquidity premium (LP). The bond is low quality and, thus, has a default risk premium (DRP) of 2.5 percent. The bond has a remaining lite of twenty-five years, resulting in a maturity risk premium (MRP) of 1.5 percent a. Estimate the nominal interest rate on a Treasury bond. b. What would be the inflation premium on the Treasury bond if investors required a real rate of interest of 2.5 percent ? 2- The interest rate on a ten-year Treasury bond is 9.25 percent. A comparable maturity Aaa-rated corporate bond is yielding 10 percent. Another comparable maturity, but lower-quality corporate bond has a yield of 14 percent, which inclades a liquidity premium of 1.5 percent. a. Determine the default risk premium (DRP) on the Aaa-rated bond. b. Determine the DRP on the lower-quality corporate bond. 3-Following are some selected interest rates: 1 year year 1 year 5 years 5 years 5 years 10 years 10 years 10 years 20 years 20 years 20 years Corporate loan (high quality) Corporate loan (low quality) Treasury bill Treasury note Corporate bond (high quality) Corporate bond (low quality) Corporate bond (low quality) Corporate bond (high quality) Treasury bond Treasury bond Corporate bond (high quality) Corporate bond (low quality 4% 5% 3.5% 5% 6.5% 8% 10.5% 8.5% 7% 7.5% 9.5% 12% a. Plot a yield curve using interest rates for government default risk-free securitics. b. Plot a yield curve using corporate debt securities with low default risk (high quality) and a separate yield curve for low quality corporate debt securities. c. Measure the amount of default risk premiums (DRPs), assuming constant inflation rate expectations and no maturity or liquidity risk premiums on any of the debt securities for high-quality and low-quality corporate securities based on information PART C. PROBLEMS Each question is worth 2.75 points (Please show all your work) 1- A corporate boad has a nominal interest rate of 12 percent. This bond is not liguid and requires a 2 percent liquidity premium (LP). The bond is low quality and, thus, has a default risk premium (DRP) of 2.5 percent. The bond has a remaining lite of twenty-five years, resulting in a maturity risk premium (MRP) of 1.5 percent a. Estimate the nominal interest rate on a Treasury bond. b. What would be the inflation premium on the Treasury bond if investors required a real rate of interest of 2.5 percent ? 2- The interest rate on a ten-year Treasury bond is 9.25 percent. A comparable maturity Aaa-rated corporate bond is yielding 10 percent. Another comparable maturity, but lower-quality corporate bond has a yield of 14 percent, which inclades a liquidity premium of 1.5 percent. a. Determine the default risk premium (DRP) on the Aaa-rated bond. b. Determine the DRP on the lower-quality corporate bond. 3-Following are some selected interest rates: 1 year year 1 year 5 years 5 years 5 years 10 years 10 years 10 years 20 years 20 years 20 years Corporate loan (high quality) Corporate loan (low quality) Treasury bill Treasury note Corporate bond (high quality) Corporate bond (low quality) Corporate bond (low quality) Corporate bond (high quality) Treasury bond Treasury bond Corporate bond (high quality) Corporate bond (low quality 4% 5% 3.5% 5% 6.5% 8% 10.5% 8.5% 7% 7.5% 9.5% 12% a. Plot a yield curve using interest rates for government default risk-free securitics. b. Plot a yield curve using corporate debt securities with low default risk (high quality) and a separate yield curve for low quality corporate debt securities. c. Measure the amount of default risk premiums (DRPs), assuming constant inflation rate expectations and no maturity or liquidity risk premiums on any of the debt securities for high-quality and low-quality corporate securities based on information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts