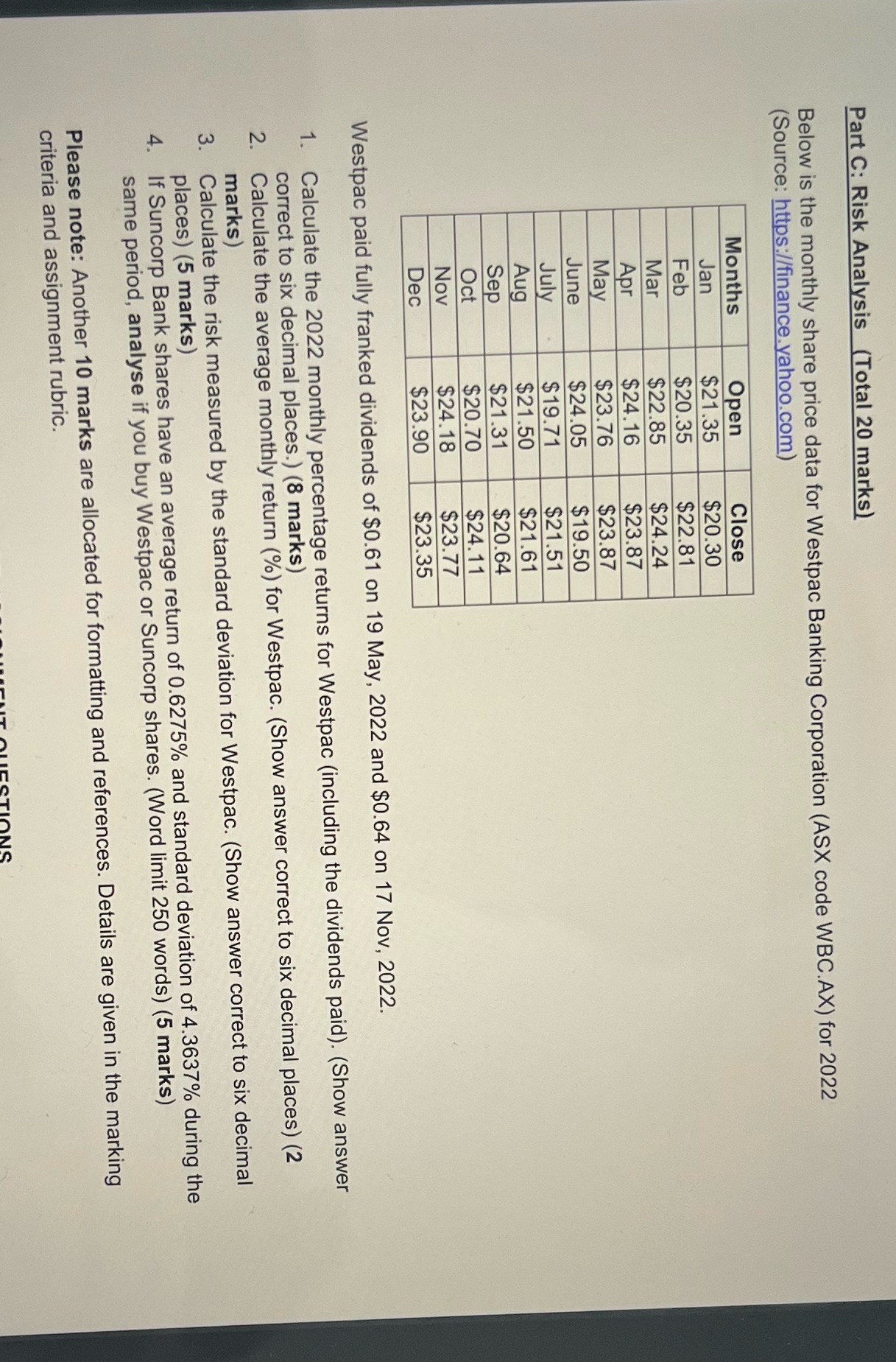

Question: Part C: Risk Analysis (Total 20 marks) Below is the monthly share price data for Westpac Banking Corporation (ASX code WBC.AX) for 2022 (Source: https://finance.yahoo.com)

Part C: Risk Analysis (Total 20 marks) Below is the monthly share price data for Westpac Banking Corporation (ASX code WBC.AX) for 2022 (Source: https://finance.yahoo.com) Months Open Close Jan $21.35 $20.30 Feb $20.35 $22.81 Mar $22.85 $24.24 Apr $24. 16 $23.87 May $23.76 $23.87 June $24.05 $19.50 July $19.71 $21.51 Aug $21.50 $21.61 Sep $21.31 $20.64 Oct $20.70 $24. 11 Nov $24.18 $23.77 Dec $23.90 $23.35 Westpac paid fully franked dividends of $0.61 on 19 May, 2022 and $0.64 on 17 Nov, 2022. 1. Calculate the 2022 monthly percentage returns for Westpac (including the dividends paid). (Show answer correct to six decimal places.) (8 marks) Calculate the average monthly return (%) for Westpac. (Show answer correct to six decimal places) (2 marks) 3. Calculate the risk measured by the standard deviation for Westpac. (Show answer correct to six decimal places) (5 marks) If Suncorp Bank shares have an average return of 0.6275% and standard deviation of 4.3637% during the same period, analyse if you buy Westpac or Suncorp shares. (Word limit 250 words) (5 marks) Please note: Another 10 marks are allocated for formatting and references. Details are given in the marking criteria and assignment rubric

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts