Question: Part C. Understating assets or overstating liabilities and reserves when acquiring a new company: When a new company is acquired, how does understating assets or

Part C. Understating assets or overstating liabilities and reserves when acquiring a new company: When a new company is acquired, how does understating assets or overstating liabilities and reserves increase the reported post-acquisition income of the parent company?

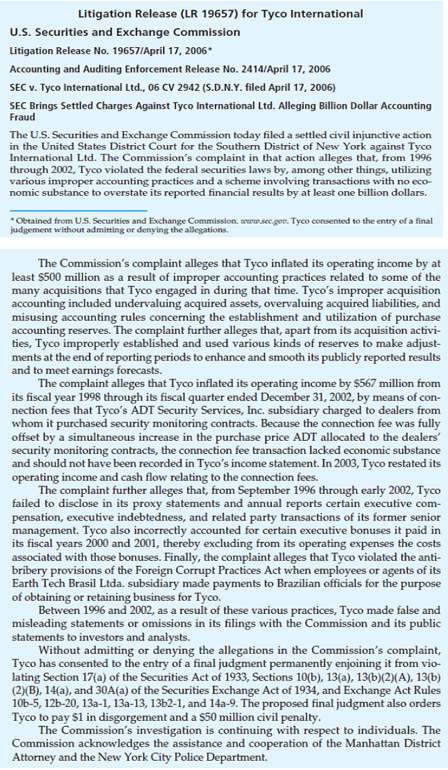

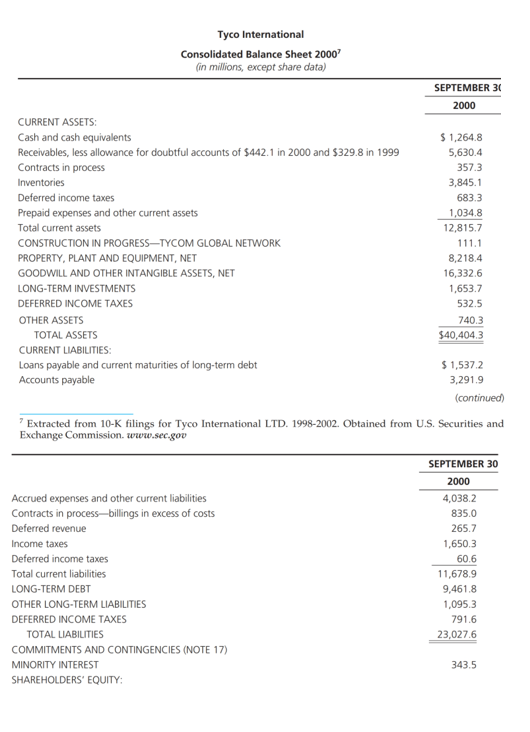

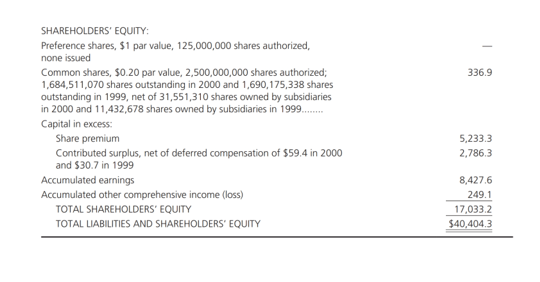

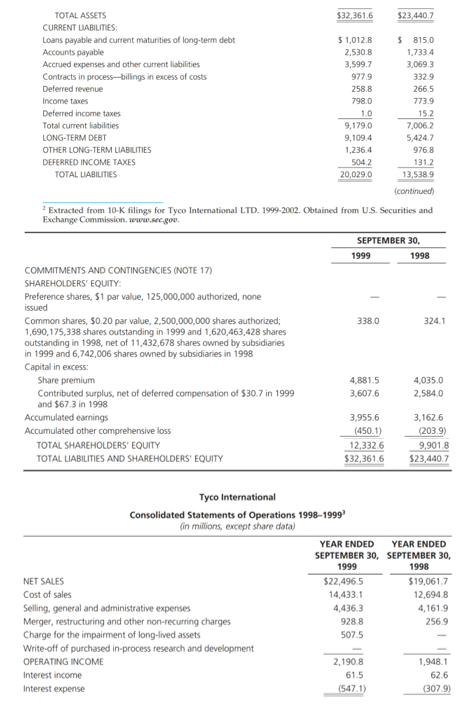

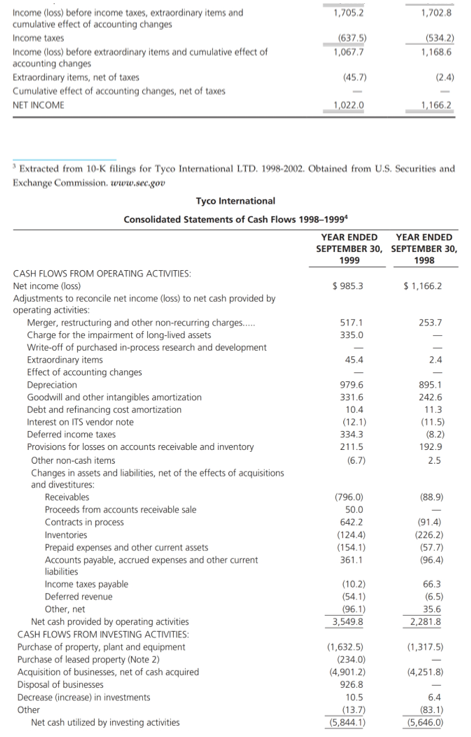

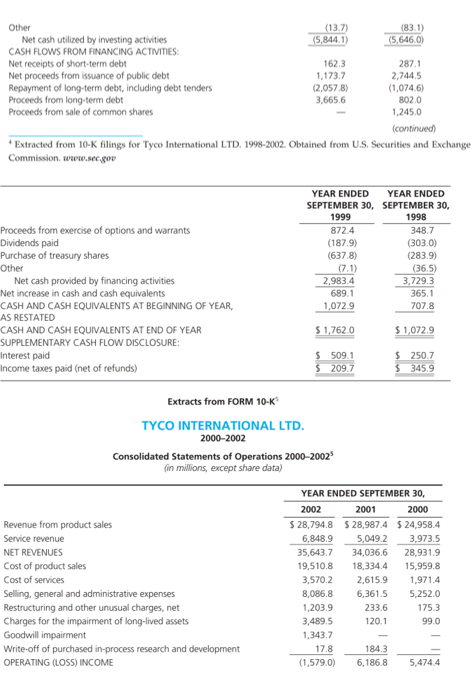

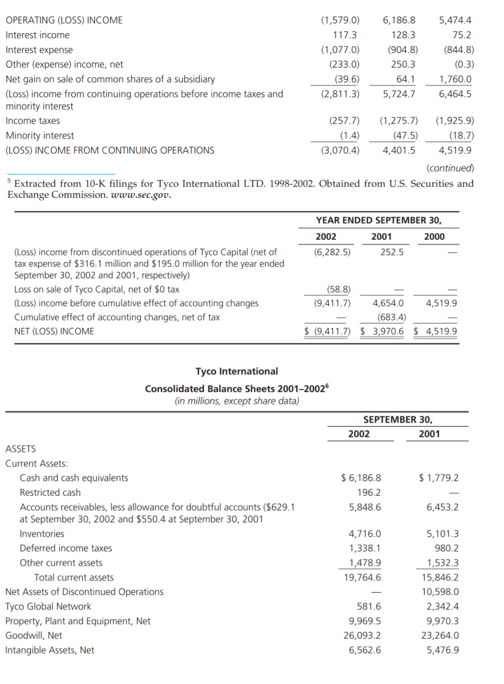

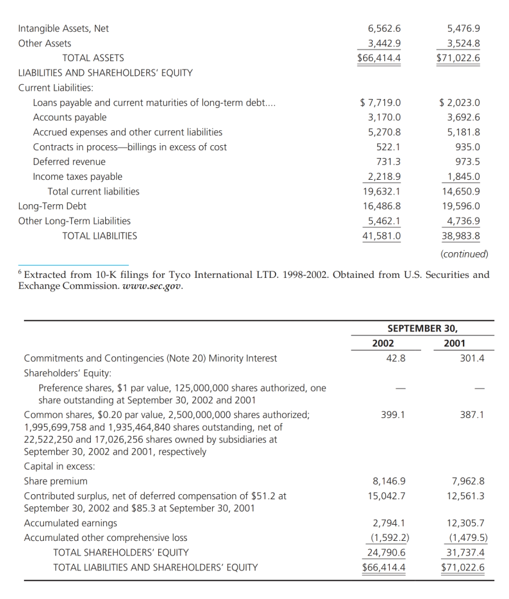

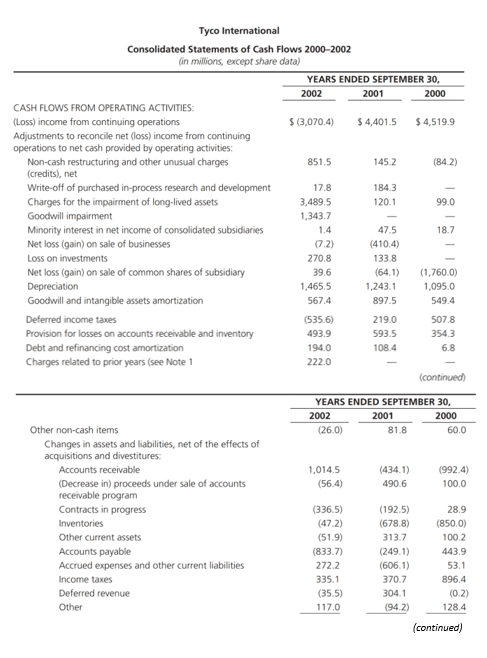

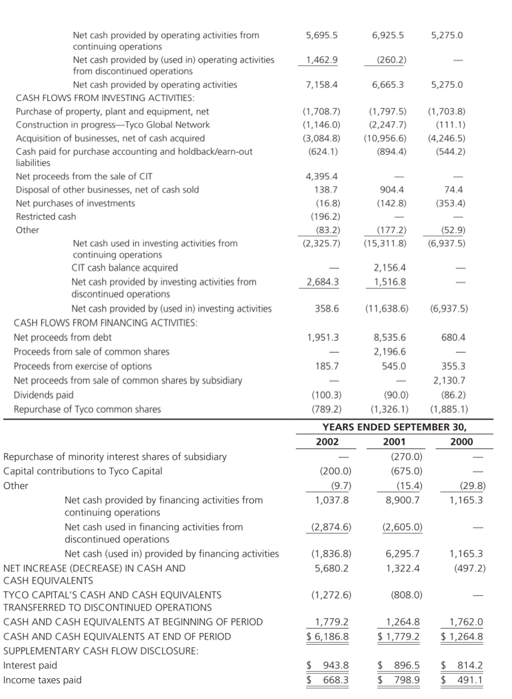

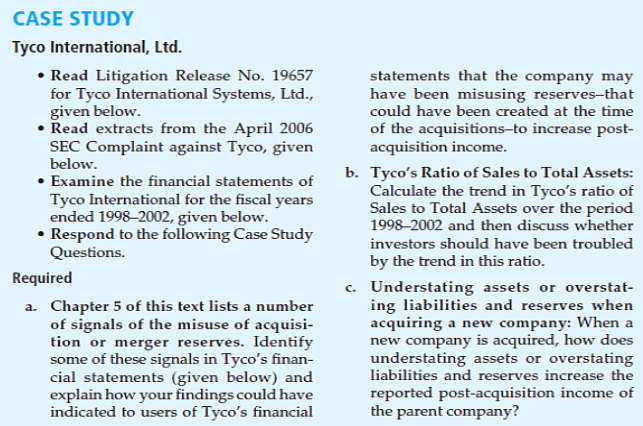

Litigation Release (LR 19657) for Tyco International U.S. Securities and Exchange Commission Litigation Release No. 19657/April 17, 2006* Accounting and Auditing Enforcement Release No. 2414/April 17, 2006 SEC v. Tyco International Ltd., 06 CV 2942 (5.D.N.Y. filed April 17, 2006) SEC Brings Settled Charges Against Tyco International Ltd. Alleging Billion Dollar Accounting Fraud The U.S. Securities and Exchange Commission today filed a settled civil injunction action in the United States District Court for the Southern District of New York against Tyco International Lid. The Commission's complaint in that action alleges that, from 1996 through 2002, Tyco violated the federal securities laws by, among other things, utilizing various improper accounting practices and a scheme involving transactions with no eco- nomic substance to overstate its reported financial results by at least one billion dollars. "Obtained from US. Securities and Exchange Commission. accuser ger. Tyco consented to the entry of a final judgement without admitting or denying the allegations, The Commission's complaint alleges that Tyco inflated its operating income by at least $500 million as a result of improper accounting practices related to some of the many acquisitions that Tyco engaged in during that time. Tyco's improper acquisition accounting included undervaluing acquired assets, overvaluing acquired liabilities, and misusing accounting rules concerning the establishment and utilization of purchase accounting reserves. The complaint further alleges that, apart from its acquisition activi- ties, Tyco improperly established and used various kinds of reserves to make adjust- ments at the end of reporting periods to enhance and smooth its publicly reported results and to meet earnings forecasts. The complaint alleges that Tyco inflated its operating income by $567 million from its fiscal year 1998 through its fiscal quarter ended December 31, 2002, by means of con- nection fees that Tyco's ADT Security Services, Inc. subsidiary charged to dealers from whom it purchased security monitoring contracts. Because the connection fee was fully offset by a simultaneous increase in the purchase price ADT allocated to the dealers' security monitoring contracts, the connection fee transaction lacked economic substance and should not have been recorded in Tyco's income statement. In 2003, Tyco restated its operating income and cash flow relating to the connection fees. The complaint further alleges that, from September 1996 through early 2002, Tyco failed to disclose in its proxy statements and annual reports certain executive com- pensation, executive indebtedness, and related party transactions of its former senior management. Tyco also incorrectly accounted for certain executive bonuses it paid in its fiscal years 2000 and 2001, thereby excluding from its operating expenses the costs associated with those bonuses. Finally, the complaint alleges that Tyco violated the anti- bribery provisions of the Foreign Corrupt Practices Act when employees or agents of its Earth Tech Brasil Leda. subsidiary made payments to Brazilian officials for the purpose of obtaining or retaining business for Tyco. Between 1996 and 2002, as a result of these various practices, Tyco made false and misleading statements or omissions in its filings with the Commission and its public statements to investors and analysts. Without admitting or denying the allegations in the Commission's complaint, Tyco has consented to the entry of a final judgment permanently enjoining it from vio- lating Section 17(a) of the Securities Act of 1933, Sections 10(b), 13(a), 13(b)(2)(A), 13(b) (2)(B), 14(a), and 30A(a) of the Securities Exchange Act of 1934, and Exchange Act Rules 10b-5, 12b-20, 13a-1, 13a-13, 13b2-1, and 14a-9. The proposed final judgment also orders Tyco to pay $1 in disgorgement and a $50 million civil penalty. The Commission's investigation is continuing with respect to individuals. The Commission acknowledges the assistance and cooperation of the Manhattan District Attorney and the New York City Police Department.Tyco International Consolidated Balance Sheet 2000' (in millions, except share data) SEPTEMBER 30 2000 CURRENT ASSETS: Cash and cash equivalents $ 1,264.8 Receivables, less allowance for doubtful accounts of $442.1 in 2000 and $329.8 in 1999 5,630.4 Contracts in process 357.3 Inventories 3,845.1 Deferred income taxes 683.3 Prepaid expenses and other current assets 1,034.8 Total current assets 12,815.7 CONSTRUCTION IN PROGRESS-TYCOM GLOBAL NETWORK 111.1 PROPERTY, PLANT AND EQUIPMENT, NET 8,218.4 GOODWILL AND OTHER INTANGIBLE ASSETS, NET 16,332.6 LONG-TERM INVESTMENTS 1,653.7 DEFERRED INCOME TAXES 532.5 OTHER ASSETS 740.3 TOTAL ASSETS $40,404.3 CURRENT LIABILITIES: Loans payable and current maturities of long-term debt $ 1,537.2 Accounts payable 3,291.9 (continued) Extracted from 10-K filings for Tyco International LTD. 1998-2002. Obtained from U.S. Securities and Exchange Commission. www.sec.gov SEPTEMBER 30 2000 Accrued expenses and other current liabilities 4,038.2 Contracts in process-billings in excess of costs 835.0 Deferred revenue 265.7 Income taxes 1,650.3 Deferred income taxes 60.6 Total current liabilities 11,678.9 LONG-TERM DEBT 9,461.8 OTHER LONG-TERM LIABILITIES 1,095.3 DEFERRED INCOME TAXES 791.6 TOTAL LIABILITIES 23,027.6 COMMITMENTS AND CONTINGENCIES (NOTE 17) MINORITY INTEREST 343.5 SHAREHOLDERS' EQUITY:SHAREHOLDERS' EQUITY: Preference shares, $1 par value, 125,000,000 shares authorized, none issued Common shares, $0.20 par value, 2,500,000,000 shares authorized; 336.9 1,684,511,070 shares outstanding in 2000 and 1,690,175,338 shares outstanding in 1999, net of 31,551,310 shares owned by subsidiaries in 2000 and 11,432,678 shares owned by subsidiaries in 1999. Capital in excess: Share premium 5,233.3 Contributed surplus, net of deferred compensation of $59,4 in 2000 2.786.3 and $30.7 in 1999 Accumulated earnings 8,427.6 Accumulated other comprehensive income (loss) 249.1 TOTAL SHAREHOLDERS' EQUITY 17,033.2 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $40.404.3Extract from Complaint against Tyco International Case 06-CV-2942 Filed April 13, 2006* UNITED STATES DISTRICT COURT SOUTHERN DISTRICT OF NEW YORK 16. Understating acquired assets benefited Tyco's earnings by decreasing deprecia- tion expense in future periods for long-lived assets and, for current assets, by allowing Tyco to record larger profits as the assets were utilized. Overstating acquired liabilities allowed Tyco to maintain on its books and records inflated reserves, which Tyco used in future periods to improve its earnings. 17. In certain acquisitions made in 1996, Tyco officials convinced the companies that were being acquired to make entries to their books and records that understated the assets and overstated the liabilities that Tyco would acquire. For example, at the urg- ing of Tyco officials, Thorn-EMI, whose fire protection operations Tyco acquired, made adjustments that reduced its assets and increased its liabilities by $76.5 million, resulting in Tyco's operating income in future financial periods being overstated by approximately $29 million. At Zettler AG, a security monitoring company Tyco acquired, adjustments were made to Zettler's books that overstated its liabilities and resulted in Tyco's operat- ing income in subsequent reporting periods being increased by approximately $6.6 mil- lion. And at Carlisle Plastics, Carlisle management made entries to its books and records, at Tyco's request, that reduced its assets and increased its liabilities by $36.4 million, resulting in an overstatement of Tyco's post-acquisition earnings. * Obtained from U. S. Securities and Exchange Commission www ser.gon. FINANCIAL STATEMENTS UNITED STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 Extracts from FORM 10-K Annual report pursuant to Section 13 or 15/dj of the Securities Exchange Act of 1934 For the fiscal years 1998-2002 TYCO INTERNATIONAL LTD. Consolidated Balance Sheet 1999 Consolidated Balance Sheet 1999 (in millions, except share data) SEPTEMBER 30 1999 1998 CURRENT ASSETS Cash and cash equivalents $ 1,762.0 $ 1,072.9 Receivables, less allowance for doubtful accounts of $329.8 in 4,582.3 3,478.4 1999 and $317.6 in 1998 Contracts in process 536.6 565.3 Inventories 2,849.1 2,610.0 Deferred income taxes 711.6 797.6 Prepaid expenses and other current assets 721.2 430.7 Total current assets 11,162.8 8.954.9 PROPERTY, PLANT AND EQUIPMENT, NET 7,322.4 6,104.3 GOODWILL AND OTHER INTANGIBLE ASSETS, NET 12,158.9 7,105.5 LONG-TERM INVESTMENTS 269,7 228.4 DEFERRED INCOME TAXES 668.8 320.9 OTHER ASSETS 779.0 726.7 TOTAL ASSETS $32,361.6 $23.440.7TOTAL ASSETS $32.361.6 $23.440.7 CURRENT LIABILITIES: Loans payable and current maturities of long-term debt $ 1,012.8 815.0 Accounts payable 2.530.B 1.733.4 Accrued expenses and other current liabilities 3,599.7 3.069 3 Contracts in process-billings in excess of costs 977.9 332.9 Deferred revenue 258.8 266.5 Income taxes 798.0 773.9 Deferred income taxes 1.0 15.2 Total current liabilities 9,179.0 7,006.2 LONG-TERM DEBT 9,109.4 5.424.7 OTHER LONG-TERM LIABILITIES 1,236.4 976.8 DEFERRED INCOME TAXES 504.2 131.2 TOTAL LIABILITIES 20,029.0 13.538.9 (continued) Extracted from 10-K filings for Tyco International LTD. 1999-2002. Obtained from U.S. Securities and Exchange Commission. www.are cop. SEPTEMBER 30 1995 1998 COMMITMENTS AND CONTINGENCIES (NOTE 17) SHAREHOLDERS' EQUITY: Preference shares, $1 par value, 125,000,000 authorized, none issued Common shares, $0.20 par value, 2,500,000,000 shares authorized; 338.0 324.1 1,690,175,338 shares outstanding in 1999 and 1,620,463,428 shares outstanding in 1998, net of 11,432,678 shares owned by subsidiaries in 1999 and 6,742,006 shares owned by subsidiaries in 1998 Capital in excess: Share premium 4.881.5 4,035.0 Contributed surplus, net of deferred compensation of $30.7 in 1999 3.607.6 2,584.0 and $67.3 in 1998 Accumulated earnings 3.955.6 3,162 6 Accumulated other comprehensive loss (450.1) (203.9) TOTAL SHAREHOLDERS' EQUITY 12.332.6 9.901.8 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $32,361.6 $23,440.7 Tyco International Consolidated Statements of Operations 1998-1999" (in millions, except share data) YEAR ENDED YEAR ENDED SEPTEMBER 30, SEPTEMBER 30, 1999 1998 NET SALES $22,496.5 $19,061.7 Cost of sales L'EEV'VI 12,694.8 Selling, general and administrative expenses 4,436.3 4,161.9 Merger, restructuring and other non-recurring charges 928 8 256.9 Charge for the impairment of long-lived assets 507.5 Write-off of purchased in-process research and development OPERATING INCOME 2,190.8 1,948.1 Interest income 61.5 62.6 Interest expense (547.1) (307.9)Income (loss) before income taxes, extraordinary items and 1,705.2 1,702 8 cumulative effect of accounting changes Income taxes (637.5) (534.2) Income (loss) before extraordinary items and cumulative effect of 1,067.7 1,168.6 accounting changes Extraordinary items, net of taxes (45.7) (2.4) Cumulative effect of accounting changes, net of taxes NET INCOME 1,022.0 1,166.2 Extracted from 10-K filings for Tyco International LTD. 1998-2002. Obtained from U.S. Securities and Exchange Commission. www.sec.gov Tyco International Consolidated Statements of Cash Flows 1998-1999* YEAR ENDED YEAR ENDED SEPTEMBER 30, SEPTEMBER 30. 1999 1998 CASH FLOWS FROM OPERATING ACTIVITIES: Net income (loss) $ 985.3 $ 1,166.2 Adjustments to reconcile net income (loss) to net cash provided by operating activities: Merger, restructuring and other non-recurring charges..... 517.1 253.7 Charge for the impairment of long-lived assets 335.0 Write-off of purchased in-process research and development Extraordinary items 45.4 2.4 Effect of accounting changes Depreciation 979.6 895.1 Goodwill and other intangibles amortization 331.6 242.6 Debt and refinancing cost amortization 10.4 11.3 Interest on ITS vendor note (12.1) (11.5) Deferred income taxes 334.3 (8.2) Provisions for losses on accounts receivable and inventory 211.5 192.9 Other non-cash items (6.7) 2.5 Changes in assets and liabilities, net of the effects of acquisitions and divestitures: Receivables (796.0) (88.9) Proceeds from accounts receivable sale 50.0 Contracts in process 642.2 (91.4) Inventories (124.4) (226.2) Prepaid expenses and other current assets (154.1) (57.7) Accounts payable, accrued expenses and other current 361.1 (96.4) liabilities Income taxes payable (10.2) 66.3 Deferred revenue (54.1) (6.5) Other, net (96.1) 35.6 Net cash provided by operating activities 3,549.8 2,281.8 CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of property, plant and equipment (1,632.5) (1,317.5) Purchase of leased property (Note 2) (234.0) Acquisition of businesses, net of cash acquired (4,901.2) (4,251.8) Disposal of businesses 926.8 Decrease (increase) in investments 10.5 6,4 Other (13.7) (83. 1) Net cash utilized by investing activities (5,844.1) (5,646.0Other (13.7) (83.1) Net cash utilized by investing activities (5,844.1) (5,646.0) CASH FLOWS FROM FINANCING ACTIVITIES: Net receipts of short-term debt 162.3 287.1 Net proceeds from issuance of public debt 1,173.7 2.744.5 Repayment of long-term debt, including debt tenders (2,057.8) (1,074.6) Proceeds from long-term debt 3,665.6 802.0 Proceeds from sale of common shares 1,245.0 (continued) Extracted from 10-K filings for Tyco International LTD. 1998-2002. Obtained from U.S. Securities and Exchange Commission. wow.sec.gov YEAR ENDED YEAR ENDED SEPTEMBER 30, SEPTEMBER 30, 1999 1998 Proceeds from exercise of options and warrants 872.4 348.7 Dividends paid (187.9) (303.0) Purchase of treasury shares (637.8) (283.9) Other (7.1) (36.5) Net cash provided by financing activities 2,983.4 3,729.3 Net increase in cash and cash equivalents 689.1 365.1 CASH AND CASH EQUIVALENTS AT BEGINNING OF YEAR, 1,072.9 707.8 AS RESTATED CASH AND CASH EQUIVALENTS AT END OF YEAR $ 1,762.0 $ 1,072.9 SUPPLEMENTARY CASH FLOW DISCLOSURE: Interest paid 509.1 250.7 Income taxes paid (net of refunds) $ 209.7 345.9 Extracts from FORM 10-K* TYCO INTERNATIONAL LTD. 2000-2002 Consolidated Statements of Operations 2000-2002" (in millions, except share data) YEAR ENDED SEPTEMBER 30, 2002 2001 2000 Revenue from product sales $ 28,794.8 $ 28,987.4 $ 24,958.4 Service revenue 6,848.9 5,049.2 3,973.5 NET REVENUES 35,643.7 34,036.6 28,931.9 Cost of product sales 19,510.8 18,334.4 15,959.8 Cost of services 3,570.2 2,615.9 1,971.4 Seling, general and administrative expenses 8,086.8 6,361.5 5,252.0 Restructuring and other unusual charges, net 1,203.9 233.6 175.3 Charges for the impairment of long-lived assets 3,489.5 120.1 99.0 Goodwill impairment 1,343.7 Write-off of purchased in-process research and development 17.8 184.3 OPERATING (LOSS) INCOME (1,579.0) 6,186.8 5,474.4OPERATING (LOSS) INCOME (1,579.0) 6,186.8 5,474.4 Interest income 117.3 128.3 75.2 Interest expense (1,077.0) (904.8) (844.8) Other (expense) income, net (233.0) 250.3 (0.3) Net gain on sale of common shares of a subsidiary (39.6) 64.1 1,760.0 (Loss) income from continuing operations before income taxes and (2,811.3) 5,724.7 6,464.5 minority interest Income taxes (257.7) (1,275.7) (1,925.9) Minority interest (1.4) (47.5) (18.7) (LOSS) INCOME FROM CONTINUING OPERATIONS (3,070.4) 4,401.5 4,519.9 (continued) Extracted from 10-K filings for Tyco International LTD. 1998-2002. Obtained from U.S. Securities and Exchange Commission. www.sec.gov. YEAR ENDED SEPTEMBER 30, 2007 2001 2000 (Loss) income from discontinued operations of Tyco Capital (net of (6,282.5) 252.5 tax expense of $316.1 million and $195.0 million for the year ended September 30, 2002 and 2001, respectively) Loss on sale of Tyco Capital, net of $0 tax (58.8) (Loss) income before cumulative effect of accounting changes (9,411.7) 4.654.0 4,519.9 Cumulative effect of accounting changes, net of tax (683 4) NET (LOSS) INCOME $ (9.411.7) $ 3.970.6 $ 4.519.9 Tyco International Consolidated Balance Sheets 2001-2002* (in millions, except share data) SEPTEMBER 30 2002 2001 ASSETS Current Assets: Cash and cash equivalents $ 6,186.8 $ 1,779.2 Restricted cash 196.2 Accounts receivables, less allowance for doubtful accounts ($629.1 5,848.6 6,453.2 at September 30, 2002 and $550.4 at September 30, 2001 Inventories 4,716.0 5,101.3 Deferred income taxes 1,338.1 980.2 Other current assets 1,478.9 1,532.3 Total current assets 19,764.6 15,846.2 Net Assets of Discontinued Operations 10,598.0 Tyco Global Network 581.6 2,342.4 Property, Plant and Equipment, Net 9,969.5 9,970.3 Goodwill, Net 26,093.2 23,264.0 Intangible Assets, Net 6,562.6 5,476.9Intangible Assets, Net 6,562.6 5,476.9 Other Assets 3,442.9 3,524.8 TOTAL ASSETS $66,414.4 $71,022.6 LIABILITIES AND SHAREHOLDERS' EQUITY Current Liabilities: Loans payable and current maturities of long-term debt.... $ 7,719.0 $ 2,023.0 Accounts payable 3,170.0 3,692.6 Accrued expenses and other current liabilities 5,270.8 5,181.8 Contracts in process-billings in excess of cost 522.1 935.0 Deferred revenue 731.3 973.5 Income taxes payable 2,218.9 1,845.0 Total current liabilities 19,632.1 14,650.9 Long-Term Debt 16,486.8 19,596.0 Other Long-Term Liabilities 5,462.1 4,736.9 TOTAL LIABILITIES 41,581.0 38,983.8 (continued) *Extracted from 10-K filings for Tyco International LTD. 1998-2002. Obtained from U.S. Securities and Exchange Commission. www.sec.gov. SEPTEMBER 30, 2007 2001 Commitments and Contingencies (Note 20) Minority Interest 42.8 301.4 Shareholders' Equity: Preference shares, $1 par value, 125,000,000 shares authorized, one share outstanding at September 30, 2002 and 2001 Common shares, $0.20 par value, 2,500,000,000 shares authorized; 399.1 387.1 1,995,699,758 and 1,935,464,840 shares outstanding, net of 22,522,250 and 17,026,256 shares owned by subsidiaries at September 30, 2002 and 2001, respectively Capital in excess: Share premium 8,146.9 7,962.8 Contributed surplus, net of deferred compensation of $51.2 at 15,042.7 12,561.3 September 30, 2002 and $85.3 at September 30, 2001 Accumulated earnings 2,794.1 12,305.7 Accumulated other comprehensive loss (1,592.2) (1,479.5) TOTAL SHAREHOLDERS' EQUITY 24,790.6 31,737.4 TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY $66,414.4 $71,022.6Tyco International Consolidated Statements of Cash Flows 2000-2002 (in mwions, except share data) YEARS ENDED SEPTEMBER 30, 2002 2001 2000 CASH FLOWS FROM OPERATING ACTIVITIES: (Loss) income from continuing operations $ (3,070.4) $ 4,401.5 $ 4,519.9 Adjustments to reconcile net (loss) income from continuing operations to net cash provided by operating activities: Non-cash restructuring and other unusual charges 851.5 145.2 (84 2) (credits), net Write-off of purchased in-process research and development 17.8 184.3 Charges for the impairment of long-lived assets 3,489.5 120.1 99.0 Goodwill impairment 1,343.7 Minority interest in net income of consolidated subsidiaries 1.4 47.5 18.7 Net loss (gain) on sale of businesses (7.2) (410.4) Loss on investments 270.8 133.8 Net loss (gain) on sale of common shares of subsidiary 39.6 (64.1) (1,760.0) Depreciation 1,465.5 1,243.1 1,095.0 Goodwill and intangible assets amortization 567.4 897.5 549.4 Deferred income taxes (535.6) 219.0 507.8 Provision for losses on accounts receivable and inventory 493.9 593.5 354.3 Debt and refinancing cost amortization 194.0 108.4 6.8 Charges related to prior years (see Note 1 222.0 (continued) YEARS ENDED SEPTEMBER 30, 2002 2001 2000 Other non-cash items (26.0) 81 8 60.0 Changes in assets and liabilities, net of the effects of acquisitions and divestitures: Accounts receivable 1,014.5 (434.1) (992.4) (Decrease in) proceeds under sale of accounts (56.4) 490.6 100.0 receivable program Contracts in progress (336.5) (192.5) 28.9 Inventories (47.2) (678.8) (850.0) Other current assets (51.9) 313.7 100.2 Accounts payable (833.7) (249.1) 443.9 Accrued expenses and other current liabilities 272.2 (606.1) 53.1 Income taxes 335.1 370.7 896.4 Deferred revenue (35.5) 304.1 (0.2) Other 117.0 (94.2) 128,4 (continued)Net cash provided by operating activities from 5,695.5 6,925.5 5,275.0 continuing operations Net cash provided by (used in) operating activities 1,462.9 (260.2) from discontinued operations Net cash provided by operating activities 7,158.4 6,665.3 5,275.0 CASH FLOWS FROM INVESTING ACTIVITIES: Purchase of property, plant and equipment, net (1,708.7) (1,797.5) (1,703.8) Construction in progress-Tyco Global Network (1,146.0) (2,247.7) (111.1) Acquisition of businesses, net of cash acquired (3,084.8) (10,956.6) (4.246.5) Cash paid for purchase accounting and holdback/earn-out (624.1) (894.4) (544.2) Liabilities Net proceeds from the sale of CIT 4,395.4 Disposal of other businesses, net of cash sold 138.7 904.4 74.4 Net purchases of investments (16.8) (142 8) (353.4) Restricted cash (196.2) Other (83.2) (177.2) (52.9) Net cash used in investing activities from (2,325.7) (15,311 8) (6,937.5) continuing operations CIT cash balance acquired 2,156.4 Net cash provided by investing activities from 2,684.3 1,516.8 discontinued operations Net cash provided by (used in) investing activities 358.6 (11,638.6) (6,937.5) CASH FLOWS FROM FINANCING ACTIVITIES: Net proceeds from debt 1,951.3 8,535.6 680.4 Proceeds from sale of common shares 2,196.6 Proceeds from exercise of options 185.7 545.0 355.3 Net proceeds from sale of common shares by subsidiary 2,130.7 Dividends paid (100.3) (90.0) (86.2) Repurchase of Tyco common shares (789.2) (1.326.1) (1,885.1) YEARS ENDED SEPTEMBER 30 2002 2001 2000 Repurchase of minority interest shares of subsidiary (270.0) Capital contributions to Tyco Capital (200.0) (675.0) Other (9.7) (15.4) (29.8) Net cash provided by financing activities from 1,037.8 8,900.7 1,165.3 continuing operations Net cash used in financing activities from (2,874.6) (2,605.0) discontinued operations Net cash (used in) provided by financing activities (1,836.8) 6,295.7 1.165.3 NET INCREASE (DECREASE) IN CASH AND 5,680.2 1,322.4 (497.2) CASH EQUIVALENTS TYCO CAPITAL'S CASH AND CASH EQUIVALENTS (1,272.6) (808.0) TRANSFERRED TO DISCONTINUED OPERATIONS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 1,779.2 1,264.8 1,762.0 CASH AND CASH EQUIVALENTS AT END OF PERIOD $ 6,186.8 $ 1,779.2 $ 1,264.8 SUPPLEMENTARY CASH FLOW DISCLOSURE; Interest paid 943.8 896.5 $ 814.2 Income taxes paid S 668.3 798.9 491.1CASE STUDY Tyco International, Ltd. . Read Litigation Release No. 19657 statements that the company may for Tyco International Systems, Ltd., have been misusing reserves-that given below. could have been created at the time . Read extracts from the April 2006 of the acquisitions-to increase post- SEC Complaint against Tyco, given acquisition income. below. . Examine the financial statements of b. Tyco's Ratio of Sales to Total Assets: Tyco International for the fiscal years Calculate the trend in Tyco's ratio of ended 1998-2002, given below. Sales to Total Assets over the period . Respond to the following Case Study 1998-2002 and then discuss whether Questions. investors should have been troubled by the trend in this ratio. Required c. Understating assets or overstat- a. Chapter 5 of this text lists a number ing liabilities and reserves when of signals of the misuse of acquisi- acquiring a new company: When a tion or merger reserves. Identify new company is acquired, how does some of these signals in Tyco's finan- understating assets or overstating cial statements (given below) and liabilities and reserves increase the explain how your findings could have reported post-acquisition income of indicated to users of Tyco's financial the parent company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts