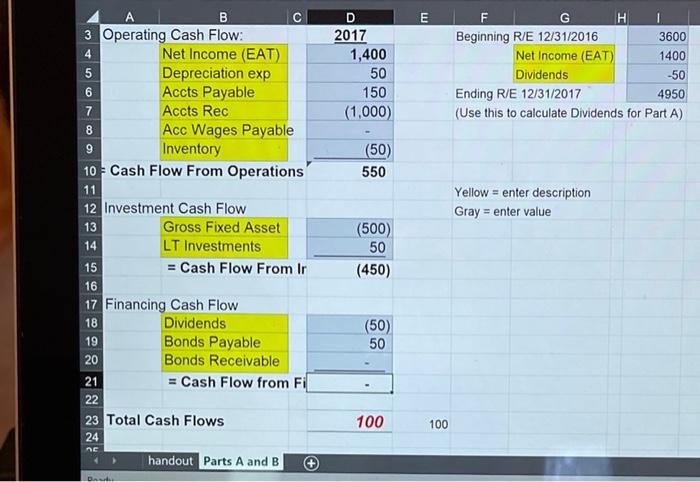

Question: part c&d E HI 1400 D 2017 1,400 50 150 (1,000) F G Beginning R/E 12/31/2016 3600 Net Income (EAT) Dividends Ending R/E 12/31/2017 4950

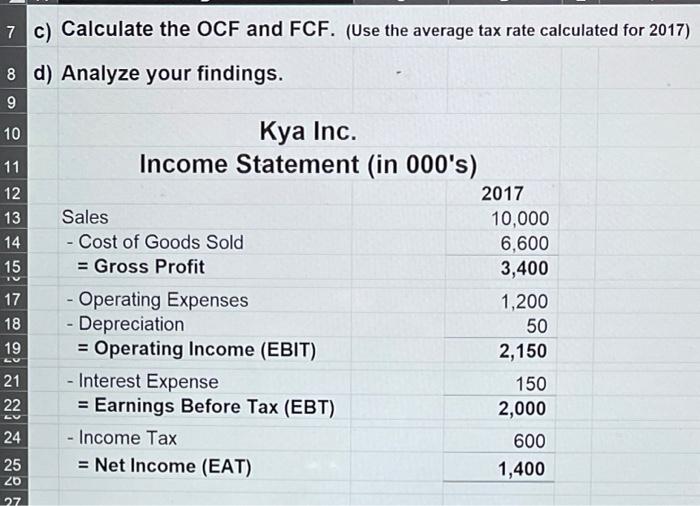

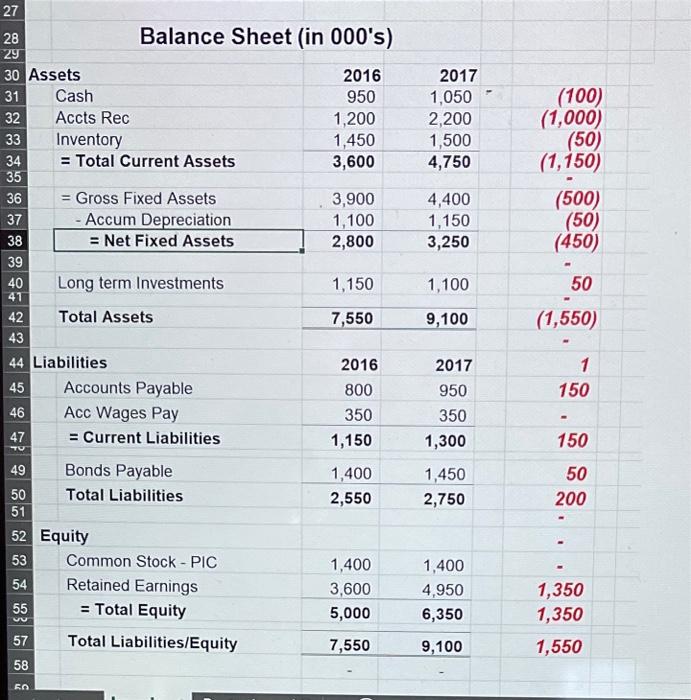

E HI 1400 D 2017 1,400 50 150 (1,000) F G Beginning R/E 12/31/2016 3600 Net Income (EAT) Dividends Ending R/E 12/31/2017 4950 (Use this to calculate Dividends for Part A) -50 8 (50) 550 Yellow = enter description Gray = enter value B 3 Operating Cash Flow: 4 Net Income (EAT) 5 Depreciation exp 6 Accts Payable 7 Accts Rec Acc Wages Payable 9 Inventory 10 Cash Flow From Operations 11 12 Investment Cash Flow 13 Gross Fixed Asset 14 LT Investments 15 = Cash Flow From Ir 16 17 Financing Cash Flow 18 Dividends 19 Bonds Payable 20 Bonds Receivable 21 = Cash Flow from Fil 22 23 Total Cash Flows 24 (500) 50 (450) (50) 50 100 100 ne handout Parts A and B 7 c) Calculate the OCF and FCF. (Use the average tax rate calculated for 2017) 8 d) Analyze your findings. 9 10 Kya Inc. 11 Income Statement (in 000's) 12 2017 13 Sales 10,000 14 - Cost of Goods Sold 6,600 15 = Gross Profit 3,400 17 - Operating Expenses 1,200 18 - Depreciation 50 19 = Operating Income (EBIT) 2,150 21 - Interest Expense 150 22 = Earnings Before Tax (EBT) 2,000 24 - Income Tax 600 = Net Income (EAT) 1,400 LU EV 25 27 2017 1,050 2,200 1,500 4,750 (100) (1,000) (50) (1,150) (500) (50) (450) 37 4,400 1,150 3,250 1,100 50 9,100 27 28 Balance Sheet (in 000's) 29 30 Assets 2016 31 Cash 950 32 Accts Rec 1,200 33 Inventory 1,450 34 = Total Current Assets 3,600 35 36 = Gross Fixed Assets 3,900 - Accum Depreciation 1,100 38 = Net Fixed Assets 2,800 39 40 Long term Investments 1,150 47 42 Total Assets 7,550 43 44 Liabilities 2016 45 Accounts Payable 800 46 Acc Wages Pay 350 47 = Current Liabilities 1,150 49 Bonds Payable 1,400 50 Total Liabilities 2,550 51 52 Equity 53 Common Stock - PIC 1,400 54 Retained Earnings 3,600 55 = Total Equity 5,000 57 Total Liabilities/Equity 7,550 (1,550) 1 150 2017 950 350 1,300 150 TU 1,450 2,750 50 200 1,400 4,950 6,350 y 1,350 1,350 1,550 9,100 58 En

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts