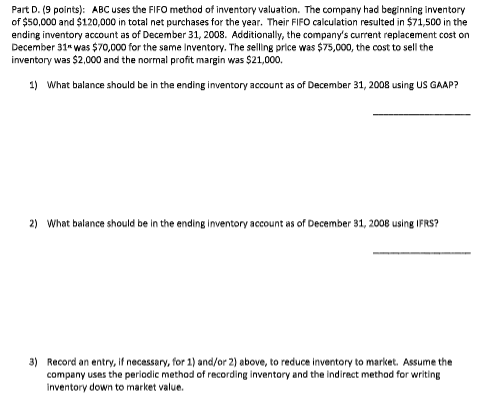

Question: Part D . ( 9 points ) : ABC uses the FIFO method of inventory valuation. The company had beginning inventory of (

Part D points: ABC uses the FIFO method of inventory valuation. The company had beginning inventory of $ and $ in total net purchases for the year. Their FIFO calculation resulted in $ in the ending inventory account as of December Additionally, the company's current replacement cost on December n was $ for the same Inventory. The selling price was $ the cost to sell the inventory was $ and the normal profit margin was $ What balance should be in the ending inventory account as of December using US GAAP? What balance should be in the ending inventory account as of December using IFRS? Record an entry, if necessary, for andor above, to reduce inventory to mariket. Assume the company uses the periodic method of recording inventory and the indirect method for writing inventory down to market value.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock