Question: part d anyone knows the correct answer plz share CAPM, Stock & Bond Valuation Q1: HF is small company listed in a junior stock market.

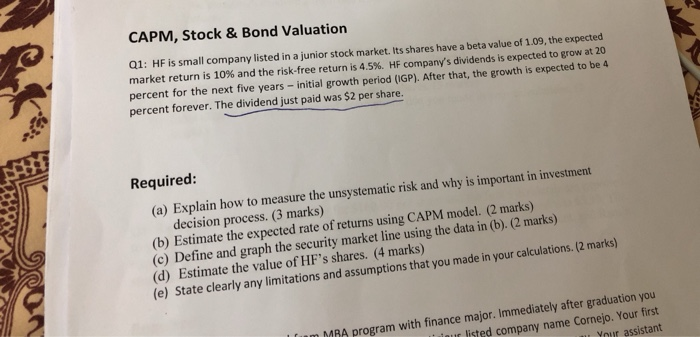

CAPM, Stock & Bond Valuation Q1: HF is small company listed in a junior stock market. Its shares have a beta value of 1.09, the expected market return is 10% and the risk-free return is 4.5%. HF company's dividends is expected to grow at 20 percent for the next five years - initial growth period (IGP). After that, the growth is expected to be 4 percent forever. The dividend just paid was $2 per share. Required: (a) Explain how to measure the unsystematic risk and why is important in investment decision process. (3 marks) (b) Estimate the expected rate of returns using CAPM model. (2 marks) (c) Define and graph the security market line using the data in (b). (2 marks) (d) Estimate the value of HF's shares. (4 marks) (e) State clearly any limitations and assumptions that you made in your calculations. (2 marks) um MBA program with finance major. Immediately after graduation you our listed company name Cornejo. Your first Your assistant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts