Question: Part (D) Assume that inflation is expected to average 5% over the next 4 years and that this expectation is reflected in the WACC. Moreover,

Part (D)

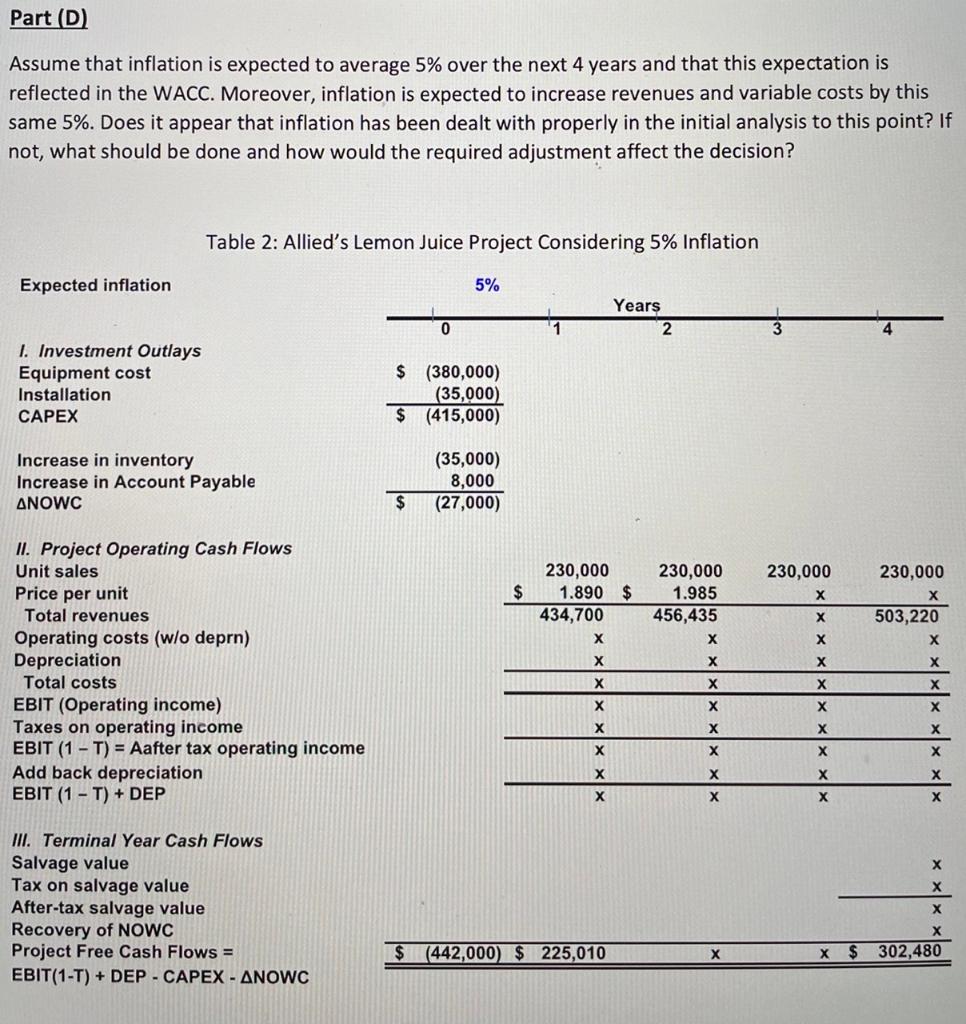

Assume that inflation is expected to average 5% over the next 4 years and that this expectation is reflected in the WACC. Moreover, inflation is expected to increase revenues and variable costs by this same 5%. Does it appear that inflation has been dealt with properly in the initial analysis to this point? If not, what should be done and how would the required adjustment affect the decision?

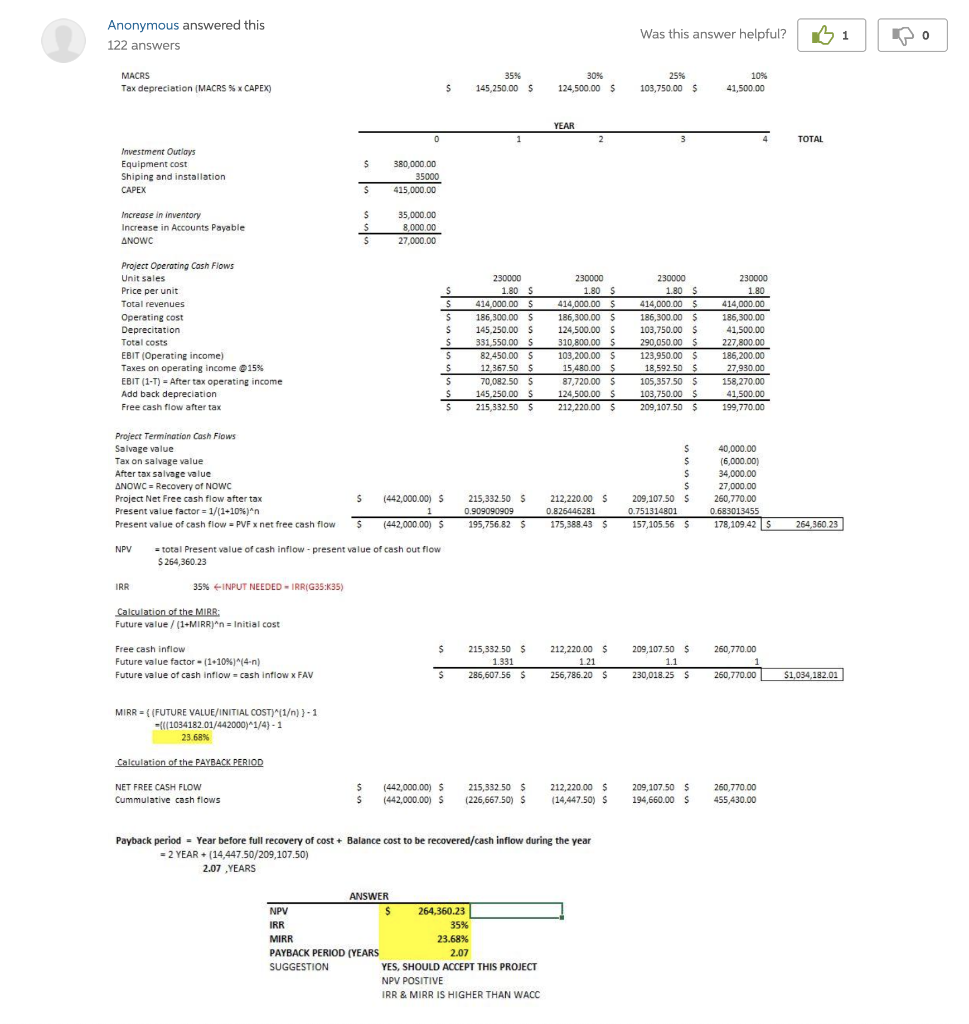

Anonymous answered this 122 answers Was this answer helpful? B1 Po MACRS Tax depreciation (MACRS % CAPEX) 35% 145,250.00 $ 30% 124,500.00 $ 25% 103,750.00 $ 10% 41,500.00 $ YEAR 0 1 2 3 TOTAL $ Investment Outlays Equipment cost Shiping and installation CAPEX 380,000.00 35000 415,000.00 $ Increase in inventory Increase in Accounts Payable ANOWC $ S $ 35,000.00 8,000.00 27,000.00 Project Operating Cash Flows Unit Sales Price per unit Total revenues Operating cost Deprecitation Total costs EBIT (Operating income) Taxes on operating income 15% EBIT (1-T) - After tax operating income Add back depreciation Free cash flow after tax S s S S S S 5 $ S $ 230000 1.80 414,000.00 $ 186,300.00 $ 145,250.00 5 331,550.00 5 82,450.00 S 12,367.50 $ 70,082 50 S 145,250.00 $ 215,332.50 $ 230000 1.80 $ 414,000.00 $ 186,300.00 $ 124,500.00 $ 310,800.00 $ 103,200.00 $ 15,480.00 $ 87,720.00 $ 124,500.00 $ 212,220.00 $ 230000 1.80 $ 414,000.00 $ 186,300.00 $ 103,750.00 $ 290,050.00 $ 123,950.00 $ 18,592.50 $ 105,357.50 $ 103,750.00 $ 209,107.50 $ 230000 1.80 414,000.00 186,300.00 41,500.00 227,800.00 186,200.00 27,930.00 158,270.00 41,500.00 199,770.00 Project Termination Cash Flows Salvage value Tax on salvage value After tax salvage value ANOWC = Recovery of NOWC Project Net Free cash flow after tax S (442,000.00) 5 Present value factor = 1/(1-10%)^n 1 Present value of cash flow = PVF x net free cash flow 5 () (442,000,00) 5 NPV = total Present value of cash inflow - present value of cash out flow $ 264,360.23 S $ S $ 209,107.50 $ 0.751314801 157,105.56 5 40,000.00 (6,000.00) 34,000.00 27,000.00 260,770,00 0.683013455 178,109.42S 215,332.50 $ 0.909090909 195,756.82 212,220.00 $ 0.825446281 175,388.43 5 264,360.23 IRR 35% INPUT NEEDED - IRR(G35:35) Calculation of the MIRR: Future value / (1+MIRR]'n = Initial cost / = $ Free cash inflow Future value factor - 11.10%) 4-n) Future value of cash inflow = cash inflow X FAV 215,332 50 $ 1.331 286,607.56 $ 212,220.00 $ 121 256,786.20 $ 209,107.50 $ 1.1 230,018.25 $ 260,770.00 1 260,770.00 $ $1,034,182.01 MIRR = {(FUTURE VALUE/INITIAL COST)^(1) - 1 ={{(1034182.01/442000)*1/4) - 1 23.68% Calculation of the PAYBACK PERIOD NET FREE CASH FLOW Cummulative cash flows $ $ (442,000.00 $ ) (442,000.00) 5 215,332 50 $ (226,667.50) $ 212,220.00 $ (14,447,50) $ 209,107.50 $ 194,660.00 $ 260,770.00 455,430.00 Payback period - Year before full recovery of cost + Balance cost to be recovered/cash inflow during the year / = 2 YEAR+ (14,447.50/209,107.50) 2.07 YEARS ANSWER NPV 264,360.23 IRR 35% MIRR 23.68% PAYBACK PERIOD (YEARS 2.07 SUGGESTION YES, SHOULD ACCEPT THIS PROJECT NPV POSITIVE IRR & MIRR IS HIGHER THAN WACC Part (D) Assume that inflation is expected to average 5% over the next 4 years and that this expectation is reflected in the WACC. Moreover, inflation is expected to increase revenues and variable costs by this same 5%. Does it appear that inflation has been dealt with properly in the initial analysis to this point? If not, what should be done and how would the required adjustment affect the decision? Table 2: Allied's Lemon Juice Project Considering 5% Inflation Expected inflation 5% Years 2 0 1. Investment Outlays Equipment cost Installation CAPEX $ (380,000) (35,000) $ (415,000) Increase in inventory Increase in Account Payable ANOWC (35,000) 8,000 (27,000) 230,000 $ 230,000 1.890 $ 434,700 X 230,000 1.985 456,435 230,000 503,220 II. Project Operating Cash Flows Unit sales Price per unit Total revenues Operating costs (w/o deprn) Depreciation Total costs EBIT (Operating income) Taxes on operating income EBIT (1 - T) = Aafter tax operating income Add back depreciation EBIT (1 - T) + DEP X X X X X X III. Terminal Year Cash Flows Salvage value Tax on salvage value After-tax salvage value Recovery of NOWC Project Free Cash Flows = EBIT (1-T) + DEP - CAPEX - ANOWC $ (442,000) $ 225,010 X $ 302,480 Anonymous answered this 122 answers Was this answer helpful? B1 Po MACRS Tax depreciation (MACRS % CAPEX) 35% 145,250.00 $ 30% 124,500.00 $ 25% 103,750.00 $ 10% 41,500.00 $ YEAR 0 1 2 3 TOTAL $ Investment Outlays Equipment cost Shiping and installation CAPEX 380,000.00 35000 415,000.00 $ Increase in inventory Increase in Accounts Payable ANOWC $ S $ 35,000.00 8,000.00 27,000.00 Project Operating Cash Flows Unit Sales Price per unit Total revenues Operating cost Deprecitation Total costs EBIT (Operating income) Taxes on operating income 15% EBIT (1-T) - After tax operating income Add back depreciation Free cash flow after tax S s S S S S 5 $ S $ 230000 1.80 414,000.00 $ 186,300.00 $ 145,250.00 5 331,550.00 5 82,450.00 S 12,367.50 $ 70,082 50 S 145,250.00 $ 215,332.50 $ 230000 1.80 $ 414,000.00 $ 186,300.00 $ 124,500.00 $ 310,800.00 $ 103,200.00 $ 15,480.00 $ 87,720.00 $ 124,500.00 $ 212,220.00 $ 230000 1.80 $ 414,000.00 $ 186,300.00 $ 103,750.00 $ 290,050.00 $ 123,950.00 $ 18,592.50 $ 105,357.50 $ 103,750.00 $ 209,107.50 $ 230000 1.80 414,000.00 186,300.00 41,500.00 227,800.00 186,200.00 27,930.00 158,270.00 41,500.00 199,770.00 Project Termination Cash Flows Salvage value Tax on salvage value After tax salvage value ANOWC = Recovery of NOWC Project Net Free cash flow after tax S (442,000.00) 5 Present value factor = 1/(1-10%)^n 1 Present value of cash flow = PVF x net free cash flow 5 () (442,000,00) 5 NPV = total Present value of cash inflow - present value of cash out flow $ 264,360.23 S $ S $ 209,107.50 $ 0.751314801 157,105.56 5 40,000.00 (6,000.00) 34,000.00 27,000.00 260,770,00 0.683013455 178,109.42S 215,332.50 $ 0.909090909 195,756.82 212,220.00 $ 0.825446281 175,388.43 5 264,360.23 IRR 35% INPUT NEEDED - IRR(G35:35) Calculation of the MIRR: Future value / (1+MIRR]'n = Initial cost / = $ Free cash inflow Future value factor - 11.10%) 4-n) Future value of cash inflow = cash inflow X FAV 215,332 50 $ 1.331 286,607.56 $ 212,220.00 $ 121 256,786.20 $ 209,107.50 $ 1.1 230,018.25 $ 260,770.00 1 260,770.00 $ $1,034,182.01 MIRR = {(FUTURE VALUE/INITIAL COST)^(1) - 1 ={{(1034182.01/442000)*1/4) - 1 23.68% Calculation of the PAYBACK PERIOD NET FREE CASH FLOW Cummulative cash flows $ $ (442,000.00 $ ) (442,000.00) 5 215,332 50 $ (226,667.50) $ 212,220.00 $ (14,447,50) $ 209,107.50 $ 194,660.00 $ 260,770.00 455,430.00 Payback period - Year before full recovery of cost + Balance cost to be recovered/cash inflow during the year / = 2 YEAR+ (14,447.50/209,107.50) 2.07 YEARS ANSWER NPV 264,360.23 IRR 35% MIRR 23.68% PAYBACK PERIOD (YEARS 2.07 SUGGESTION YES, SHOULD ACCEPT THIS PROJECT NPV POSITIVE IRR & MIRR IS HIGHER THAN WACC Part (D) Assume that inflation is expected to average 5% over the next 4 years and that this expectation is reflected in the WACC. Moreover, inflation is expected to increase revenues and variable costs by this same 5%. Does it appear that inflation has been dealt with properly in the initial analysis to this point? If not, what should be done and how would the required adjustment affect the decision? Table 2: Allied's Lemon Juice Project Considering 5% Inflation Expected inflation 5% Years 2 0 1. Investment Outlays Equipment cost Installation CAPEX $ (380,000) (35,000) $ (415,000) Increase in inventory Increase in Account Payable ANOWC (35,000) 8,000 (27,000) 230,000 $ 230,000 1.890 $ 434,700 X 230,000 1.985 456,435 230,000 503,220 II. Project Operating Cash Flows Unit sales Price per unit Total revenues Operating costs (w/o deprn) Depreciation Total costs EBIT (Operating income) Taxes on operating income EBIT (1 - T) = Aafter tax operating income Add back depreciation EBIT (1 - T) + DEP X X X X X X III. Terminal Year Cash Flows Salvage value Tax on salvage value After-tax salvage value Recovery of NOWC Project Free Cash Flows = EBIT (1-T) + DEP - CAPEX - ANOWC $ (442,000) $ 225,010 X $ 302,480

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts