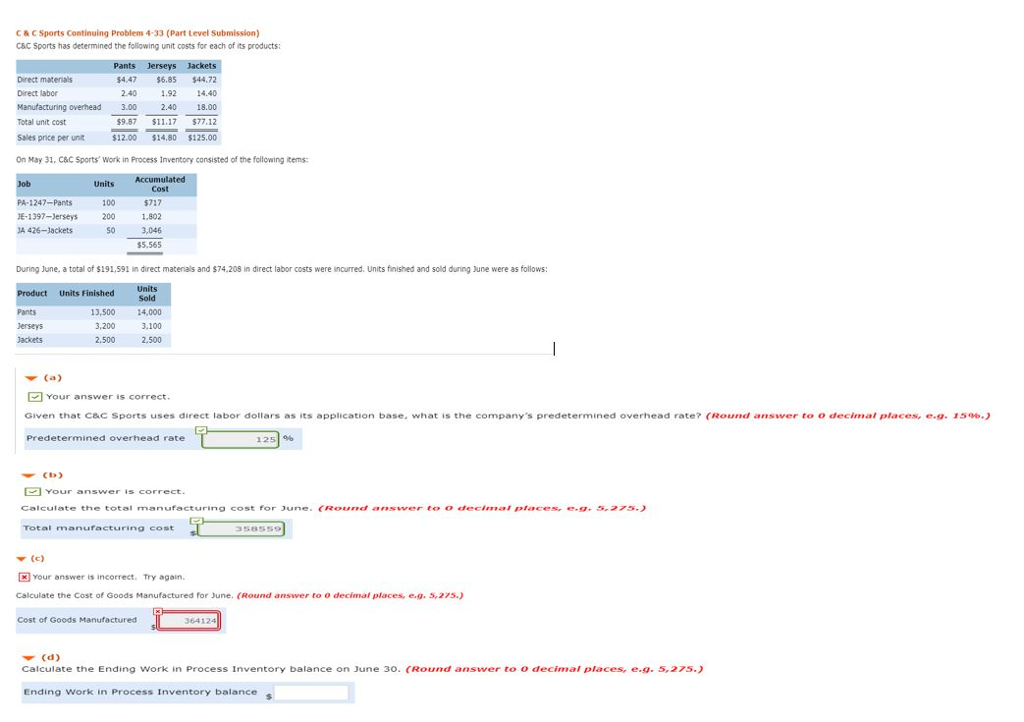

Question: Part D C & C Sports Continuing Problem 4-33 (Part Level Submission) C&C Sports has determined the following unit costs for each of its products:

Part D

Part D

C & C Sports Continuing Problem 4-33 (Part Level Submission) C&C Sports has determined the following unit costs for each of its products: Direct matenals Direct labor Manufacturing overhead Total unit cost Sales price per unt 4.47 $6.85 $44.72 1.92 2.40 $9.87 $11.17 $77.12 $12.00 $14.80 $125.00 2.40 14.40 3.00 18.00 On May 31, C&C Sports Work in Process Inventory consisted of the following items Units 100 E-1397-Jerseys200 50 Cost PA-1247- Pants 5717 1,802 3,046 5,565 A 426-1ackets During June, a total of $191,591 in direct materials and $74.208 in direct labor costs were incurred. Units finished and sold duning June were as follows: Product Units Finished Units Pants 13,500 3,200 2.500 14,000 3,100 2,500 Jackets Your answer is correct Given that C&C Sports uses direct labor dollars s its application base. what is the company's predetermined overhead rate? (Round answer to O decima, places, e.g- 25,) 125 C) C Icuate the totas rmanufacturing cost for June. (Round ansvverr to O dec,"1a, ploces, e.g. 5,275.) Total manufacturing cost Your answer is incorrect. Try again. Calculate the Cost of Goods Manufactured for June. (Round answer to 0 decimal places, e.g. 3,275.) Cost of Goods Manufactured 64124 Calculate the Ending Work in Process Inventory balance on June 30. (Round answer to o decimal places, e.g. 5,275.) Ending Work in Process Inventory balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts