Question: Part D. INCOME STATEMENT ANALYSIS (TREND-HORIZONTAL) Another useful technique is called horizontal analysis (or trend analysis). Basically you compare the same line item of an

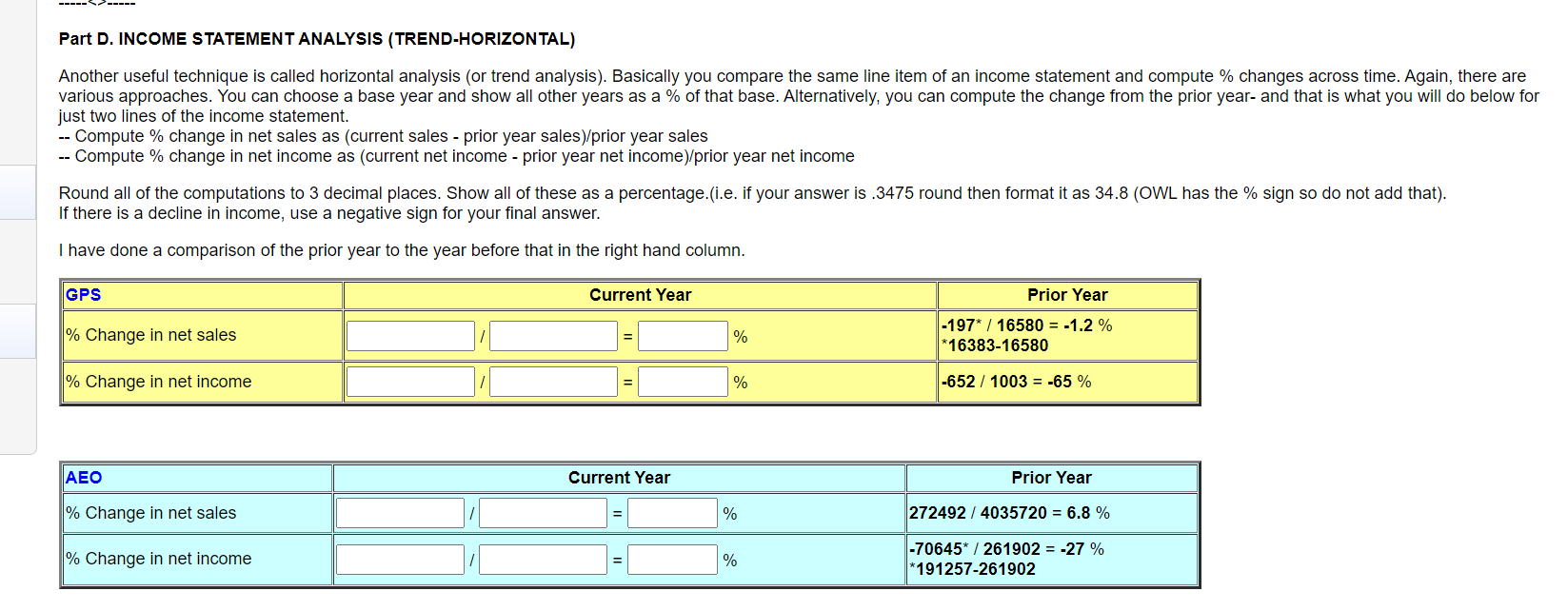

Part D. INCOME STATEMENT ANALYSIS (TREND-HORIZONTAL) Another useful technique is called horizontal analysis (or trend analysis). Basically you compare the same line item of an income statement and compute % changes across time. Again, there are various approaches. You can choose a base year and show all other years as a % of that base. Alternatively, you can compute the change from the prior year- and that is what you will do below for just two lines of the income statement. -- Compute % change in net sales as (current sales - prior year sales)/prior year sales -- Compute % change in net income as (current net income - prior year net income)/prior year net income Round all of the computations to 3 decimal places. Show all of these as a percentage.(i.e. if your answer is.3475 round then format it as 34.8 (OWL has the % sign so do not add that). If there is a decline in income, use a negative sign for your final answer. I have done a comparison of the prior year to the year before that in the right hand column. GPS Current Year Prior Year % Change in net sales % -197* / 16580 = -1.2 % *16383-16580 % Change in net income % -652 / 1003 = -65 % AEO Current Year Prior Year % Change in net sales % 272492 / 4035720 = 6.8 % % Change in net income % -70645* / 261902 = -27 % *191257-261902 Part D. INCOME STATEMENT ANALYSIS (TREND-HORIZONTAL) Another useful technique is called horizontal analysis (or trend analysis). Basically you compare the same line item of an income statement and compute % changes across time. Again, there are various approaches. You can choose a base year and show all other years as a % of that base. Alternatively, you can compute the change from the prior year- and that is what you will do below for just two lines of the income statement. -- Compute % change in net sales as (current sales - prior year sales)/prior year sales -- Compute % change in net income as (current net income - prior year net income)/prior year net income Round all of the computations to 3 decimal places. Show all of these as a percentage.(i.e. if your answer is.3475 round then format it as 34.8 (OWL has the % sign so do not add that). If there is a decline in income, use a negative sign for your final answer. I have done a comparison of the prior year to the year before that in the right hand column. GPS Current Year Prior Year % Change in net sales % -197* / 16580 = -1.2 % *16383-16580 % Change in net income % -652 / 1003 = -65 % AEO Current Year Prior Year % Change in net sales % 272492 / 4035720 = 6.8 % % Change in net income % -70645* / 261902 = -27 % *191257-261902

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts