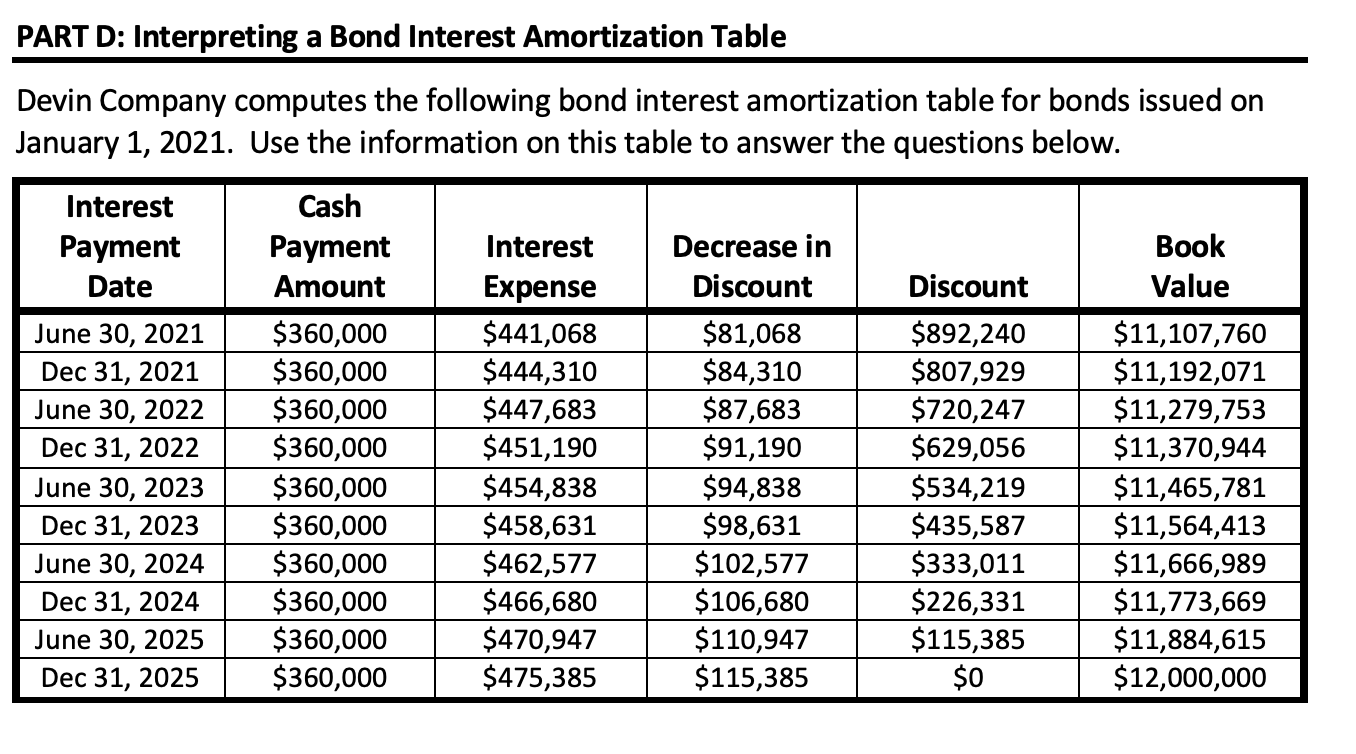

Question: PART D: Interpreting a Bond Interest Amortization Table Devin Company computes the following bond interest amortization table for bonds issued on January 1, 2021. Use

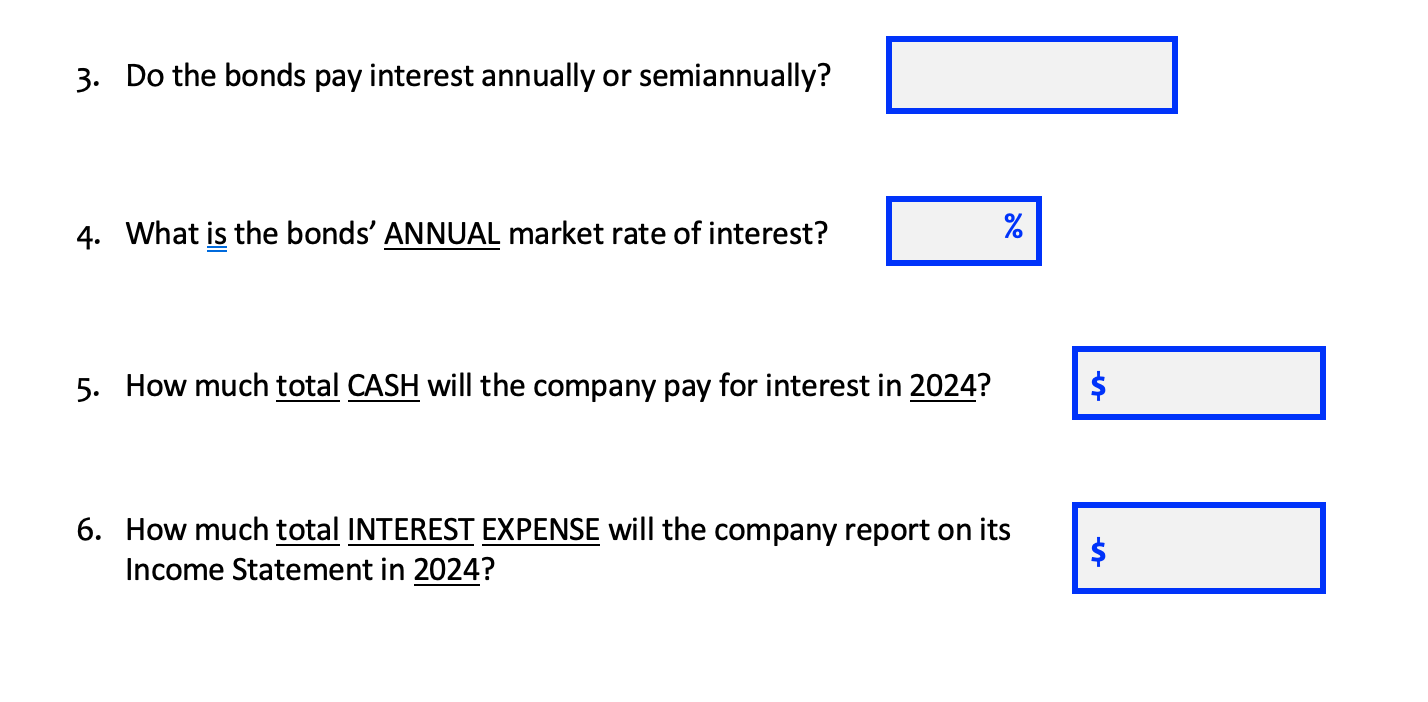

PART D: Interpreting a Bond Interest Amortization Table Devin Company computes the following bond interest amortization table for bonds issued on January 1, 2021. Use the information on this table to answer the questions below. Interest Payment Date June 30, 2021 Dec 31, 2021 June 30, 2022 Dec 31, 2022 June 30, 2023 Dec 31, 2023 June 30, 2024 Dec 31, 2024 June 30, 2025 Dec 31, 2025 Cash Payment Amount $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 $360,000 Interest Expense $441,068 $444,310 $447,683 $451,190 $454,838 $458,631 $462,577 $466,680 $470,947 $475,385 Decrease in Discount $81,068 $84,310 $87,683 $91,190 $94,838 $98,631 $102,577 $106,680 $110,947 $115,385 Discount $892,240 $807,929 $720,247 $629,056 $534,219 $435,587 $333,011 $226,331 $115,385 $0 Book Value $11,107,760 $11,192,071 $11,279,753 $11,370,944 $11,465,781 $11,564,413 $11,666,989 $11,773,669 $11,884,615 $12,000,000 3. Do the bonds pay interest annually or semiannually? 4. What is the bonds' ANNUAL market rate of interest? % 5. How much total CASH will the company pay for interest in 2024? $ 6. How much total INTEREST EXPENSE will the company report on its Income Statement in 2024? $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts