Question: Part D: Is the overapplied or underapplied overhead for the year normally transferred to cost of goods sold in the income statement? Required information Exercise

Part D: Is the overapplied or underapplied overhead for the year normally transferred to cost of goods sold in the income statement?

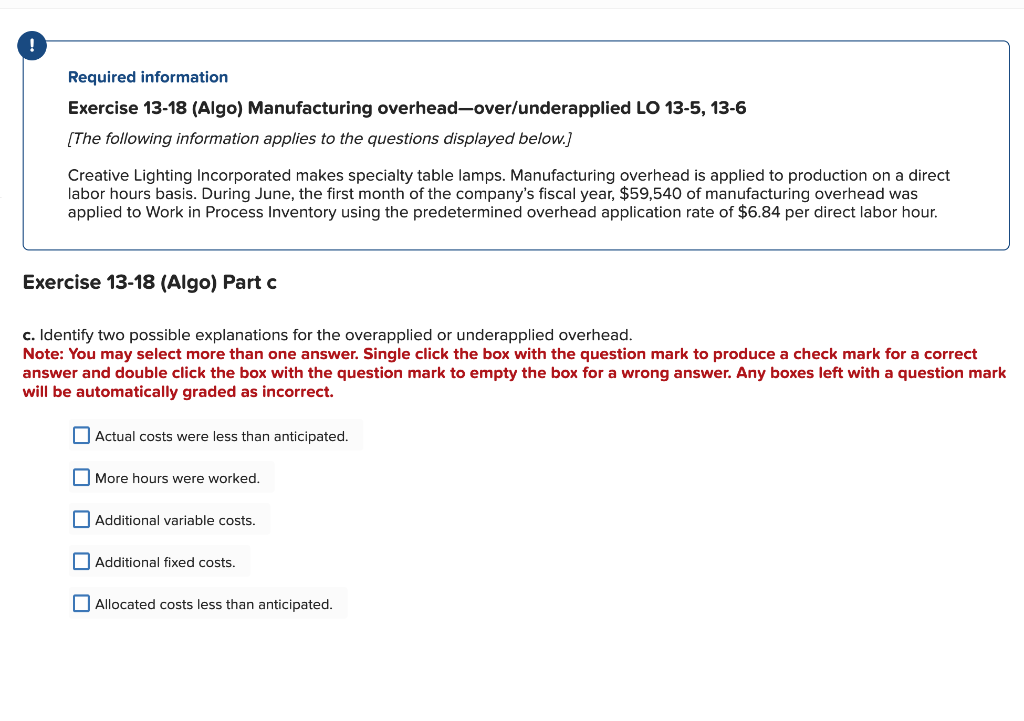

Required information Exercise 13-18 (Algo) Manufacturing overhead-over/underapplied LO 13-5, 13-6 [The following information applies to the questions displayed below.] Creative Lighting Incorporated makes specialty table lamps. Manufacturing overhead is applied to production on a direct labor hours basis. During June, the first month of the company's fiscal year, $59,540 of manufacturing overhead was applied to Work in Process Inventory using the predetermined overhead application rate of $6.84 per direct labor hour. Exercise 1318 (Algo) Part c c. Identify two possible explanations for the overapplied or underapplied overhead. Note: You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer. Any boxes left with a question mark will be automatically graded as incorrect. Actual costs were less than anticipated. More hours were worked. Additional variable costs. Additional fixed costs. Allocated costs less than anticipated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts