Question: Part D please Floating Rate Note Practice Problem Let's denote today by t = 0. The term structure of interest rates (all rates stated at

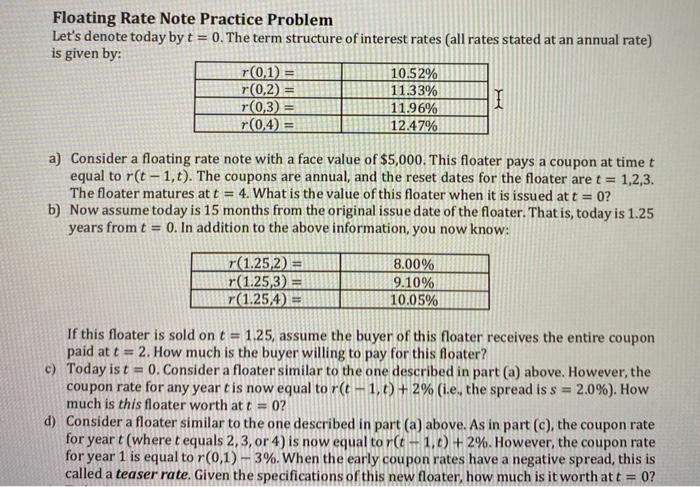

Floating Rate Note Practice Problem Let's denote today by t = 0. The term structure of interest rates (all rates stated at an annual rate) is given by: r(0,1 = 10.52% r(0,2) = 11.33% r(0,3) = 1 11.96% r(0,4)= 12.47% a) Consider a floating rate note with a face value of $5,000. This floater pays a coupon at timet equal to r(t-1,t). The coupons are annual, and the reset dates for the floater are t = 1,2,3. The floater matures at t = 4. What is the value of this floater when it is issued at t=0? b) Now assume today is 15 months from the original issue date of the floater. That is, today is 1.25 years from t = 0. In addition to the above information, you now know: r(1.25,2) = r(1.25,3)= r(1.25,4) = 8.00% 9.10% 10.05% If this floater is sold on t = 1.25, assume the buyer of this floater receives the entire coupon paid att 2. How much is the buyer willing to pay for this floater? c) Today is t = 0. Consider a floater similar to the one described in part(a) above. However, the coupon rate for any year t is now equal to r(t-1,) + 2% (i.e. the spread is s = 2.0%). How much is this floater worth at t = 0? d) Consider a floater similar to the one described in part (a) above. As in part (C), the coupon rate for yeart (where t equals 2,3, or 4) is now equal to r(t - 1,) +2%. However, the coupon rate for year 1 is equal to r(0,1) - 3%. When the early coupon rates have a negative spread, this is called a teaser rate. Given the specifications of this new floater, how much is it worth att = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts