Question: part d PSB3.3 Matrix Ltd began operations on 1 July 2019. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on 30

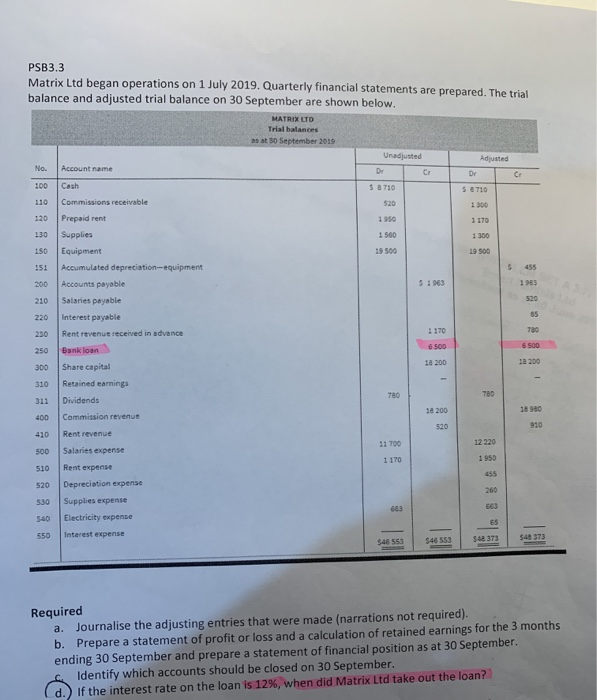

PSB3.3 Matrix Ltd began operations on 1 July 2019. Quarterly financial statements are prepared. The trial balance and adjusted trial balance on 30 September are shown below. MATRIX LTD Trial balances as at 30 September 2019 Uradjusted Adjusted Account name De CE $ 8710 110 Commissions receivable Prepaid rent Supplies Equipment 1950 1500 19 500 19 500 Accumulated depreciation equipment Accounts payable 1963 Salaries payable Interest payable Rent revenue received in advance Bank loan ta 200 18200 300 Share capital Retained earnings Dividends Commission revenue 1890 10 200 520 Rent revenue Salaries expense Rent expense Depreciation expense Supplies expense Electricity expense Interest expense Required a. Journalise the adjusting entries that were made (narrations not required). b. Prepare a statement of profit or loss and a calculation of retained earnings for the 3 months ending 30 September and prepare a statement of financial position as at 30 September Identify which accounts should be closed on 30 September d.) If the interest rate on the loan is 12%, when did Matrix Ltd take out the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts