Question: part d required only b) Calculate the expected return on a portfolio comprising each asset weighted as follows (6 marks) Asset Weighting (%) Alphabet PayZero

part d required only

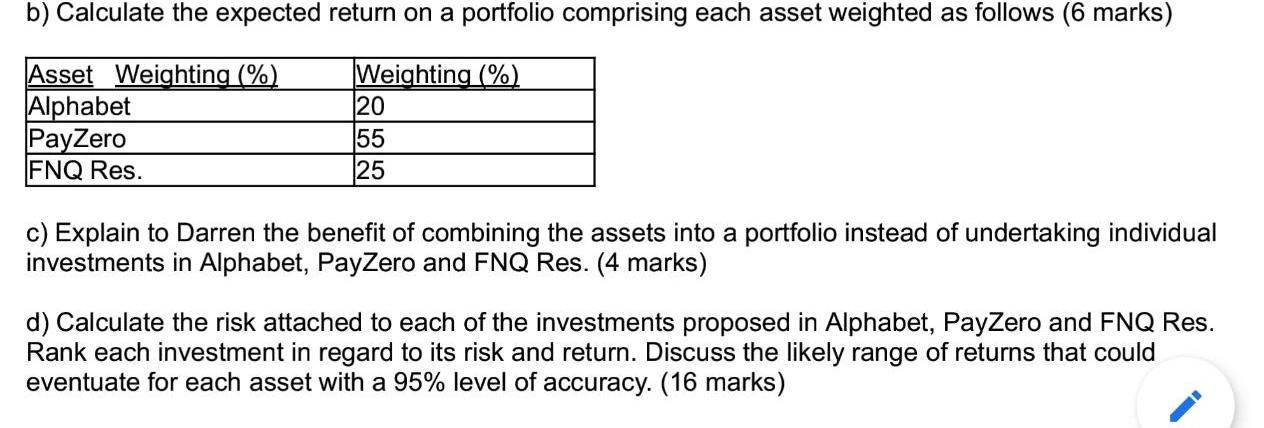

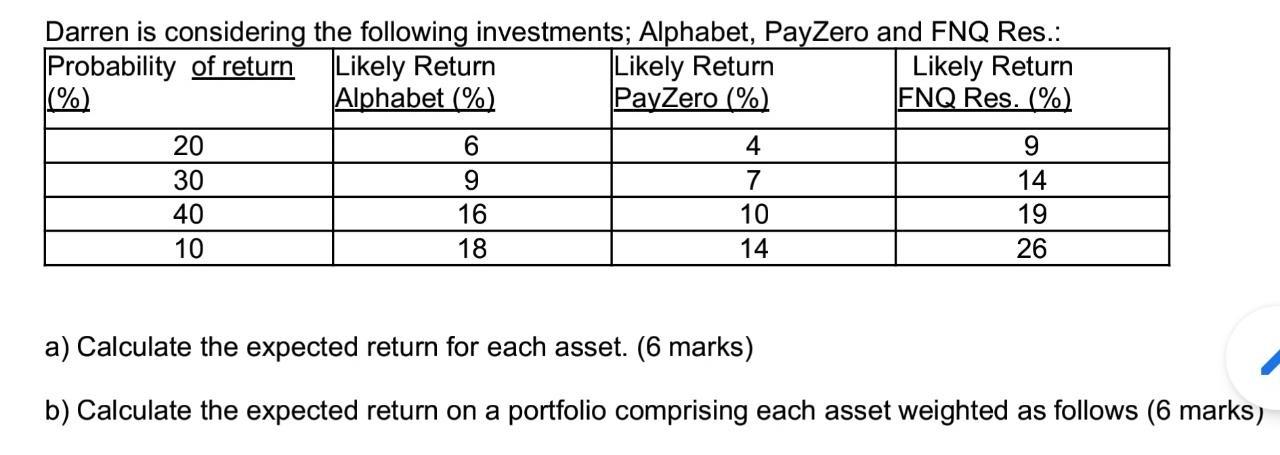

b) Calculate the expected return on a portfolio comprising each asset weighted as follows (6 marks) Asset Weighting (%) Alphabet PayZero ENQ Res. Weighting (%) 20 55 25 c) Explain to Darren the benefit of combining the assets into a portfolio instead of undertaking individual investments in Alphabet, PayZero and FNQ Res. (4 marks) d) Calculate the risk attached to each of the investments proposed in Alphabet, PayZero and FNQ Res. Rank each investment in regard to its risk and return. Discuss the likely range of returns that could eventuate for each asset with a 95% level of accuracy. (16 marks) Darren is considering the following investments; Alphabet, PayZero and FNQ Res.: Probability of return Likely Return Likely Return Likely Return %) Alphabet (%) PayZero (%) ENQ Res. (% 4 20 30 40 10 6 9 16 18 7 10 14 9 14 19 26 a) Calculate the expected return for each asset. (6 marks) b) Calculate the expected return on a portfolio comprising each asset weighted as follows (6 marks) b) Calculate the expected return on a portfolio comprising each asset weighted as follows (6 marks) Asset Weighting (%) Alphabet PayZero ENQ Res. Weighting (%) 20 55 25 c) Explain to Darren the benefit of combining the assets into a portfolio instead of undertaking individual investments in Alphabet, PayZero and FNQ Res. (4 marks) d) Calculate the risk attached to each of the investments proposed in Alphabet, PayZero and FNQ Res. Rank each investment in regard to its risk and return. Discuss the likely range of returns that could eventuate for each asset with a 95% level of accuracy. (16 marks) Darren is considering the following investments; Alphabet, PayZero and FNQ Res.: Probability of return Likely Return Likely Return Likely Return %) Alphabet (%) PayZero (%) ENQ Res. (% 4 20 30 40 10 6 9 16 18 7 10 14 9 14 19 26 a) Calculate the expected return for each asset. (6 marks) b) Calculate the expected return on a portfolio comprising each asset weighted as follows (6 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts