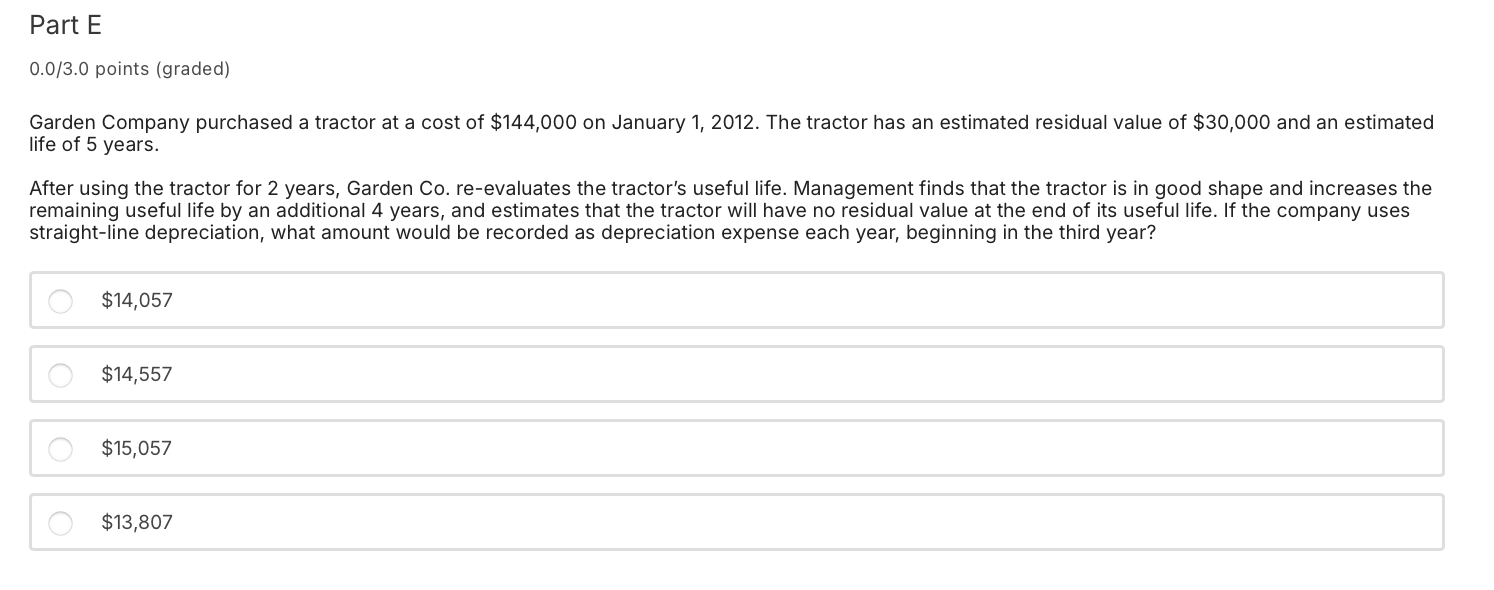

Question: Part E 0 . 0 3 . 0 points ( graded ) Garden Company purchased a tractor at a cost of $ 1 4 4

Part E

points graded

Garden Company purchased a tractor at a cost of $ on January The tractor has an estimated residual value of $ and anded estimated

life of years.

After using the tractor for years, Garden Co reevaluates the tractor's useful life. Management finds that the tractor is in good shape and increases the

remaining useful life by an additional years, and estimates that the tractor will have no residual value at the end of its useful life. If the company uses

straightline depreciation, what amount would be recorded as depreciation expense each year, beginning in the third year?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock