Question: Part E please Floating Rate Note Practice Problem Let's denote today by t = 0. The term structure of interest rates (all rates stated at

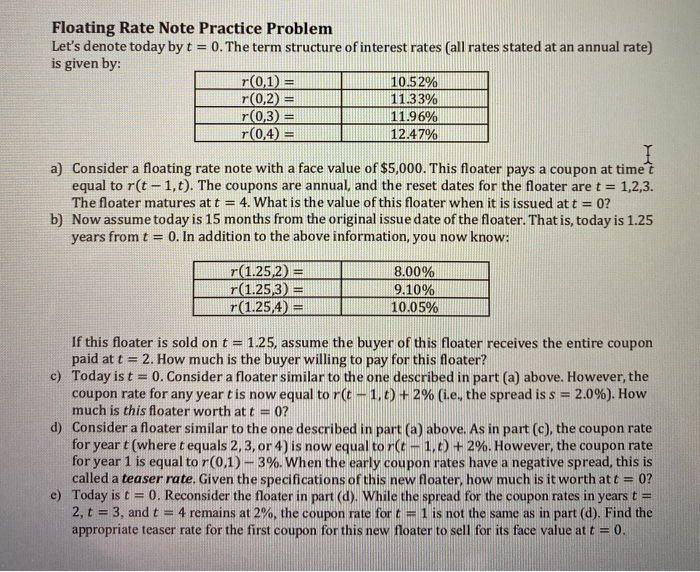

Floating Rate Note Practice Problem Let's denote today by t = 0. The term structure of interest rates (all rates stated at an annual rate) is given by: r(0,1)= 10.52% r(0,2) = 11.33% r(0,3) 11.96% r(0,4) = 12.47% DE a) Consider a floating rate note with a face value of $5,000. This floater pays a coupon at timet equal to r(t-1,t). The coupons are annual, and the reset dates for the floater are t = 1,2,3. The floater matures at t = 4. What is the value of this floater when it is issued at t = 0? b) Now assume today is 15 months from the original issue date of the floater. That is, today is 1.25 years from t = 0. In addition to the above information, you now know: r(1.25,2) = r(1.25,3) r(1.25,4) = 8.00% 19.10% 10.05% If this floater is sold on t = 1.25, assume the buyer of this floater receives the entire coupon paid at t = 2. How much is the buyer willing to pay for this floater? c) Today is t = 0. Consider a floater similar to the one described in part (a) above. However, the coupon rate for any year t is now equal to r(t = 1,t) + 2% (i.e. the spread is s = 2.0%). How much is this floater worth att = 0? d) Consider a floater similar to the one described in part (a) above. As in part (C), the coupon rate for year t (where t equals 2,3, or 4) is now equal to r(t - 1,0) +2%. However, the coupon rate for year 1 is equal to r(0,1) - 3%. When the early coupon rates have a negative spread, this is called a teaser rate. Given the specifications of this new floater how much is it worth att = 0? e) Today is t = 0. Reconsider the floater in part (d). While the spread for the coupon rates in years t = 2, t = 3, and t = 4 remains at 2%, the coupon rate for t = 1 is not the same as in part (d). Find the appropriate teaser rate for the first coupon for this new floater to sell for its face value at t = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts