Question: part e with clear step, with d8=0 Question 3 ABC company is evaluating an engineering project which will last for 5 years. For an initial

part e with clear step, with d8=0

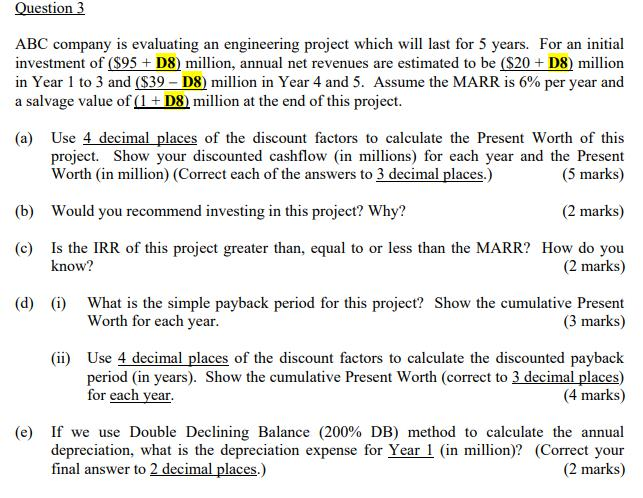

Question 3 ABC company is evaluating an engineering project which will last for 5 years. For an initial investment of ($95 + D8) million, annual net revenues are estimated to be ($20 + D8) million in Year 1 to 3 and ($39 - D8) million in Year 4 and 5. Assume the MARR is 6% per year and a salvage value of (1 + D8) million at the end of this project. (a) Use 4 decimal places of the discount factors to calculate the Present Worth of this project. Show your discounted cashflow (in millions) for each year and the Present Worth (in million) (Correct each of the answers to 3 decimal places.) (5 marks) (b) Would you recommend investing in this project? Why? (2 marks) (c) Is the IRR of this project greater than, equal to or less than the MARR? How do you know? (2 marks) (d) (i) What is the simple payback period for this project? Show the cumulative Present Worth for each year. (3 marks) (ii) Use 4 decimal places of the discount factors to calculate the discounted payback period in years). Show the cumulative Present Worth (correct to 3 decimal places) for each year. (4 marks) (e) If we use Double Declining Balance (200% DB) method to calculate the annual depreciation, what is the depreciation expense for Year 1 (in million)? (Correct your final answer to 2 decimal places.) (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts