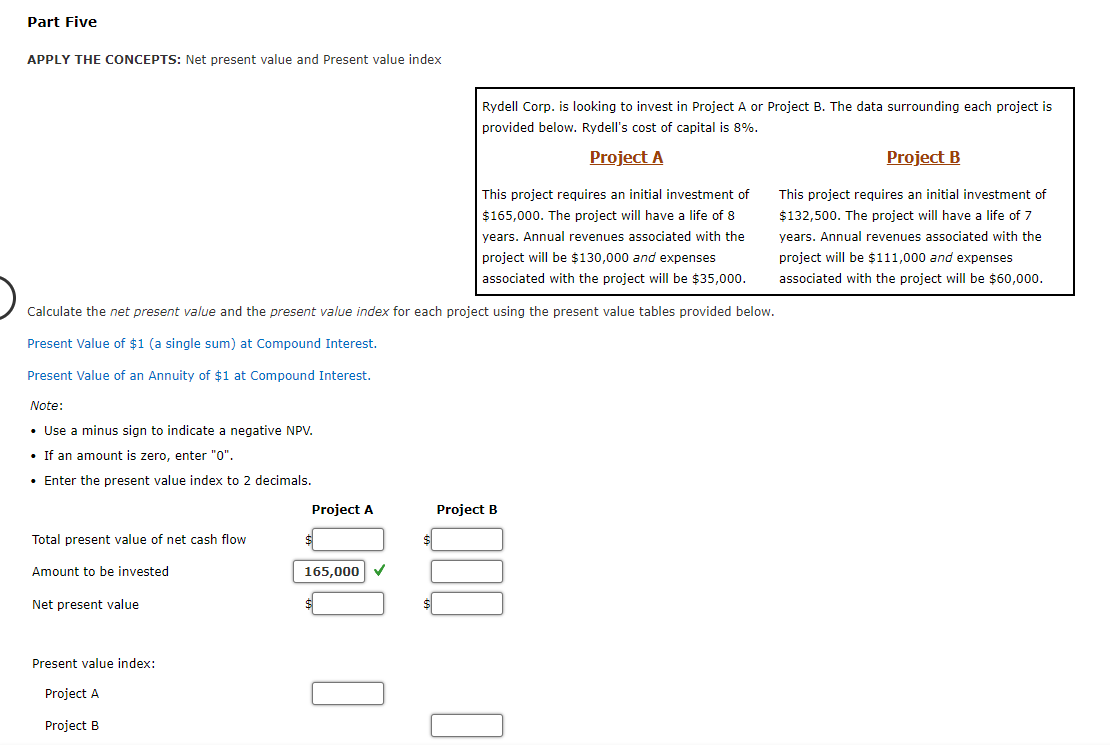

Question: Part Five APPLY THE CONCEPTS: Net present value and Present value index Rydell Corp. is looking to invest in Project A or Project B. The

Part Five APPLY THE CONCEPTS: Net present value and Present value index Rydell Corp. is looking to invest in Project A or Project B. The data surrounding each project is provided below. Rydell's cost of capital is 8%. Project A Project B This project requires an initial investment of $165,000. The project will have a life of 8 years. Annual revenues associated with the project will be $130,000 and expenses associated with the project will be $35,000. This project requires an initial investment of $132,500. The project will have a life of 7 years. Annual revenues associated with the project will be $111,000 and expenses associated with the project will be $60,000. Calculate the net present value and the present value index for each project using the present value tables provided below. Present Value of $1 (a single sum) at Compound Interest. Present Value of an Annuity of $1 at Compound Interest. Note: Use a minus sign to indicate a negative NPV. If an amount is zero, enter "0". Enter the present value index to 2 decimals. Project A Project B Total present value of net cash flow Amount to be invested 165,000 Net present value $ Present value index: Project A Project B Year 5% 14% 15% 1 0.870 0.952 1.859 0.877 1.647 2 1.626 3 2.283 2.723 3.546 4.329 2.322 2.914 4 2.855 Present Value of an Annuity of $1 at Compound Interest 6% 7% 8% 9% 10% 11% 12% 13% 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.885 1.833 1.808 1.783 1.759 1.736 1.713 1.690 1.668 2.673 2.624 2.577 2.531 2.487 2.444 2.402 2.361 3.465 3.387 3.312 3.240 3.170 3.102 3.037 2.974 4.212 4.100 3.993 3.890 3.791 3.696 3.605 3.517 4.917 4.767 4.623 4.486 4.355 4.231 4.111 3.998 5.582 5.389 5.206 5.033 4.868 4.712 4.564 4.423 6.210 5.971 5.747 5.535 5.335 5.146 4.968 4.799 6.802 6.515 6.247 5.995 5.759 5.537 5.328 5.132 7.360 7.024 6.710 6.418 6.145 5.889 5.650 5.426 5 3.433 6 3.889 3.352 3.784 4.160 5.076 5.786 6.463 7 4.288 8 4.639 4.487 9 7.108 4.946 4.772 10 7.722 5.216 5.019 5% 6% 13% 14% 15% Year 1 2 0.877 0.943 0.890 0.885 0.783 0.870 0.756 0.769 3 0.952 0.907 0.864 0.823 0.784 0.840 0.693 0.675 0.658 4 0.592 0.792 0.747 Present Value of $1 at Compound Interest 7% 8% 9% 10% 11% 12% 0.935 0.926 0.917 0.909 0.901 0.893 0.873 0.857 0.842 0.826 0.812 0.797 0.816 0.794 0.772 0.751 0.731 0.712 0.763 0.735 0.708 0.683 0.659 0.636 0.713 0.681 0.650 0.621 0.593 0.567 0.666 0.630 0.596 0.564 0.535 0.507 0.623 0.583 0.547 0.513 0.482 0.452 0.582 0.540 0.502 0.467 0.434 0.404 0.544 0.500 0.460 0.424 0.391 0.361 0.508 0.463 0.422 0.386 0.352 0.322 0.613 0.543 0.480 0.572 0.497 5 6 7 0.519 0.746 0.705 0.456 0.432 0.376 0.665 0.425 0.400 8 0.711 0.677 0.645 0.627 0.376 0.351 0.327 0.284 9 0.592 0.333 0.308 10 0.614 0.558 0.295 0.270 0.247

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts