Question: PART FIVE Case Problem 1. Byron Bass is a commercial real estate broker who also has a keen eye for personal investment opportunities. He has

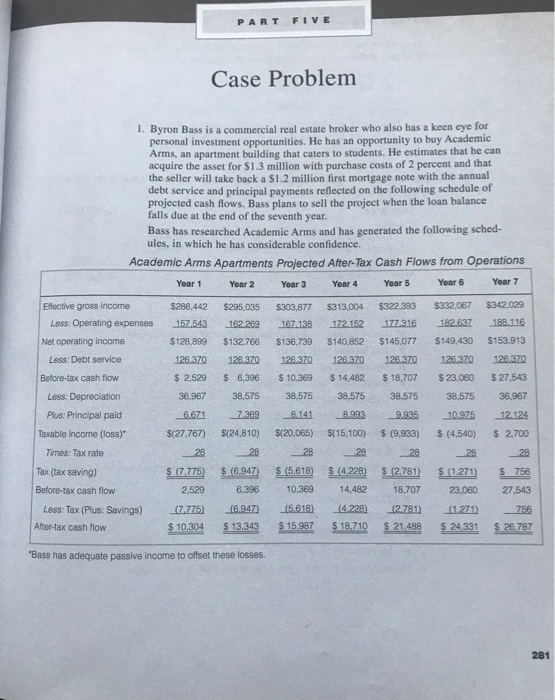

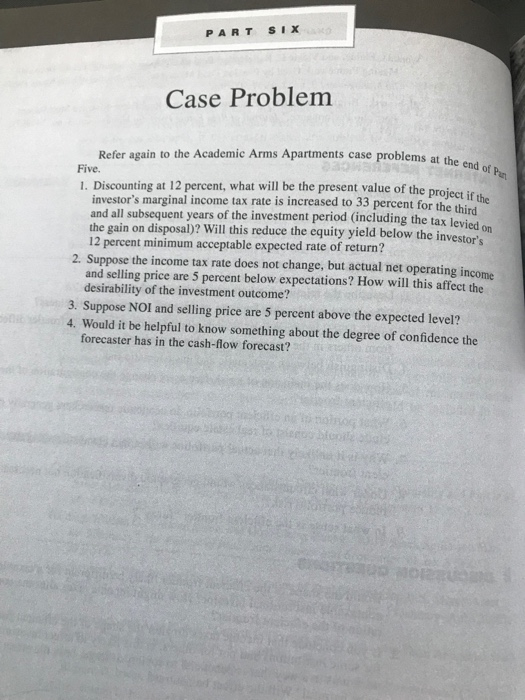

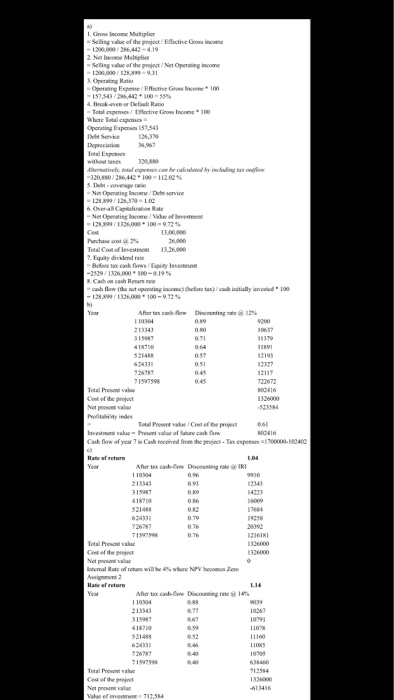

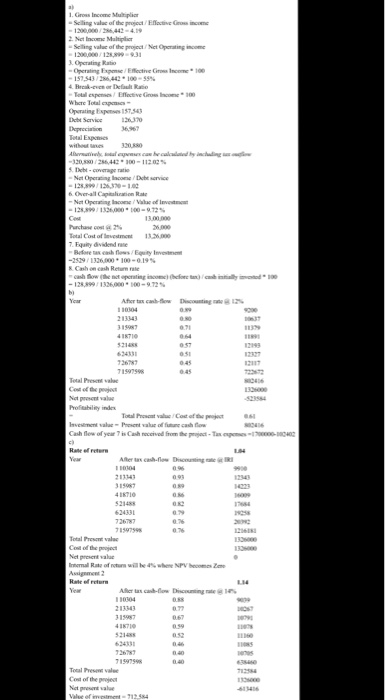

PART FIVE Case Problem 1. Byron Bass is a commercial real estate broker who also has a keen eye for personal investment opportunities. He has an opportunity to buy Academic Arms, an apartment building that caters to students. He estimates that he can acquire the asset for $1.3 million with purchase costs of 2 percent and that the seller will take back a $1.2 million first mortgage note with the annual debt service and principal payments reflected on the following schedule of projected cash flows. Bass plans to sell the project when the loan balance falls due at the end of the seventh year Bass has researched Academic Arms and has generated the following sched- ules, in which he has considerable confidence. Academic Arms Apartments Projected After-Tax Cash Flows from Operations Year 1 Year 2 Year 3 Year 4 Year 5 Year 6Year 7 $286.442 $295,035 $303,877 $313,004 $322.393 $332,067 $342.029 Less: Operating expenses "15Z543 6220g 167.198 172 152 .177316 8263Z .208.116 $128,899 $132.766 $136,739 $140,852 $145,077 $149,430 $153.913 Effective gross income Net operating income Less: Debt service Before-tax cash flow Less: Depreciation Plus: Principal paid Taxable income (loss)" 126370 126370 12637 126.370 126370 lanazo 126370 $2,529 S 6,396 $ 10.369 $ 14,482 $18,707 $23.060 $27.543 36,967 38,57538,575 38,575 38,575 38,575 36.967 66717.3698.1418.993 9.935 10.975 12.124 $(27,767) $(24,810) $(20,065) (15,100) (9,933) $ (4,540) 2,700 Times: Tax rate Tax (tax saving) Before-tax cash flow 28282828 28 28 28 2,5296,39610,369 14,482 18,707 23,060 27,543 17.775) 6.947) 15.618) 14.220 L2rn 11271) -156 Less: Tax (Pius. Savings) After-tax cash flow 'Bass has adequate passive income to offset these losses. 281 PART SIX Case Problem Refer again to the Academic Arms Apartments case problems at the Five. . Discounting at 12 percent, what will be the present value of the projectif investor's marginal income tax rate is increased to 33 percent for th and all subsequent years of the investment period (including the tax the gain on disposal)? Will this reduce the equity yield below the investor's 12 percent minimum acceptable expected rate of return? e third levied on 2. Suppose the income tax rate does not change, but actual net operating income and selling price are 5 percent below expectations? How will this affect the desirability of the investment outcome? 3. Suppose NOI and selling price are 5 percent above the expected level? 4. Would it be helpful to know something about the degree of confidence the forecaster has in the cash-flow forecast? Selingvalu of the project/Net Openacing income Operating Espome/ EfWective Goss Encon100 Dfaul Rat . 100-u202% 13,00,000 13.26000 10304 Aher tax casbaw D cu tate @ 14% Operating Epnse/Efficective C Income 100 Afer tas cabAm Dwouatmg nane @ L2% PART FIVE Case Problem 1. Byron Bass is a commercial real estate broker who also has a keen eye for personal investment opportunities. He has an opportunity to buy Academic Arms, an apartment building that caters to students. He estimates that he can acquire the asset for $1.3 million with purchase costs of 2 percent and that the seller will take back a $1.2 million first mortgage note with the annual debt service and principal payments reflected on the following schedule of projected cash flows. Bass plans to sell the project when the loan balance falls due at the end of the seventh year Bass has researched Academic Arms and has generated the following sched- ules, in which he has considerable confidence. Academic Arms Apartments Projected After-Tax Cash Flows from Operations Year 1 Year 2 Year 3 Year 4 Year 5 Year 6Year 7 $286.442 $295,035 $303,877 $313,004 $322.393 $332,067 $342.029 Less: Operating expenses "15Z543 6220g 167.198 172 152 .177316 8263Z .208.116 $128,899 $132.766 $136,739 $140,852 $145,077 $149,430 $153.913 Effective gross income Net operating income Less: Debt service Before-tax cash flow Less: Depreciation Plus: Principal paid Taxable income (loss)" 126370 126370 12637 126.370 126370 lanazo 126370 $2,529 S 6,396 $ 10.369 $ 14,482 $18,707 $23.060 $27.543 36,967 38,57538,575 38,575 38,575 38,575 36.967 66717.3698.1418.993 9.935 10.975 12.124 $(27,767) $(24,810) $(20,065) (15,100) (9,933) $ (4,540) 2,700 Times: Tax rate Tax (tax saving) Before-tax cash flow 28282828 28 28 28 2,5296,39610,369 14,482 18,707 23,060 27,543 17.775) 6.947) 15.618) 14.220 L2rn 11271) -156 Less: Tax (Pius. Savings) After-tax cash flow 'Bass has adequate passive income to offset these losses. 281 PART SIX Case Problem Refer again to the Academic Arms Apartments case problems at the Five. . Discounting at 12 percent, what will be the present value of the projectif investor's marginal income tax rate is increased to 33 percent for th and all subsequent years of the investment period (including the tax the gain on disposal)? Will this reduce the equity yield below the investor's 12 percent minimum acceptable expected rate of return? e third levied on 2. Suppose the income tax rate does not change, but actual net operating income and selling price are 5 percent below expectations? How will this affect the desirability of the investment outcome? 3. Suppose NOI and selling price are 5 percent above the expected level? 4. Would it be helpful to know something about the degree of confidence the forecaster has in the cash-flow forecast? Selingvalu of the project/Net Openacing income Operating Espome/ EfWective Goss Encon100 Dfaul Rat . 100-u202% 13,00,000 13.26000 10304 Aher tax casbaw D cu tate @ 14% Operating Epnse/Efficective C Income 100 Afer tas cabAm Dwouatmg nane @ L2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts