Question: Part I (1) What does it mean to amortize a bond premium or discount? Why is it necessary? (2) What are the two bond amortization

Part I (1) What does it mean to amortize a bond premium or discount? Why is it necessary?

(2) What are the two bond amortization methods mentioned in the book and how are they different?

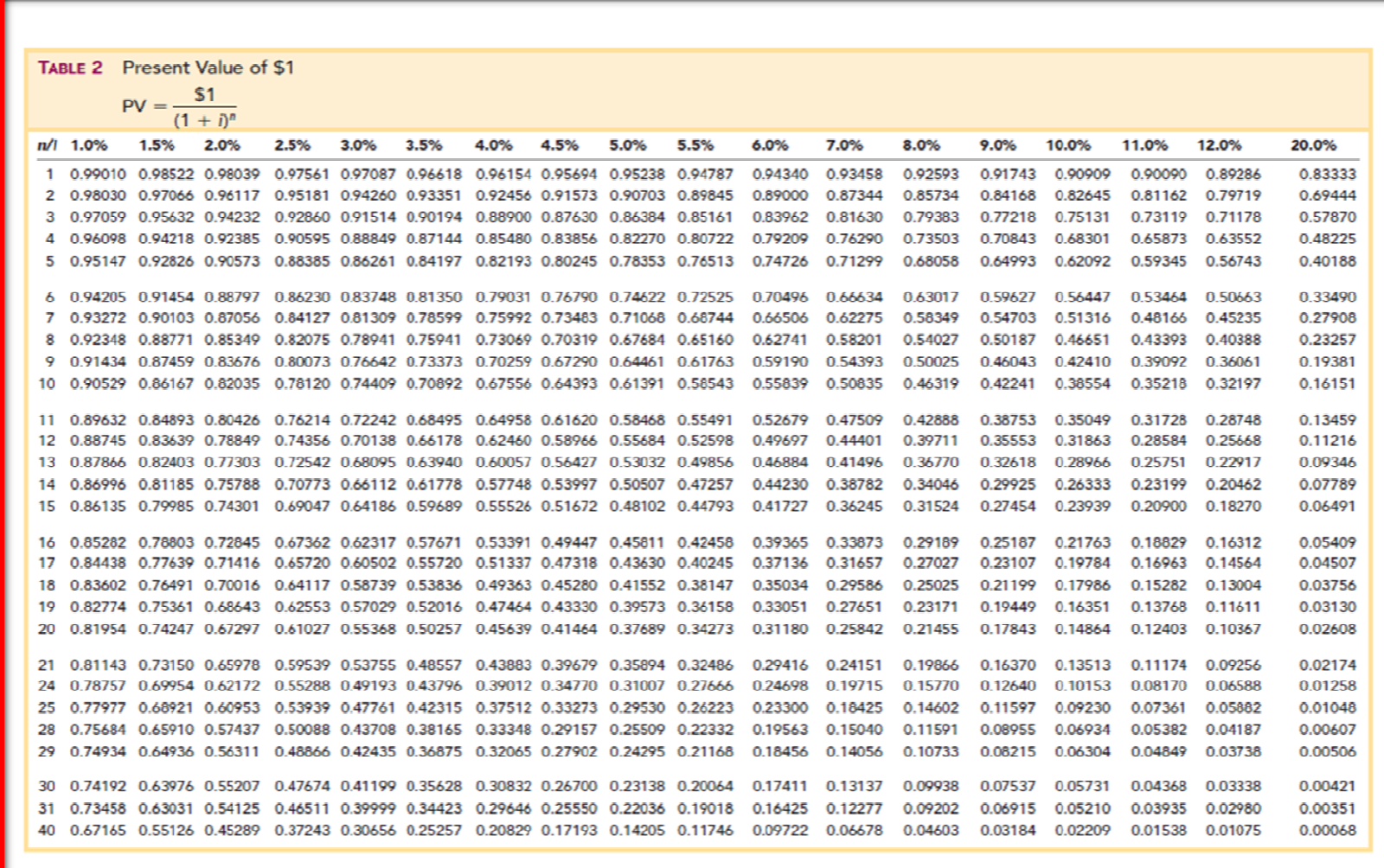

Part II Please select ONE of the problems below and record the proper journal entry for recording the issuance of the bond. Hint: You will need to refer to the Present Value Tables.pdf Download Present Value Tables.pdf. Please indicate which scenario you are answering.

(a) On January 1, a corporation issued a $1 million, five-year, 10 percent bond that pays interest semiannually. The market interest rate on January 1 was 12 percent.

(b) On January 1, a corporation issued a $1 million, five-year, 11 percent bond that pays interest semiannually. The market interest rate on January 1 was 10 percent.

Part III Please describe what is meant by Times Interest Earned. How is it calculated? Suppose you calculated this ratio for a company for two consecutive years and the results were the following:

Year 2018 24.0 Year 2017 28.0

Please interpret the results. What conclusions can you draw?

6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 20.0% TABLE 2 Present Value of $1 $1 PV = (1 + D)" ni 1.0% 1.5% 2.0% 2.5% 3.0% 3.5% 4.0% 4.5% 5.0% 5.5% 10.99010 0.98522 0.98039 0.97561 0.97087 0.96618 0.96154 0.95694 0.95238 0.94787 2 0.98030 0.97066 0.96117 0.95181 0.94260 0.93351 0.92456 0.91573 0.90703 0.89845 3 0.97059 0.95632 0.94232 0.92860 0.91514 0.90194 0.88900 0.87630 0.86384 0.85161 4 0.96098 0.94218 0.92385 0.90595 0.88849 0.87144 0.85480 0.83856 0.82270 0.80722 5 0.95147 0.92826 0.90573 0.88385 0.86261 0.84197 0.82193 0.80245 0.78353 0.76513 0.94340 0.89000 0.83962 0.79209 0.74726 0.93458 0.87344 0.81630 0.76290 0.71299 0.92593 0.85734 0.79383 0.73503 0.68058 0.91743 0.84168 0.77218 0.70843 0.64993 0.90909 0.82645 0.75131 0.68301 0.62092 0.90090 0.89286 0.81162 0.79719 0.73119 0.71178 0.65873 0.63552 0.59345 0.56743 0.83333 0.69444 0.57870 0.48225 0.40188 6 0.94205 0.91454 0.88797 0.86230 0.83748 0.81350 0.79031 0.76790 0.74622 0.72525 7 0.93272 0.90103 0.87056 0.84127 0.81309 0.78599 0.75992 0.73483 0.71068 0.68744 8 0.92348 0.88771 0.85349 0.82075 0.78941 0.75941 0.73069 0.70319 0.67684 0.65160 9 0.91434 0.87459 0.83676 0.80073 0.76642 0.73373 0.70259 0.67290 0.64461 0.61763 10 0.90529 0.86167 0.82035 0.78120 0.74409 0.70892 0.67556 0.84393 0.61391 0.58543 0.70496 0.66506 0.62741 0.59190 0.55839 0.66634 0.62275 0.58201 0.54393 0.50835 0.63017 0.58349 0.54027 0.50025 0.46319 0.59627 0.54703 0.50187 0.46043 0.42241 0.56447 0.51316 0.46651 0.42410 0.38554 0.53464 0.48166 0.43393 0.39092 0.35218 0.50663 0.45235 0.40388 0.36061 0.32197 0.33490 0.27908 0.23257 0.19381 0.16151 11 0.89632 0.84893 0.80426 0.76214 0.72242 0.68495 0.64958 0.61620 0.58468 0.55491 12 0.88745 0.83639 0.78849 0.74356 0.70138 0.66178 0.62460 0.58966 0.55684 0.52598 13 0.87866 0.82403 0.77303 0.72542 0.68095 0.63940 0.60057 0.56427 0.53032 0.49856 14 0.86996 0.81185 0.75788 0.70773 0.66112 0.61778 0.57748 0.53997 0.50507 0.47257 15 0.86135 0.79985 0.74301 0.69047 0.64186 0.59689 0.55526 0.51672 0.48102 0.44793 0.52679 0.47509 0.49697 0.44401 0.46884 0.41496 0.44230 0.38782 0.41727 0.36245 0.42888 0.39711 0.36770 0.34046 0.31524 0.38753 0.35553 0.32618 0.29925 0.27454 0.35049 0.31863 0.28966 0.26333 0.23939 0.31728 0.28584 0.25751 0.23199 0.20900 0.28748 0.25668 0.22917 0.20462 0.18270 0.13459 0.11216 0.09346 0.07789 0.06491 16 0.85282 0.78803 0.72845 0.67362 0.62317 0.57671 0.53391 0.49447 0.45811 0.42458 17 0.84438 0.77639 0.71416 0.65720 0.80502 0.55720 0.51337 0.47318 0.43630 0.40245 18 0.83602 0.76491 0.70016 0.64117 0.58739 0.53836 0.49363 0.45280 0.41552 0.38147 19 0.82774 0.75361 0.68643 0.62553 0.57029 0.52016 0.47464 0.43330 0.39573 0.36158 20 0.81954 0.74247 0.67297 0.61027 0.55368 0.50257 0.45639 0.41464 0.37689 0.34273 0.39365 0.33873 0.37136 0.31657 0.35034 0.29586 0.33051 0.27651 0.31180 0.25842 0.29189 0.27027 0.25025 0.23171 0.21455 0.25187 0.23107 0.21199 0.19449 0.17843 0.21763 0.19784 0.17986 0.16351 0.14864 0.18829 0.16312 0.16963 0.14564 0.15282 0.13004 0.13768 0.11611 0.12403 0.10367 0.05409 0.04507 0.03756 0.03130 0.02608 21 0.81143 0.73150 0.65978 0.59539 0.53755 0.48557 0.43883 0.39679 0.35894 0.32486 24 0.78757 0.69954 0.62172 0.55288 0.49193 0.43796 0.39012 0.34770 0.31007 0.27666 25 0.77977 0.68921 0.60953 0.53939 0.47761 0.42315 0.37512 0.33273 0.29530 0.26223 28 0.75684 0.65910 0.57437 0.50088 0.43708 0.38165 0.33348 0.29157 0.25509 0.22332 29 0.74934 0.64936 0.56311 0.48866 0.42435 0.36875 0.32065 0.27902 0.24295 0.21168 0.29416 0.24151 0.24698 0.19715 0.23300 0.18425 0.19563 0.15040 0.18456 0.14056 0.19866 0.15770 0.14602 0.11591 0.10733 0.16370 0.12640 0.11597 0.08955 0.08215 0.13513 0.10153 0.09230 0.06934 0.06304 0.11174 0.09256 0.08170 0.06588 0.07361 0.05882 0.05382 0.04187 0.04849 0.03738 0.02174 0.01258 0.01048 0.00607 0.00506 30 0.74192 0.63976 0.55207 0.47674 0.41199 0.35628 0.30832 0.26700 0.23138 0.20064 31 0.73458 0.63031 0.54125 0.46511 0.39999 0.34423 0.29646 0.25550 0.22036 0.19018 40 0.67165 0.55126 0.45289 0.37243 0.30656 0.25257 0.20829 0.17193 0.14205 0.11746 0.17411 0.16425 0.09722 0.13137 0.12277 0.06678 0.09938 0.09202 0.04603 0.07537 0.06915 0.03184 0.05731 0.05210 0.02209 0.04368 0.03935 0.01538 0.03338 0.02980 0.01075 0.00421 0.00351 0.00068

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts