Question: Part I (20 points) 1. (10 points) Why do new ventures have grave difficulty tapping traditional sources of capital (e.g bank loans)? (There may be

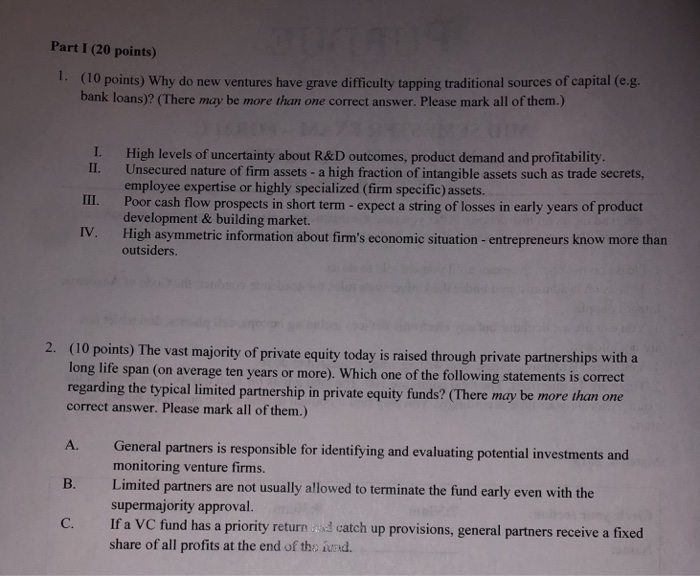

Part I (20 points) 1. (10 points) Why do new ventures have grave difficulty tapping traditional sources of capital (e.g bank loans)? (There may be more than one correct answer. Please mark all of them.) I. High levels of uncertainty about R&D outcomes, product demand and profitability. II. Unsecured nature of firm assets - a high fraction of intangible assets such as trade secrets employee expertise or highly specialized (firm specific) assets. Poor cash flow prospects in short term - expect a string of losses in early years of product development & building market. High asymmetric information about firm's economic situation- entrepreneurs know more than outsiders IV. 2. (10 points) The vast majority of private equity today is raised through private partnerships with a long life span (on average ten years or more). Which one of the following statements is correct regarding the typical limited partnership in private equity funds? (There may be more than one correct answer. Please mark all of them.) A. General partners is responsible for identifying and evaluating potential investments and monitoring venture firms. Limited partners are not usually allowed to terminate the fund early even with the supermajority approval. B. C. If a VC fund has a priority return id catch up provisions, general partners receive a fixed share of all profits at the end of the iund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts