Question: Part I. Analysis and Application Problems (65 points) 1. (11 points) Michael is trying to evaluate the following three assets for future investment considerations: a.

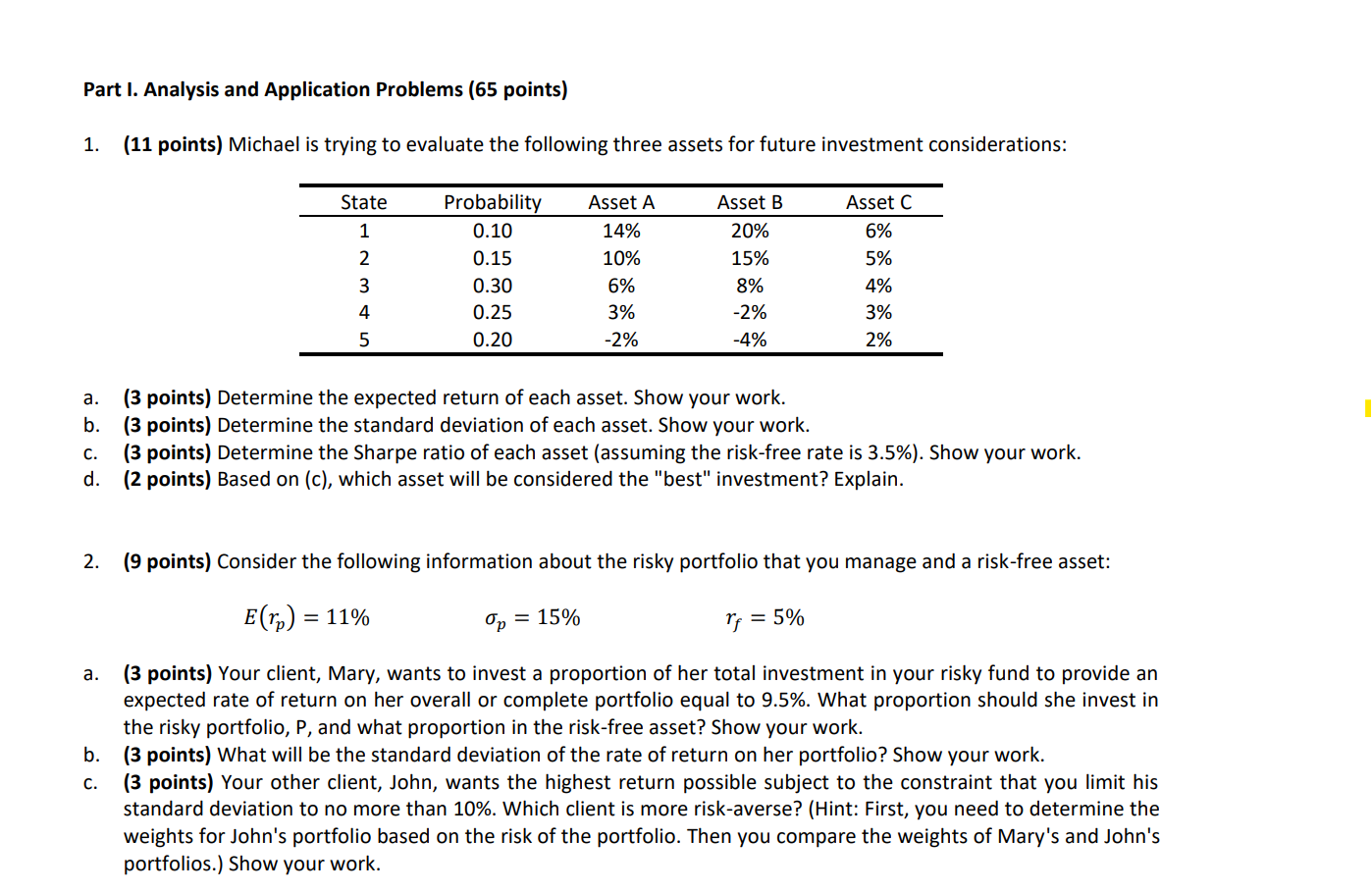

Part I. Analysis and Application Problems (65 points) 1. (11 points) Michael is trying to evaluate the following three assets for future investment considerations: a. (3 points) Determine the expected return of each asset. Show your work. b. (3 points) Determine the standard deviation of each asset. Show your work. c. (3 points) Determine the Sharpe ratio of each asset (assuming the risk-free rate is 3.5\%). Show your work. d. ( 2 points) Based on (c), which asset will be considered the "best" investment? Explain. 2. (9 points) Consider the following information about the risky portfolio that you manage and a risk-free asset: E(rp)=11%p=15%rf=5% a. (3 points) Your client, Mary, wants to invest a proportion of her total investment in your risky fund to provide an expected rate of return on her overall or complete portfolio equal to 9.5%. What proportion should she invest in the risky portfolio, P, and what proportion in the risk-free asset? Show your work. b. (3 points) What will be the standard deviation of the rate of return on her portfolio? Show your work. c. (3 points) Your other client, John, wants the highest return possible subject to the constraint that you limit his standard deviation to no more than 10%. Which client is more risk-averse? (Hint: First, you need to determine the weights for John's portfolio based on the risk of the portfolio. Then you compare the weights of Mary's and John's portfolios.) Show your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts