Question: Part I Assess how disruptive technology might affect the demand for traditional financial statements and assurance and evaluate which areas of the audit are more

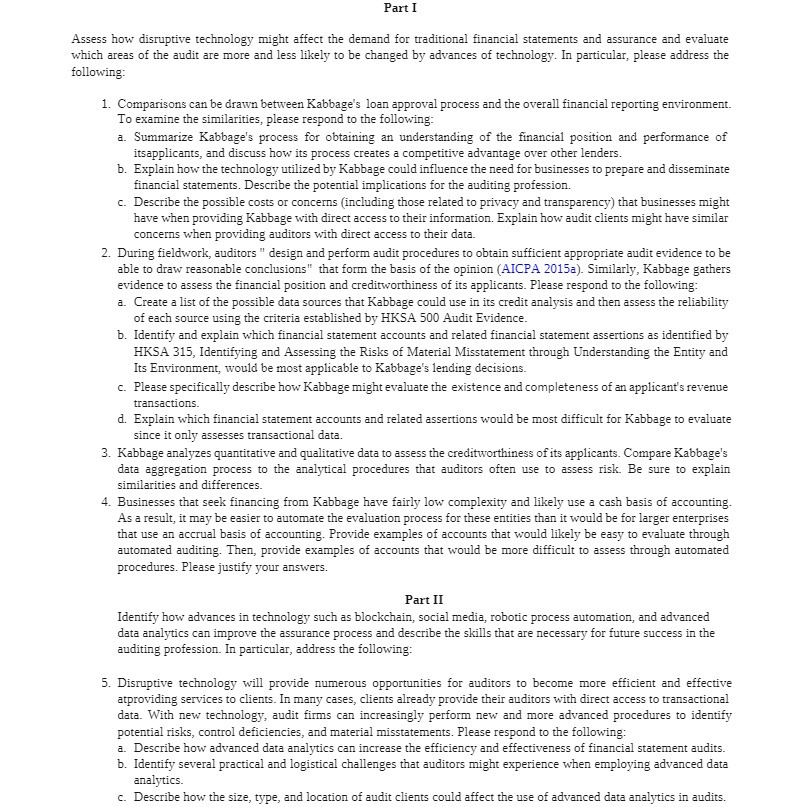

Part I Assess how disruptive technology might affect the demand for traditional financial statements and assurance and evaluate which areas of the audit are more and less likely to be changed by advances of technology. In particular, please address the following 1. Comparisons can be drawn between Kabbage's loan approval process and the overall financial reporting environment. To examine the similarities, please respond to the following: a. Summarize Kabbage's process for obtaining an understanding of the financial position and performance of itsapplicants, and discuss how its process creates a competitive advantage over other lenders. b. Explain how the technology utilized by Kabbage could influence the need for businesses to prepare and disseminate financial statements. Describe the potential implications for the auditing profession. c. Describe the possible costs or concerns (including those related to privacy and transparency) that businesses might have when providing Kabbage with direct access to their information. Explain how audit clients might have similar concerns when providing auditors with direct access to their data 2. During fieldwork, auditors " design and perform audit procedures to obtain sufficient appropriate audit evidence to be able to draw reasonable conclusions" that form the basis of the opinion (AICPA 2015a). Similarly, Kabbage gathers evidence to assess the financial position and creditworthiness of its applicants. Please respond to the following: a. Create a list of the possible data sources that Kabbage could use in its credit analysis and then assess the reliability of each source using the criteria established by HKSA 500 Audit Evidence. b. Identify and explain which financial statement accounts and related financial statement assertions as identified by HKSA 315, Identifying and Assessing the Risks of Material Misstatement through Understanding the Entity and Its Environment, would be most applicable to Kabbage's lending decisions. c. Please specifically describe how Kabbage might evaluate the existence and completeness of an applicant's revenue transactions. d. Explain which financial statement accounts and related assertions would be most difficult for Kabbage to evaluate since it only assesses transactional data. 3. Kabbage analyzes quantitative and qualitative data to assess the creditworthiness of its applicants. Compare Kabbage's data aggregation process to the analytical procedures that auditors often use to assess risk. Be sure to explain similarities and differences. 4. Businesses that seek financing from Kabbage have fairly low complexity and likely use a cash basis of accounting As a result, it may be easier to automate the evaluation process for these entities than it would be for larger enterprises that use an accrual basis of accounting. Provide examples of accounts that would likely be easy to evaluate through automated auditing. Then, provide examples of accounts that would be more difficult to assess through automated procedures. Please justify your answers. Part II Identify how advances in technology such as blockchain, social media, robotic process automation, and advanced data analytics can improve the assurance process and describe the skills that are necessary for future success in the auditing profession. In particular, address the following 5. Disruptive technology will provide numerous opportunities for auditors to become more efficient and effective atproviding services to clients. In many cases, clients already provide their auditors with direct access to transactional data. With new technology, audit firms can increasingly perform new and more advanced procedures to identify potential risks, control deficiencies, and material misstatements. Please respond to the following: a. Describe how advanced data analytics can increase the efficiency and effectiveness of financial statement audits. b. Identify several practical and logistical challenges that auditors might experience when employing advanced data analytics. c. Describe how the size, type, and location of audit clients could affect the use of advanced data analytics in audits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts