Question: Part I: Construct common size income statements for the four most recent fiscal years (that is why you need the two most recent annual reports).

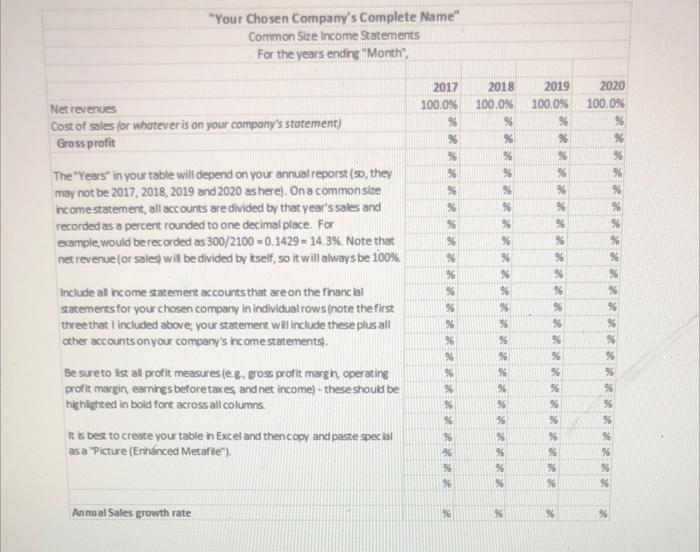

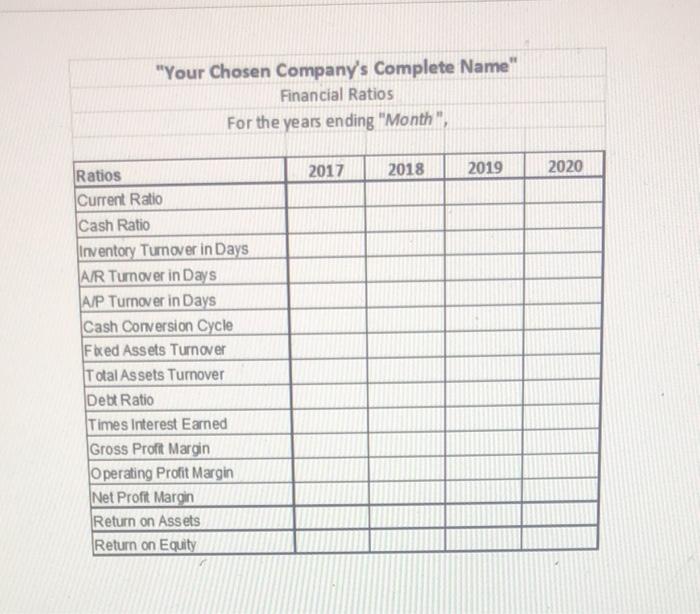

Part I: Construct common size income statements for the four most recent fiscal years (that is why you need the two most recent annual reports). Also, include a line listing the annual growth rate in net revenue (or sales) for the four most recent years, 11 "Your Chosen Company's Complete Name" Common Size Income Statements For the years ending "Month 2017 100.0% Net revenues Cost of sales for whatever is on your company's statement) Gross profit % 95 2018 100.0% % 96 % % % % %6 % % 2020 100.0% % % 96 % % % The "Years in your table will depend on your annual report (so, they may not be 2017, 2018, 2019 and 2020 as here). On a common size income statement, all accounts are divided by that year's sales and recorded as a percent rounded to one decimal place. For example, would be recorded as 300/2100 -0.1429-14.3% Note that net revenue for sales will be divided by itself, so it will always be 100% %6 % % 96 % 90 2019 100.0% 96 % > 9 96 % 95 $ % % % % % 96 % 9 RRRR % % Include al income statement accounts that are on the financial satements for your chosen company in individual rows (note the first three that included above your statement will include these plus all other accounts on your company's income statements Be sure to list all profit measuresle . gross profit margh, operating profit margin, earnings before taxes and net income) - these should be highlighted in bold font across all columns It is best to create your table in Excel and then copy and paste special asa Picture (Enhanced Metafie") 96 X %6 % 36 3 36 $ % 26 % 96 RRRRRRR BRRRR Annual Sales growth rate % 95 3 * R "Your Chosen Company's Complete Name" Financial Ratios For the years en ding "Month", 2017 2018 2019 2020 Ratios Current Ratio Cash Ratio Inventory Turnover in Days A/R Turnover in Days A/P Turnover in Days Cash Conversion Cycle Fbxed Assets Turnover Total Assets Turnover Debt Ratio Times Interest Earned Gross Proft Margin Operating Profit Margin Net Profit Margin Return on Assets Return on Equity Part I: Construct common size income statements for the four most recent fiscal years (that is why you need the two most recent annual reports). Also, include a line listing the annual growth rate in net revenue (or sales) for the four most recent years, 11 "Your Chosen Company's Complete Name" Common Size Income Statements For the years ending "Month 2017 100.0% Net revenues Cost of sales for whatever is on your company's statement) Gross profit % 95 2018 100.0% % 96 % % % % %6 % % 2020 100.0% % % 96 % % % The "Years in your table will depend on your annual report (so, they may not be 2017, 2018, 2019 and 2020 as here). On a common size income statement, all accounts are divided by that year's sales and recorded as a percent rounded to one decimal place. For example, would be recorded as 300/2100 -0.1429-14.3% Note that net revenue for sales will be divided by itself, so it will always be 100% %6 % % 96 % 90 2019 100.0% 96 % > 9 96 % 95 $ % % % % % 96 % 9 RRRR % % Include al income statement accounts that are on the financial satements for your chosen company in individual rows (note the first three that included above your statement will include these plus all other accounts on your company's income statements Be sure to list all profit measuresle . gross profit margh, operating profit margin, earnings before taxes and net income) - these should be highlighted in bold font across all columns It is best to create your table in Excel and then copy and paste special asa Picture (Enhanced Metafie") 96 X %6 % 36 3 36 $ % 26 % 96 RRRRRRR BRRRR Annual Sales growth rate % 95 3 * R "Your Chosen Company's Complete Name" Financial Ratios For the years en ding "Month", 2017 2018 2019 2020 Ratios Current Ratio Cash Ratio Inventory Turnover in Days A/R Turnover in Days A/P Turnover in Days Cash Conversion Cycle Fbxed Assets Turnover Total Assets Turnover Debt Ratio Times Interest Earned Gross Proft Margin Operating Profit Margin Net Profit Margin Return on Assets Return on Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts