Question: Part I. Multiple Choice (2 points each, 100 points total) 1. You deposit $10,000 today in a savings account paying 6% per year, compounded quarterly.

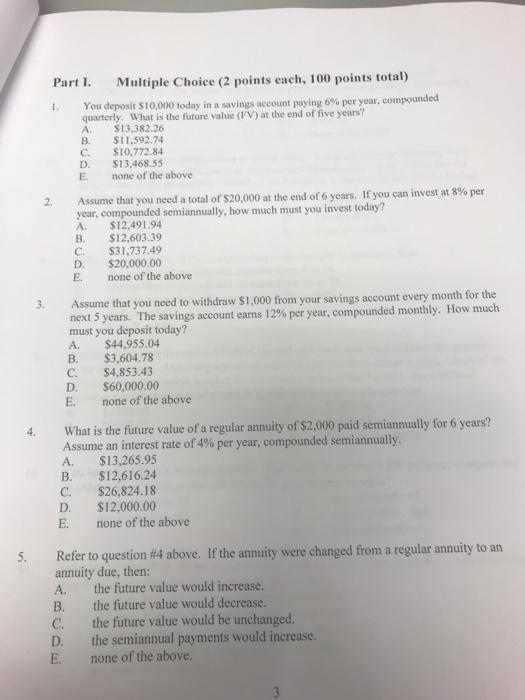

Part I. Multiple Choice (2 points each, 100 points total) 1. You deposit $10,000 today in a savings account paying 6% per year, compounded quarterly. What is the future value (FV) at the end of five years? A $13,382.26 B $11.592.74 C. $10,772.84 D $13,468.55 E none of the above Assume that you need a total of $20,000 at the end of 6 years. If you can invest at 8% per year, compounded semiannually, how much must you invest today? A. S12.491.94 B. $12,603.39 $31.737.49 D. $20,000.00 E none of the above Assume that you need to withdraw $1.000 from your savings account every month for the next 5 years. The savings account carns 12% per year, compounded monthly. How much must you deposit today? A. $44.955.04 B. $3,604.78 C. $4,853.43 D. $60,000.00 E. none of the above 3. 4. What is the future value of a regular annuity of $2,000 paid semiannually for 6 years? Assume an interest rate of 4% per year, compounded semiannually. A. $13,265.95 B. $12.616.24 C. $26.824.18 D. $12,000.00 E. none of the above 5. Refer to question #4 above. If the annuity were changed from a regular annuity to an annuity due, then: A. the future value would increase B. the future value would decrease. C. the future value would be unchanged. D. the semiannual payments would increase. E. none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts