Question: Part I: Multiple Choice (24 questions, 2.5 points cach) For each of the following questions, select the best answer from among those give and record

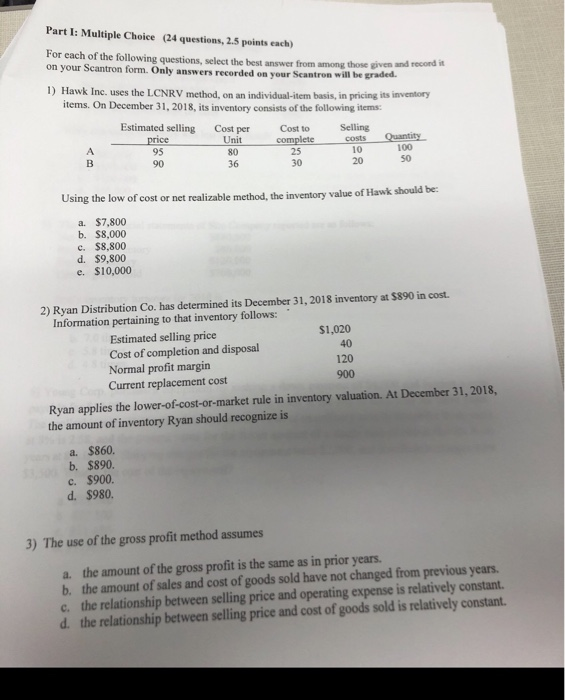

Part I: Multiple Choice (24 questions, 2.5 points cach) For each of the following questions, select the best answer from among those give and record on your Scantron form. Only answers recorded on your Scantron will be praded. 1) Hawk Inc. uses the LCNRV method, on an individual-item basis, in pricing its inventory items. On December 31, 2018, its inventory consists of the following items Estimated selling Cost per Cost to price Unit complete costs Quantity 10 100 36 20 90 Using the low of cost or net realizable method, the inventory value of Hawk should be: a $7.800 b. $8,000 c. $8.800 d. $9,800 e. $10,000 120 2) Ryan Distribution Co. has determined its December 31, 2018 inventory at $890 in cost. Information pertaining to that inventory follows: Estimated selling price $1,020 Cost of completion and disposal 40 Normal profit margin Current replacement cost 900 Ryan applies the lower-of-cost-or-market rule in inventory valuation. At December 31, 2018, the amount of inventory Ryan should recognize is a. $860. b. $890 c. $900. d. $980. 3) The use of the gross profit method assumes a. the amount of the gross profit is the same as in prior years. b. the amount of sales and cost of goods sold have not changed from previous years. c. the relationship between selling price and operating expense is relatively constant. d. the relationship between selling price and cost of goods sold is relatively constant

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts