Question: Part I (Multiple choice problem). Care appropriate alternatives. There is no partial watives. There is no partial credit for this 1. The constant-growth dividend discount

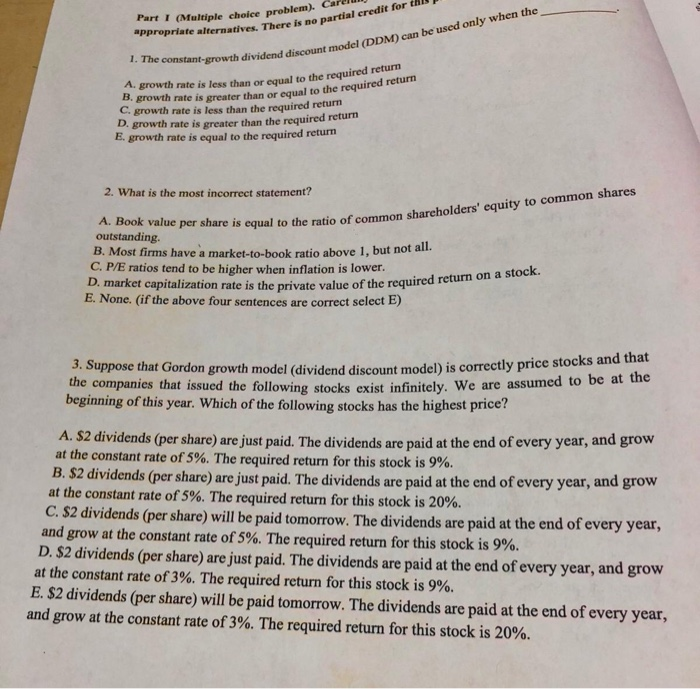

Part I (Multiple choice problem). Care appropriate alternatives. There is no partial watives. There is no partial credit for this 1. The constant-growth dividend discount model ( discount model (DDM) can be used only when the than or equal to the required return A. growth rate is less than or equal to the requ rowth rate is greater than or equal to the required return C. growth rate is less than the required return D. growth rate is greater than the required return E growth rate is equal to the required return 2. What is the most incorrect statement? equal to the ratio of common shareholders' equity to common shares A. Book value per share is equal to the ratio of outstanding. B. Most firms have a market-to-book ratio above 1, but not all. C. P/E ratios tend to be higher when inflation is lower. D. market capitalization rate is the private value of the required E. None. (if the above four sentences are correct select E) private value of the required return on a stock. discount model) is correctly price stocks and that 3. Suppose that Gordon growth model (dividend discount model) is correctly price stock the companies that issued the following stocks exist infinitely. We are assumed lowing stocks exist infinitely. We are assumed to be at the beginning of this year. Which of the following stocks has the highest price A. $2 dividends (per share) are just paid. The dividends are paid at the end of every year, and so at the constant rate of 5%. The required return for this stock is 9%. B. $2 dividends (per share) are just paid. The dividends are paid at the end of every year, and grow at the constant rate of 5%. The required return for this stock is 20%. C. $2 dividends (per share) will be paid tomorrow. The dividends are paid at the end of every year, and grow at the constant rate of 5%. The required return for this stock is 9%. D. $2 dividends (per share) are just paid. The dividends are paid at the end of every year, and grow at the constant rate of 3%. The required return for this stock is 9%. E. $2 dividends (per share) will be paid tomorrow. The dividends are paid at the end of every year, and grow at the constant rate of 3%. The required return for this stock is 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts