Question: Part I: Multiple Choice Questions (20 x 2 marks - 40 marks) 1. Mr. Siu, a Hong Kong resident, married his wife in Mainland China

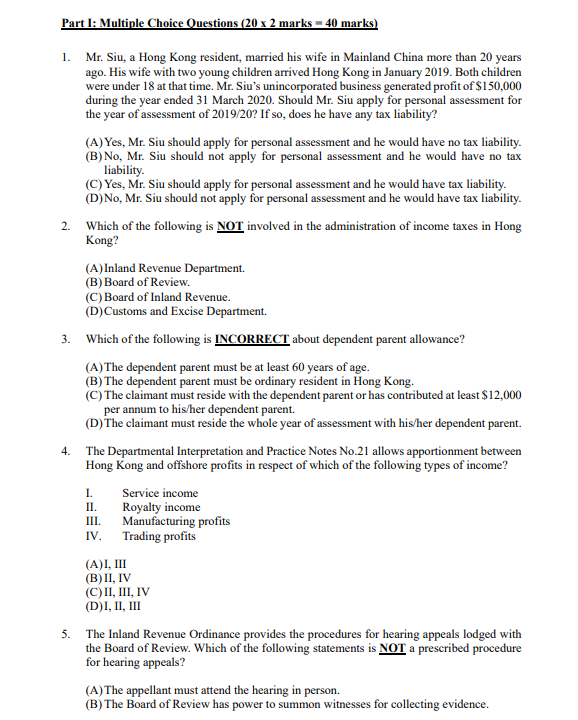

Part I: Multiple Choice Questions (20 x 2 marks - 40 marks) 1. Mr. Siu, a Hong Kong resident, married his wife in Mainland China more than 20 years ago. His wife with two young children arrived Hong Kong in January 2019. Both children were under 18 at that time. Mr. Siu's unincorporated business generated profit of $150,000 during the year ended 31 March 2020. Should Mr. Siu apply for personal assessment for the year of assessment of 2019/20? If so, does he have any tax liability? (A)Yes, Mr. Siu should apply for personal assessment and he would have no tax liability. (B) No, Mr. Siu should not apply for personal assessment and he would have no tax liability. (C) Yes, Mr. Siu should apply for personal assessment and he would have tax liability. (D)No, Mr. Siu should not apply for personal assessment and he would have tax liability. 2. Which of the following is NOT involved in the administration of income taxes in Hong Kong? (A) Inland Revenue Department. (B) Board of Review. (C)Board of Inland Revenue. (D) Customs and Excise Department. 3. Which of the following is INCORRECT about dependent parent allowance? (A) The dependent parent must be at least 60 years of age. (B) The dependent parent must be ordinary resident in Hong Kong. (C) The claimant must reside with the dependent parent or has contributed at least $12,000 per annum to his/her dependent parent. (D) The claimant must reside the whole year of assessment with his/her dependent parent. 4. The Departmental Interpretation and Practice Notes No.21 allows apportionment between Hong Kong and offshore profits in respect of which of the following types of income? 1. Service income II. Royalty income III. Manufacturing profits IV. Trading profits (A), III (B) II, IV (C)II, III, IV (D)I, II, III 5. The Inland Revenue Ordinance provides the procedures for hearing appeals lodged with the Board of Review. Which of the following statements is NOT a prescribed procedure for hearing appeals? (A)The appellant must attend the hearing in person. (B) The Board of Review has power to summon witnesses for collecting evidence. (C) The onus of proving that an assessment is excessive or incorrect is on the appellant. (D) The appellant can withdraw his/her appeal without prior approval by the Board of Review. 6. Mrs. Wong works for a Hong Kong company and has to work between Hong Kong and China. She wished to avoid paying China Tax. You would advise her NOT to stay in China for more than: (A) 60 days in a calendar year. (B) 60 days in a year of assessment. (C)183 days in a calendar year. (D) 183 days in a year of assessment. 7. Jody and Ada are partners operating AML Solicitors and Notaries. Under the partnership agreement, Jody is allowed to draw a monthly salary of $10,000 and the partnership profit is divided in equal shares between the partners. During the year of assessment 2019/20, the partnership profit was HK$100,000 (before deducting partner's salary). How will the assessable profits be allocated between the partners? (A)Jody (profit of $40,000) Ada (profit of $50,000) (B)Jody (profit of $45,000) Ada (loss of $45,000) (C)Jody (profit of $50,000) Ada (profit of $50,000) (D)Jody (profit of $100,000) Ada (nil) 8. John Regan is a professor of European Culture at the University of Hong Kong. He entered into an employment contract with the University on 1 October 2017 for a 5-year term. Upon completion of the contract, he is entitled to a gratuity of $600,000. If John decides to have the gratuity related back, how much will be his additional assessable income for the year of assessment 2019/20? (A)$600,000 (B) $200,000. (C)$100,000 (D)50. 9. Your client has income from property and employment. He understands that by electing personal assessment (PA), his income would be aggregated and he may enjoy deduction of personal allowance and mortgage interest. However, he is very hesitated to elect PA as he isn't sure whether he may end up paying more tax if he subsequently finds that he does not have PA advantage. What is your advice to him? (A)He must lodge an objection if he finds that the assessment under PA is not to his advantage (B) He needs not worry as the IRD will not issue an assessment under PA if it is not to his advantage. (C) He has to pay the tax under PA even if he subsequently finds that he does not have PA advantage. (D) He needs to complete a form for withdrawal within one month after election of PA if he subsequently finds that he does not have PA advantage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts