Question: PART I: Please circle your answer. No need to present the 1) Red and Blue, Inc. offers a 4 percent bond with a yield to

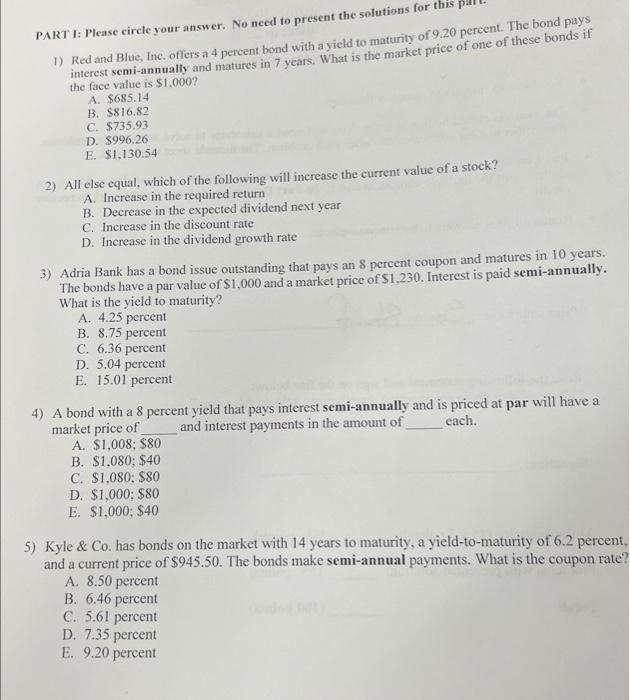

PART I: Please circle your answer. No need to present the 1) Red and Blue, Inc. offers a 4 percent bond with a yield to maturity of 9.20 percent The bone bonds if interest semi-annually and matures in 7 years. What is the market pice the face value is $1,000 ? A. $685.14 B. $816.82 C. $735.93 D. $996.26 E. $1,130.54 2) All else equal, which of the following will increase the current value of a stock? A. Increase in the required return B. Decrease in the expected dividend next year C. Increase in the discount rate D. Increase in the dividend growth rate 3) Adria Bank has a bond issue outstanding that pays an 8 percent coupon and matures in 10 years. The bonds have a par value of $1,000 and a market price of $1,230. Interest is paid semi-annually. What is the yield to maturity? A. 4.25 percent B. 8.75 percent C. 6.36 percent D. 5.04 percent E. 15.01 percent 4) A bond with a 8 percent yield that pays interest semi-annually and is priced at par will have a market price of and interest payments in the amount of each. A. $1,008;$80 B. $1,080;$40 C. $1,080;$80 D. $1,000;$80 E. $1,000;$40 5) Kyle \& Co. has bonds on the market with 14 years to maturity, a yield-to-maturity of 6.2 percent and a current price of $945.50. The bonds make semi-annual payments. What is the coupon rate A. 8.50 percent B. 6.46 percent C. 5.61 percent D. 7.35 percent E. 9.20 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts