Question: Part II ( 1 9 points ) : Nick had a general purpose truck ( Old Truck ) that he used in his sole

Part II points:

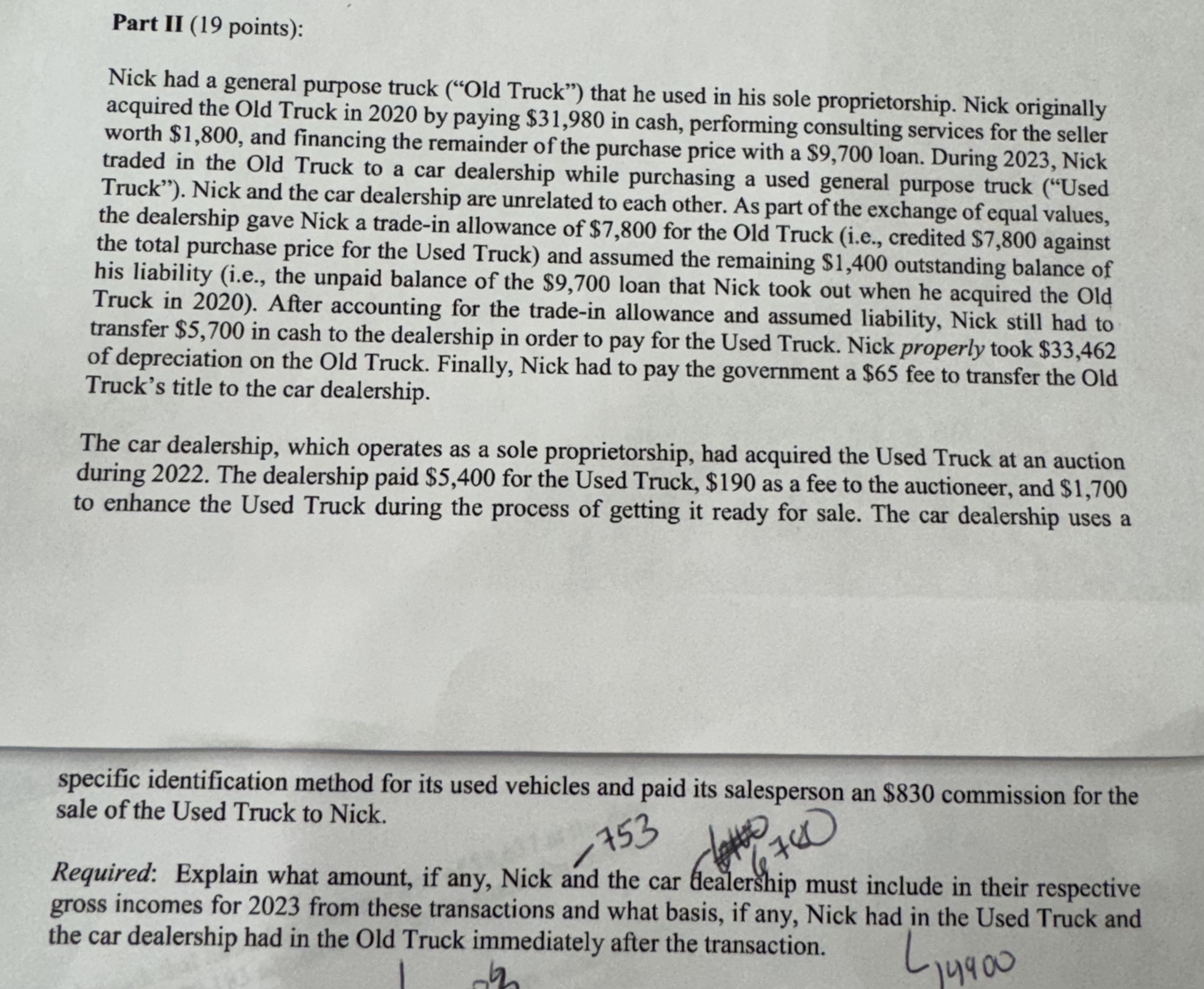

Nick had a general purpose truck Old Truck" that he used in his sole proprietorship. Nick originally acquired the Old Truck in by paying $ in cash, performing consulting services for the seller worth $ and financing the remainder of the purchase price with a $ loan. During Nick traded in the Old Truck to a car dealership while purchasing a used general purpose truck Used Truck" Nick and the car dealership are unrelated to each other. As part of the exchange of equal values, the dealership gave Nick a tradein allowance of $ for the Old Truck ie credited $ against the total purchase price for the Used Truck and assumed the remaining $ outstanding balance of his liability ie the unpaid balance of the $ loan that Nick took out when he acquired the Old Truck in After accounting for the tradein allowance and assumed liability, Nick still had to transfer $ in cash to the dealership in order to pay for the Used Truck. Nick properly took $ of depreciation on the Old Truck. Finally, Nick had to pay the government a $ fee to transfer the Old Truck's title to the car dealership.

The car dealership, which operates as a sole proprietorship, had acquired the Used Truck at an auction during The dealership paid $ for the Used Truck, $ as a fee to the auctioneer, and $ to enhance the Used Truck during the process of getting it ready for sale. The car dealership uses a

specific identification method for its used vehicles and paid its salesperson an $ commission for the sale of the Used Truck to Nick.

Required: Explain what amount, if any, Nick and the car dealership must include in their respective gross incomes for from these transactions and what basis, if any, Nick had in the Used Truck and the car dealership had in the Old Truck immediately after the transaction.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock