Question: Part II (25 Points) General Electric issues bonds with a coupon rate of 5% per year, American Stores issues bonds with a coupon rate of

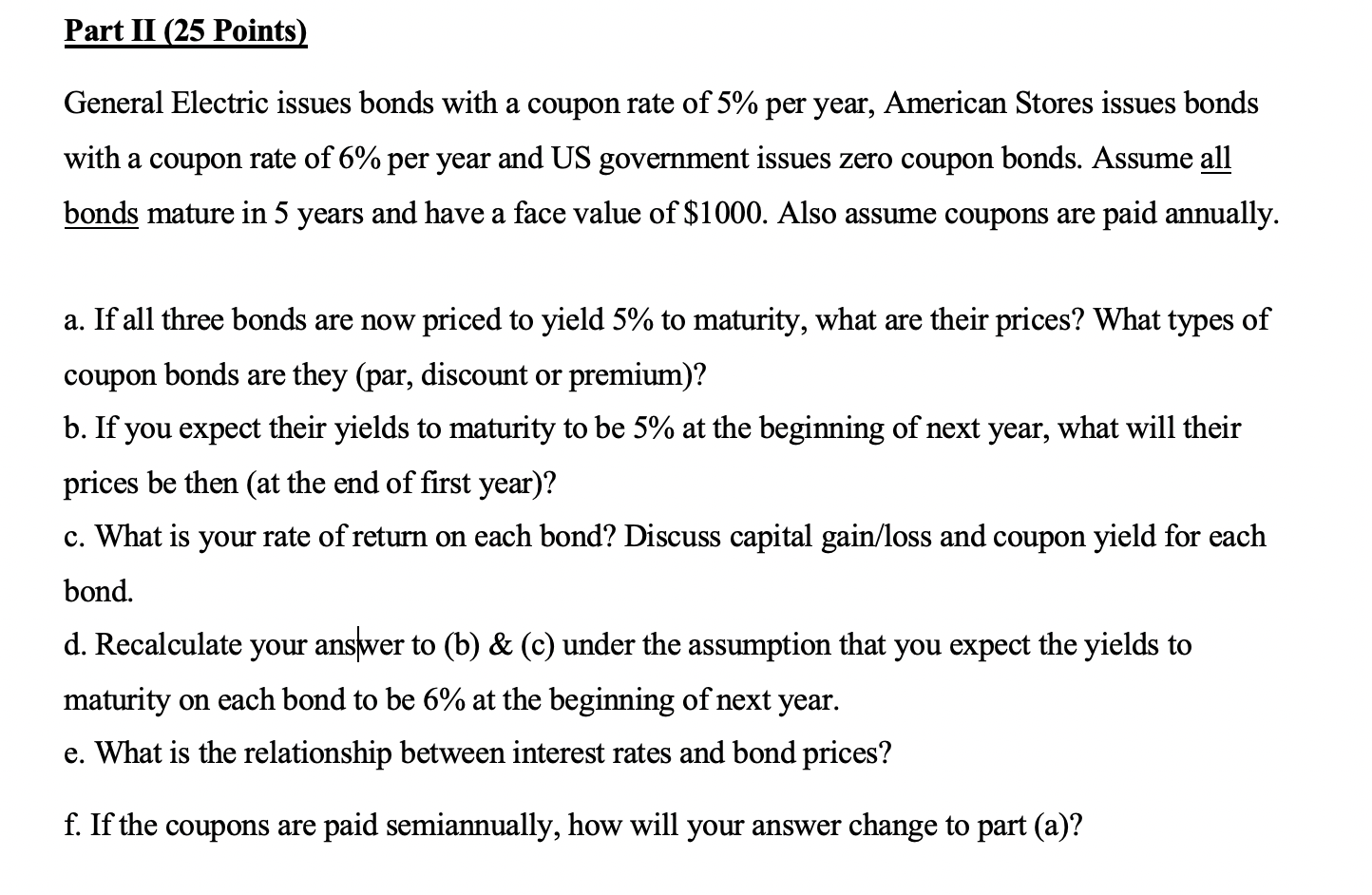

Part II (25 Points) General Electric issues bonds with a coupon rate of 5% per year, American Stores issues bonds with a coupon rate of 6% per year and US government issues zero coupon bonds. Assume all bonds mature in 5 years and have a face value of $1000. Also assume coupons are paid annually. a. If all three bonds are now priced to yield 5% to maturity, what are their prices? What types of coupon bonds are they (par, discount or premium)? b. If you expect their yields to maturity to be 5% at the beginning of next year, what will their prices be then (at the end of first year)? c. What is your rate of return on each bond? Discuss capital gain/loss and coupon yield for each bond. d. Recalculate your answer to (b) & (c) under the assumption that you expect the yields to maturity on each bond to be 6% at the beginning of next year. e. What is the relationship between interest rates and bond prices? f. If the coupons are paid semiannually, how will your answer change to part (a)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts