Question: PART II BLACK-SCHOLES OPTION PRICING MODEL Answer questions #22 - #27 based on the following information Consider an option on a non-dividend paying stock where

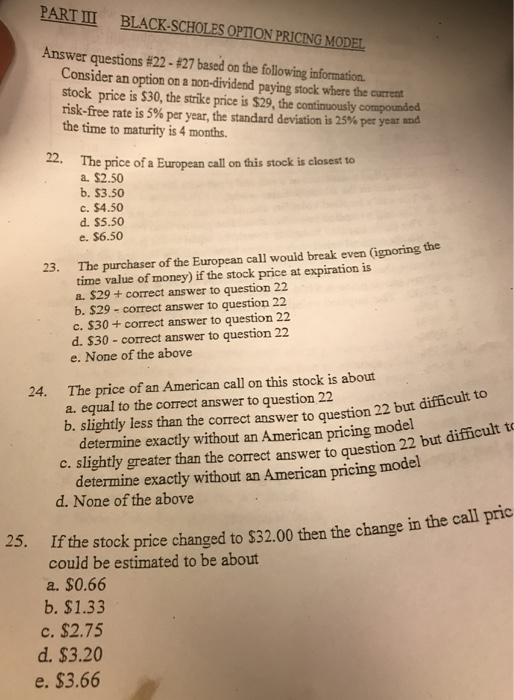

PART II BLACK-SCHOLES OPTION PRICING MODEL Answer questions #22 - #27 based on the following information Consider an option on a non-dividend paying stock where the current stock price is $30, the strike price is $29, the continuously compounded risk-free rate is 5% per year, the standard deviation is 25% per year and the time to maturity is 4 months. The price of a European call on this stock is closest to a. $2.50 b. $3.50 c. $4.50 d. $5.50 e. $6.50 23. The purchaser of the European call would break even (ignoring the time value of money) if the stock price at expiration is a. $29 + correct answer to question 22 b. $29 - correct answer to question 22 c. $30 + correct answer to question 22 d. $30 - correct answer to question 22 e. None of the above rto question 22 but difficult to er to question 22 but difficult to 24. The price of an American call on this stock is about a. equal to the correct answer to question 22 b. slightly less than the correct answer to question 22 buta determine exactly without an American pricing model c. slightly greater than the correct answer to question 22 determine exactly without an American pricing model d. None of the above 25. If the stock price changed to $32.00 then If the stock price changed to $32.00 then the change in the call prio could be estimated to be about a. $0.66 b. $1.33 c. $2.75 d. $3.20 e. $3.66

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts