Question: Part II: Cash Flow Estimation Use this information to answer questions 18-25 Bearkat Enterprises is considering a project where they will make high end designer

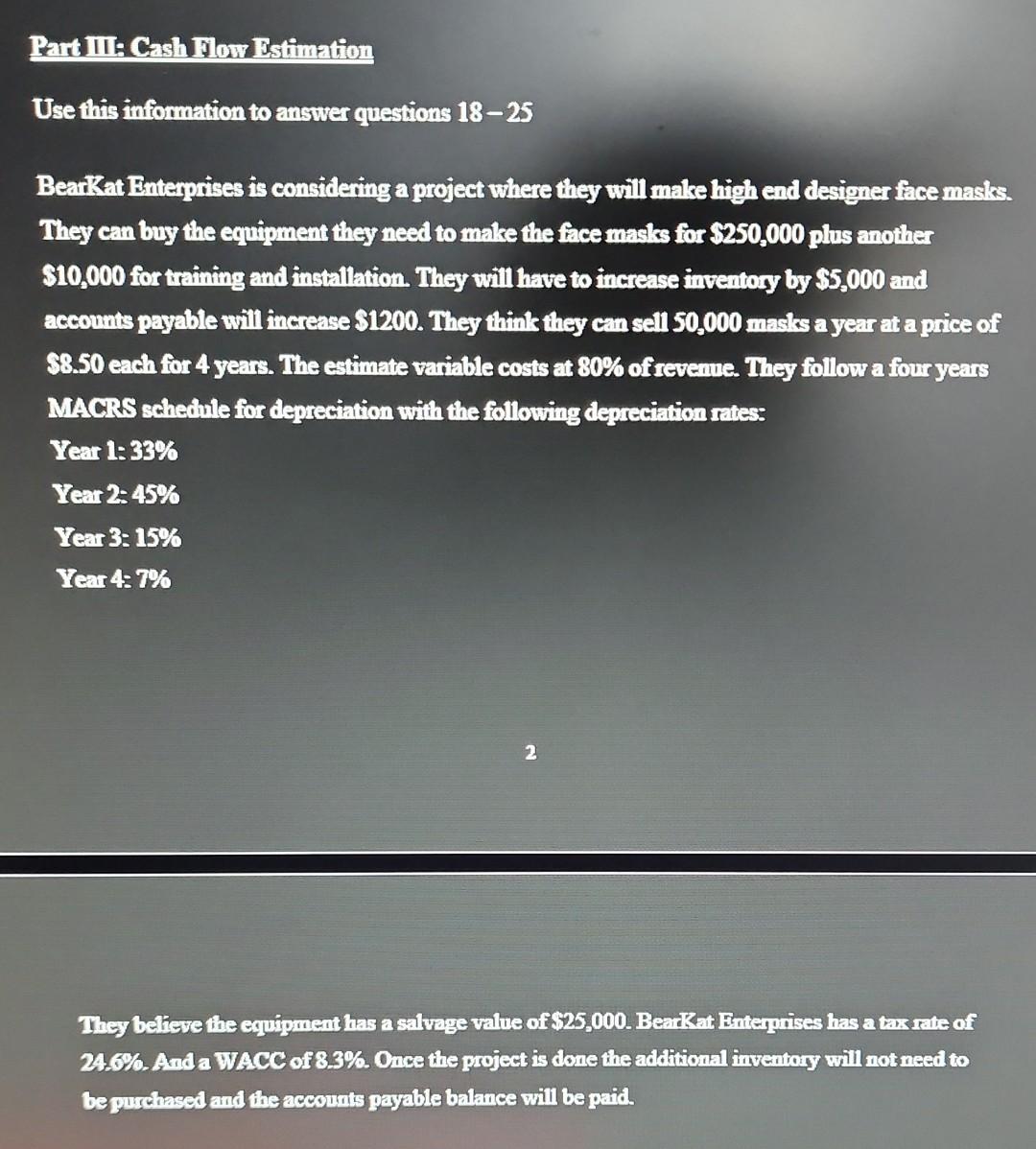

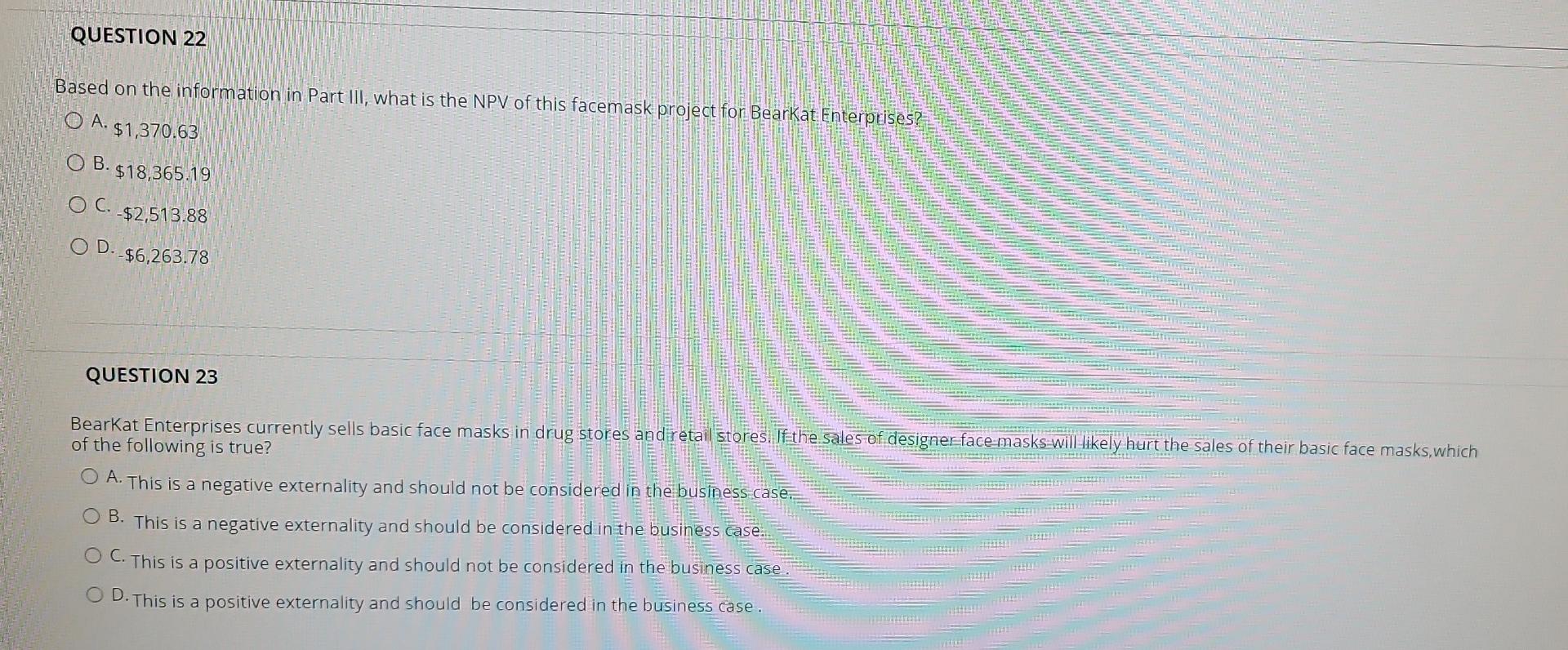

Part II: Cash Flow Estimation Use this information to answer questions 18-25 Bearkat Enterprises is considering a project where they will make high end designer face masks. They can buy the equipment they need to make the face masks for $250,000 plus another $10,000 for training and installation. They will have to increase inventory by $5,000 and accounts payable will increase $1200. They think they can sell 50,000 masks a year at a price of $8.50 each for 4 years. The estimate variable costs at 80% of revenue. They follow a four years MACRS schedule for depreciation with the following depreciation rates: Year 1:33% Year 2: 45% Year 3: 15% Year 4: 7% 2 They believe the equipment has a salvage value of $25,000. BearKat Enterprises has a tax rate of 24.6%. And a WACC of 8.3%. Once the project is done the additional inventory will not need to be purchased and the accounts payable balance will be paid. QUESTION 22 Based on the information in Part III, what is the NPV of this facemask project for Bearkat Enterprises? O A. $1,370.63 O B. $18,365.19 OC. -$2,513.88 O D.-$6,263.78 QUESTION 23 Bearkat Enterprises currently sells basic face masks in drug stores and retail stores. If the sales of designer face masks will likely hurt t the sales of their basic face masks, which of the following is true? O A. This is a negative externality and should not be considered in the business case. OB. This is a negative externality and should be considered in the business case. O C. This is a positive externality and should not be considered in the business case. O D.This is a positive externality and should be considered in the business case. Part II: Cash Flow Estimation Use this information to answer questions 18-25 Bearkat Enterprises is considering a project where they will make high end designer face masks. They can buy the equipment they need to make the face masks for $250,000 plus another $10,000 for training and installation. They will have to increase inventory by $5,000 and accounts payable will increase $1200. They think they can sell 50,000 masks a year at a price of $8.50 each for 4 years. The estimate variable costs at 80% of revenue. They follow a four years MACRS schedule for depreciation with the following depreciation rates: Year 1:33% Year 2: 45% Year 3: 15% Year 4: 7% 2 They believe the equipment has a salvage value of $25,000. BearKat Enterprises has a tax rate of 24.6%. And a WACC of 8.3%. Once the project is done the additional inventory will not need to be purchased and the accounts payable balance will be paid. QUESTION 22 Based on the information in Part III, what is the NPV of this facemask project for Bearkat Enterprises? O A. $1,370.63 O B. $18,365.19 OC. -$2,513.88 O D.-$6,263.78 QUESTION 23 Bearkat Enterprises currently sells basic face masks in drug stores and retail stores. If the sales of designer face masks will likely hurt t the sales of their basic face masks, which of the following is true? O A. This is a negative externality and should not be considered in the business case. OB. This is a negative externality and should be considered in the business case. O C. This is a positive externality and should not be considered in the business case. O D.This is a positive externality and should be considered in the business case

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts