Question: Part II Comprehensive problem (50%) AAA Corporation is going to purchase an equipment for $300,000 that will produce and sell 10,000 units per year for

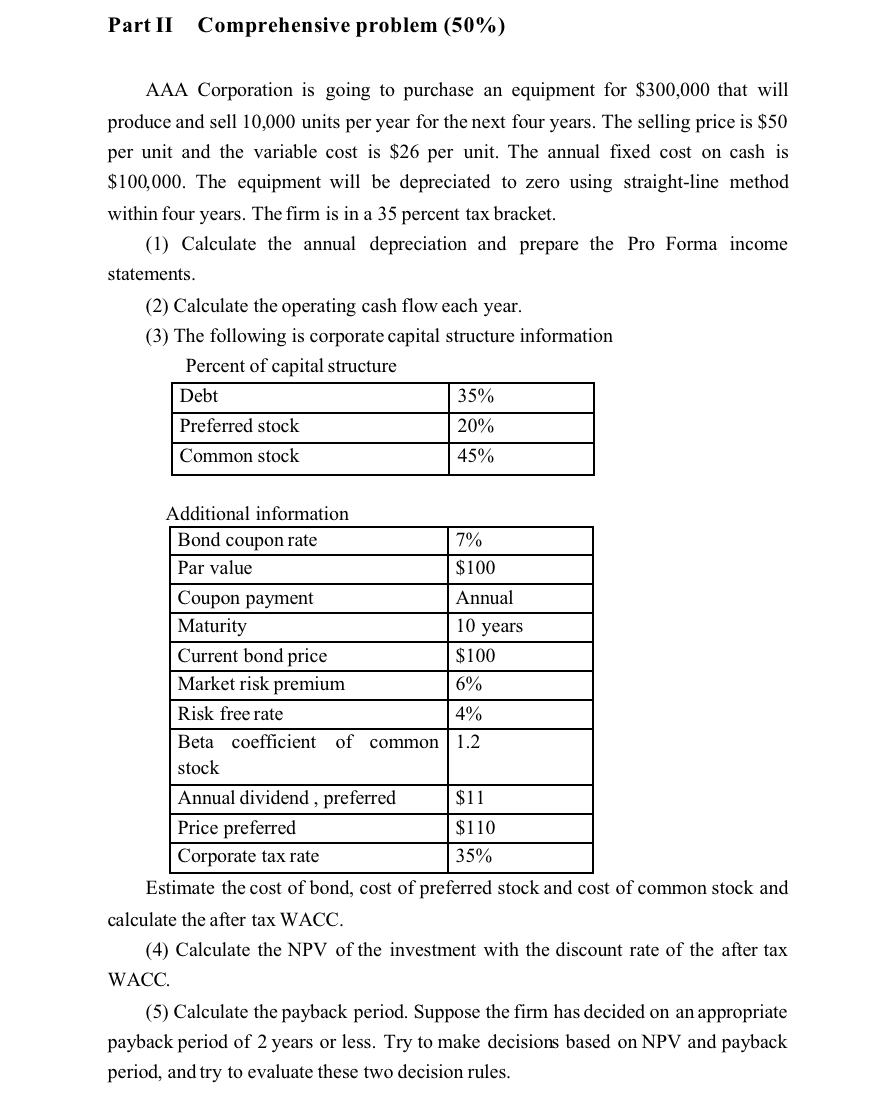

Part II Comprehensive problem (50%) AAA Corporation is going to purchase an equipment for $300,000 that will produce and sell 10,000 units per year for the next four years. The selling price is $50 per unit and the variable cost is $26 per unit. The annual fixed cost on cash is $100,000. The equipment will be depreciated to zero using straight-line method within four years. The firm is in a 35 percent tax bracket. (1) Calculate the annual depreciation and prepare the Pro Forma income statements. (2) Calculate the operating cash flow each year. (3) The following is corporate capital structure information Percent of capital structure Debt 35% Preferred stock 20% Common stock 45% Additional information Bond coupon rate 7% Par value $100 Coupon payment Annual Maturity 10 years Current bond price $100 Market risk premium 6% Risk free rate 4% Beta coefficient of common 1.2 stock Annual dividend, preferred $11 Price preferred $110 Corporate tax rate 35% Estimate the cost of bond, cost of preferred stock and cost of common stock and calculate the after tax WACC. (4) Calculate the NPV of the investment with the discount rate of the after tax WACC. (5) Calculate the payback period. Suppose the firm has decided on an appropriate payback period of 2 years or less. Try to make decisions based on NPV and payback period, and try to evaluate these two decision rules

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts