Question: PART II Exercise N1 The balance sheet dated December 31, 2003, has a balance in the Finished Goods Inventory account of $26,200. The December 31,

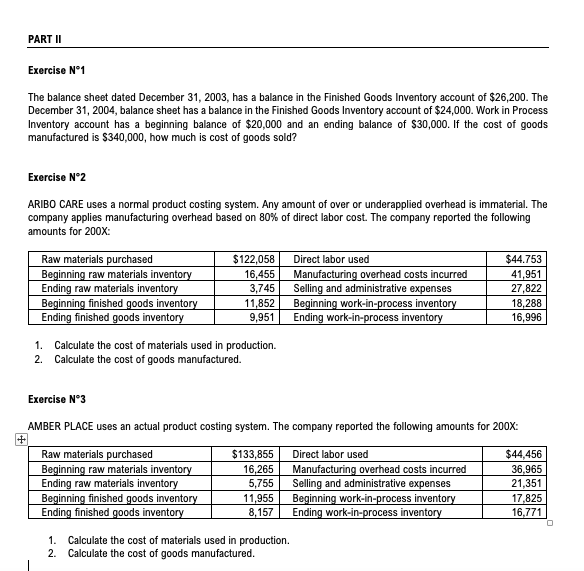

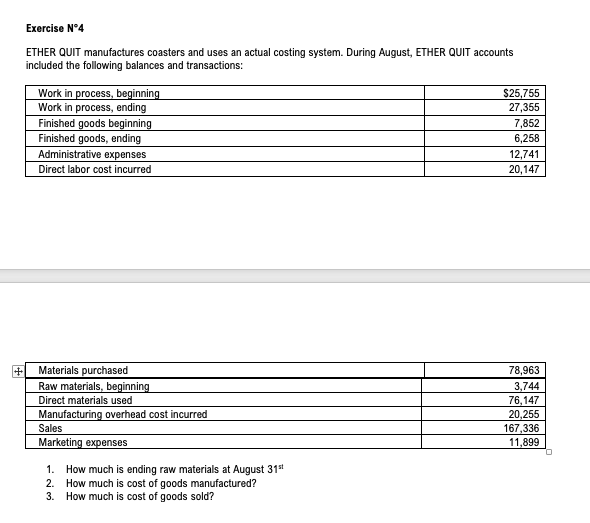

PART II Exercise N1 The balance sheet dated December 31, 2003, has a balance in the Finished Goods Inventory account of $26,200. The December 31, 2004, balance sheet has a balance in the Finished Goods Inventory account of $24,000. Work in Process Inventory account has a beginning balance of $20,000 and an ending balance of $30,000. If the cost of goods manufactured is $340,000, how much is cost of goods sold? Exercise N2 ARIBO CARE uses a normal product costing system. Any amount of over or underapplied overhead is immaterial. The company applies manufacturing overhead based on 80% of direct labor cost. The company reported the following nounts for 2007: Raw materials purchased $122,058 Beginning raw materials inventory 16,455 Ending raw materials inventory 3,745 Beginning finished goods inventory 11,852 Ending finished goods inventory 9,951 1. Calculate the cost of materials used in production. 2. Calculate the cost of goods manufactured. Direct labor used Manufacturing overhead costs incurred Selling and administrative expenses Beginning work-in-process inventory Ending work-in-process inventory $44.753 41,951 27,822 18,288 16,996 Exercise N3 AMBER PLACE uses an actual product costing system. The company reported the following amounts for 2007: Raw materials purchased $133,855 Direct labor used Beginning raw materials inventory 16,265 Manufacturing overhead costs incurred Ending raw materials inventory 5,755 Selling and administrative expenses Beginning finished goods inventory 11,955 Beginning work-in-process inventory Ending finished goods inventory 8,157 Ending work-in-process inventory 1. Calculate the cost of materials used in production. 2. Calculate the cost of goods manufactured. $44,456 36,965 21,351 17,825 16,771 Exercise N4 ETHER QUIT manufactures coasters and uses an actual costing system. During August, ETHER QUIT accounts included the following balances and transactions: Work in process, beginning $25,755 Work in process, ending 27,355 Finished goods beginning 7,852 Finished goods, ending 6,258 Administrative expenses 12,741 Direct labor cost incurred 20,147 + Materials purchased Raw materials, beginning Direct materials used Manufacturing overhead cost incurred Sales Marketing expenses 78,963 3,744 76,147 20,255 167,336 11,899 1. How much is ending raw materials at August 315 2. How much is cost of goods manufactured? 3. How much is cost of goods sold

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts