Question: Part II: Problem Solving (3 questions, 60 points) Problem I (25 points) You are evaluating a project for The Ultimate recreational canis racket anteed to

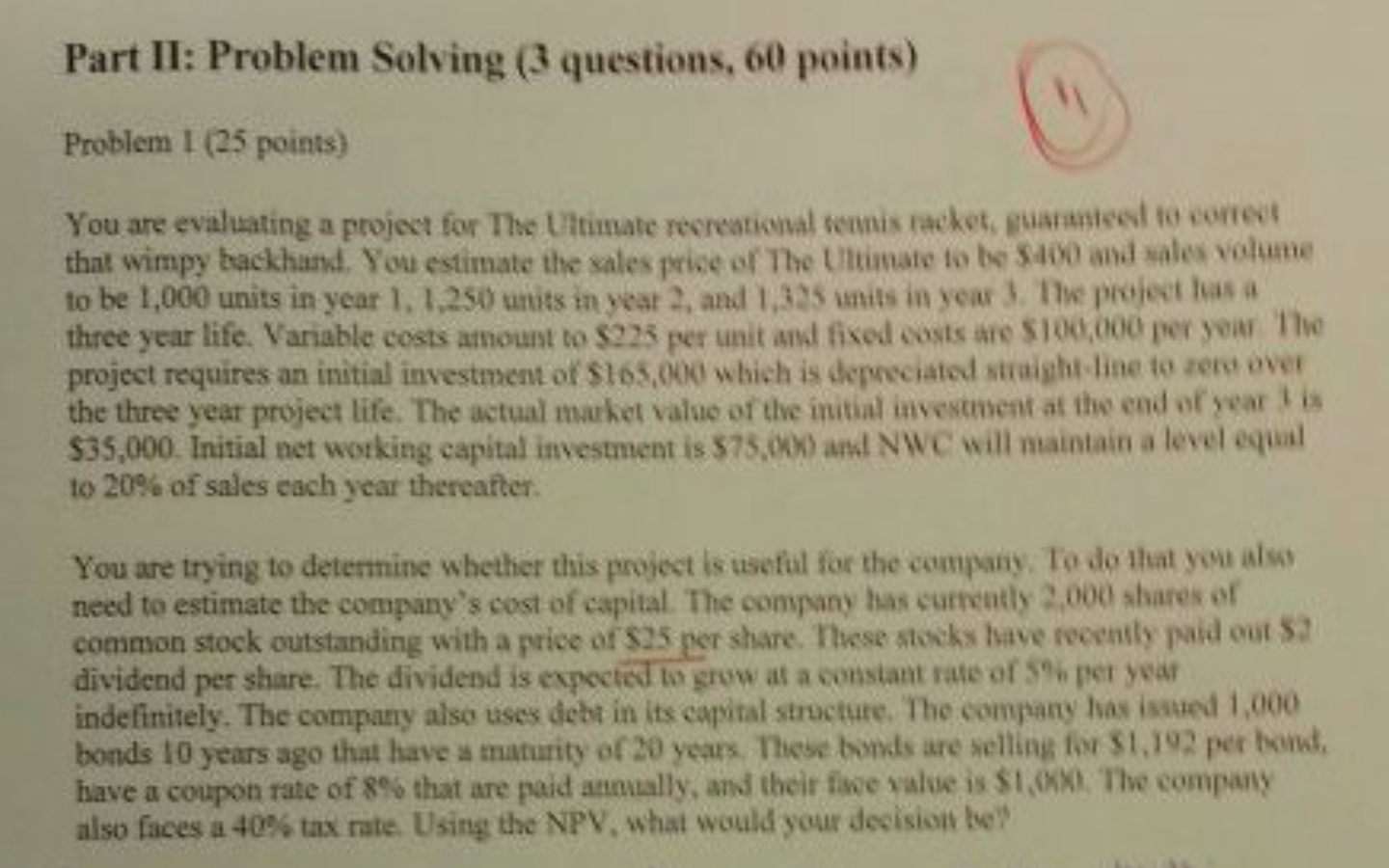

Part II: Problem Solving (3 questions, 60 points) Problem I (25 points) You are evaluating a project for The Ultimate recreational canis racket anteed to correct that wimpy backhand. You estimate the sales price of The Ultimate to be $400 and sales volume to be 1,000 units in year 1. 1.250 units in year 2 and 1335 units in year. The project as a three year life. Variable costs amount to $225 per unit and fixed costs are $100,000 per your The project requires an initial investment of $165.000 which is depreciated straight line to er over the three year project life. The actual market value of the initial investment at the end of years $35,000. Initial networking capital investment is 573,000) and NWC will maintain a level qual to 20% of sales each year thereafter. You are trying to determine whether this project is useful for the company. To do that you also need to estimate the company's cost of capital. The company has currently 2,000 shares or common stock outstanding with a price of $25 per share. These stocks lave recently paid out 2 dividend per share. The dividend is expected to grow at a constant rate of per year indefinitely. The company also uses debt in its capital structure. The company has issued 1,000 bonds 10 years ago that have a maturity of 20 years. These bonds are selling for $1.192 per bond have a coupon rate of 8% that are paid annually, and their five value is $1.0. The company also faces a 40% tax rate. Using the NPV, what would you decision be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts