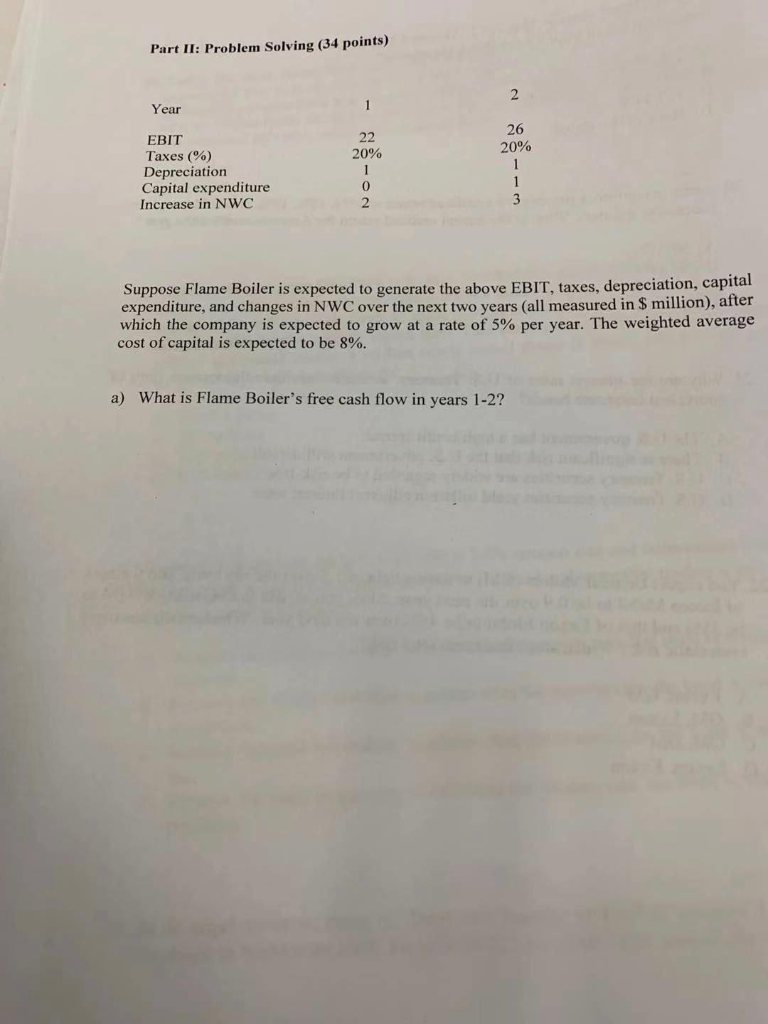

Question: Part II: Problem Solving (34 points) Year 20% EBIT Taxes (%) Depreciation Capital expenditure Increase in NWC Suppose Flame Boiler is expected to generate the

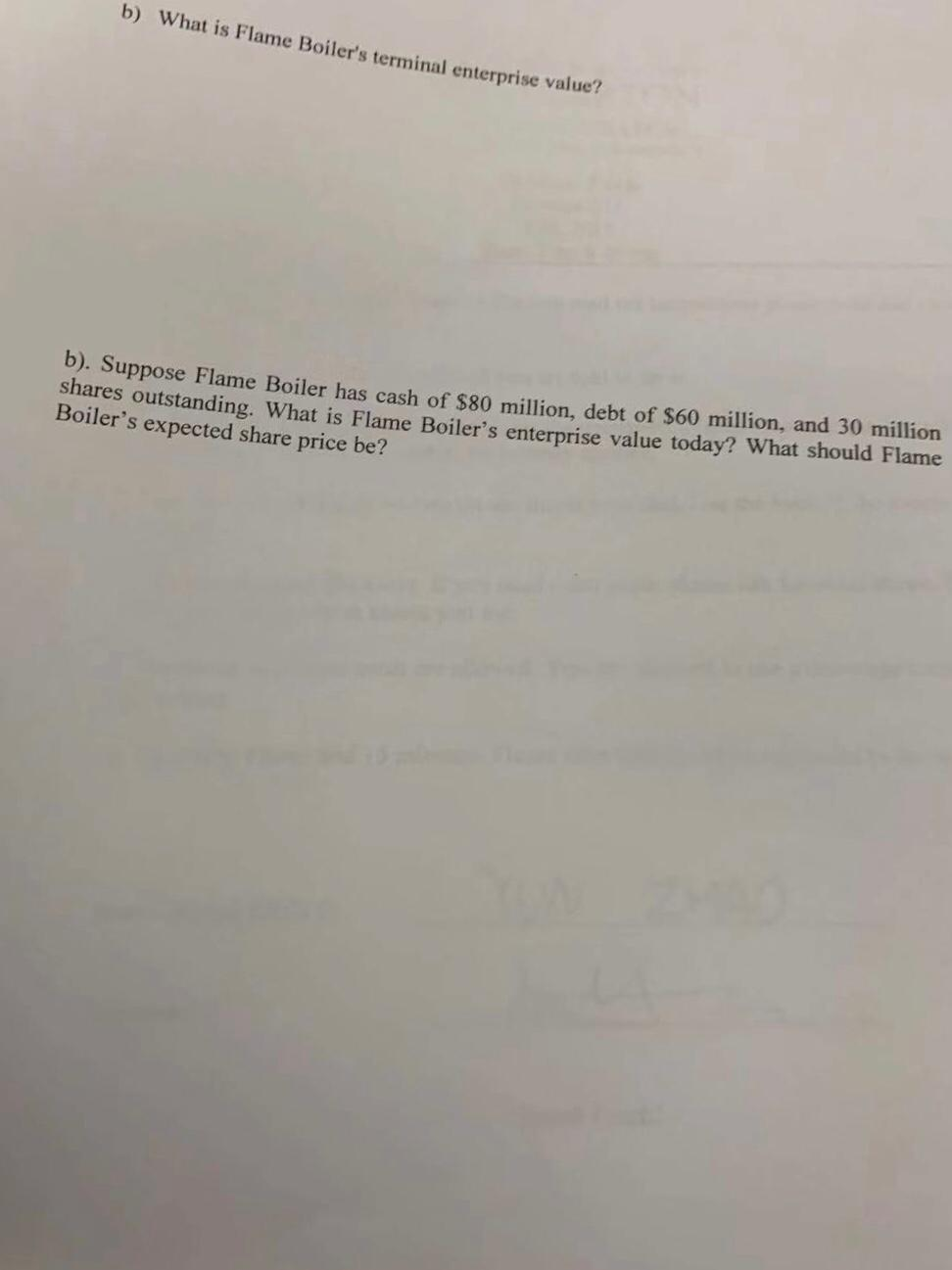

Part II: Problem Solving (34 points) Year 20% EBIT Taxes (%) Depreciation Capital expenditure Increase in NWC Suppose Flame Boiler is expected to generate the above EBIT, taxes, depreciation, capital expenditure, and changes in NWC over the next two years (all measured in $ million), after which the company is expected to grow at a rate of 5% per year. The weighted average cost of capital is expected to be 8%. a) What is Flame Boiler's free cash flow in years 1-2? b) What is Flame Boiler's terminal enterprise value? Flame Boiler has cash of $80 million, debt of $60 million, and 30 million outstanding. What is Flame Boiler's enterprise value today? What should Flame Boiler's expected share price be? Part II: Problem Solving (34 points) Year 20% EBIT Taxes (%) Depreciation Capital expenditure Increase in NWC Suppose Flame Boiler is expected to generate the above EBIT, taxes, depreciation, capital expenditure, and changes in NWC over the next two years (all measured in $ million), after which the company is expected to grow at a rate of 5% per year. The weighted average cost of capital is expected to be 8%. a) What is Flame Boiler's free cash flow in years 1-2? b) What is Flame Boiler's terminal enterprise value? Flame Boiler has cash of $80 million, debt of $60 million, and 30 million outstanding. What is Flame Boiler's enterprise value today? What should Flame Boiler's expected share price be

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts