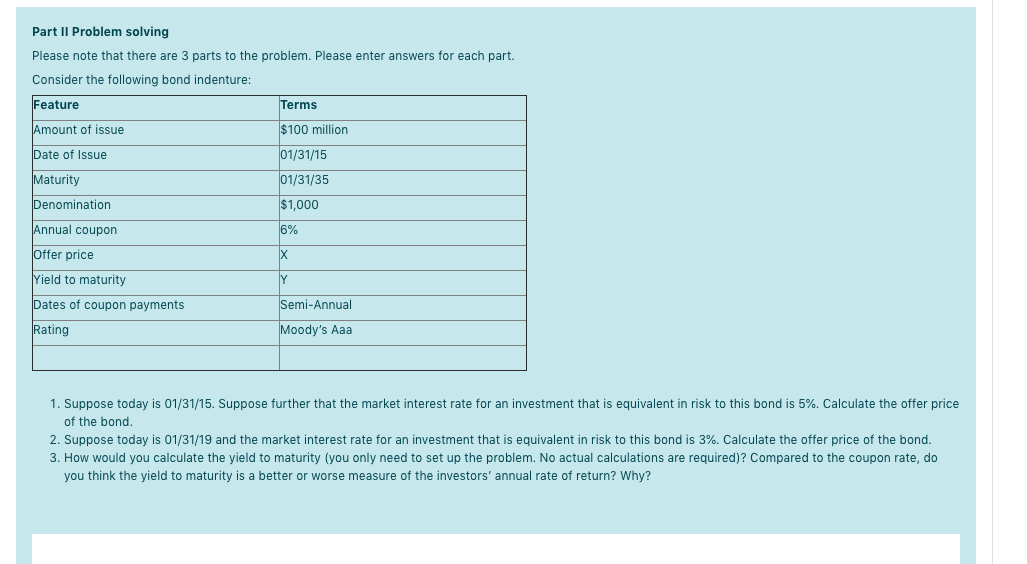

Question: Part II Problem solving Please note that there are 3 parts to the problem. Please enter answers for each part. Consider the following bond indenture:

Part II Problem solving Please note that there are 3 parts to the problem. Please enter answers for each part. Consider the following bond indenture: Feature Terms Amount of issue $100 million Date of Issue 01/31/15 Maturity 01/31/35 $1,000 Denomination Annual coupon 6% Offer price X IY Yield to maturity Dates of coupon payments Semi-Annual Rating Moody's Aaa 1. Suppose today is 01/31/15. Suppose further that the market interest rate for an investment that is equivalent in risk to this bond is 5%. Calculate the offer price of the bond. 2. Suppose today is 01/31/19 and the market interest rate for an investment that is equivalent in risk to this bond is 3%. Calculate the offer price of the bond. 3. How would you calculate the yield to maturity (you only need to set up the problem. No actual calculations are required)? Compared to the coupon rate, do you think the yield to maturity is a better or worse measure of the investors' annual rate of return? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts