Question: Part II - Problems and Multiple Choice - 2.5 points each. Total 20 points 1) Bauer Manufacturing uses departmental cost driver rates to allocate manufacturing

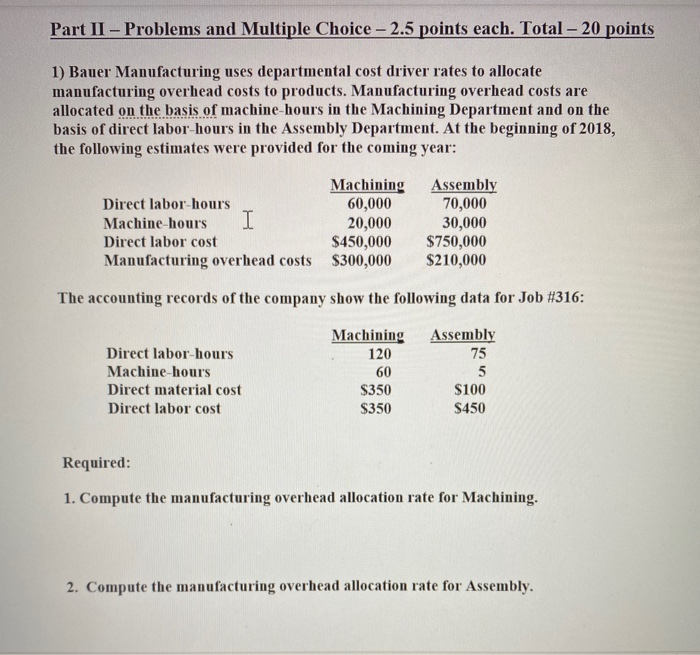

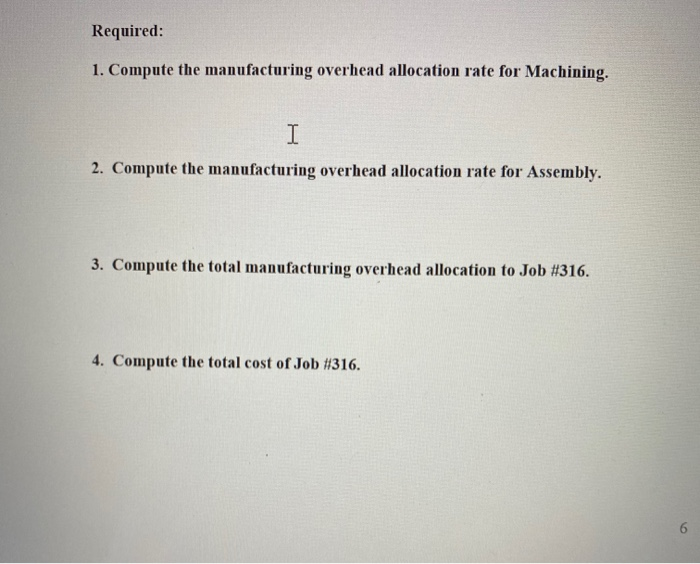

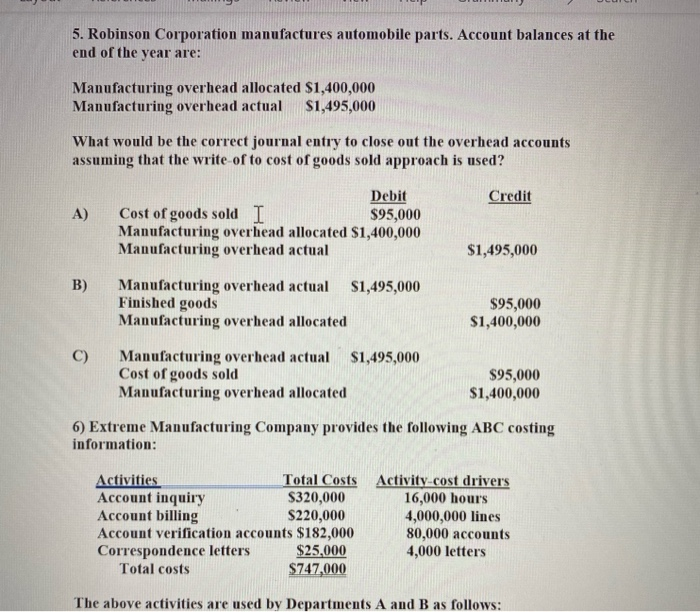

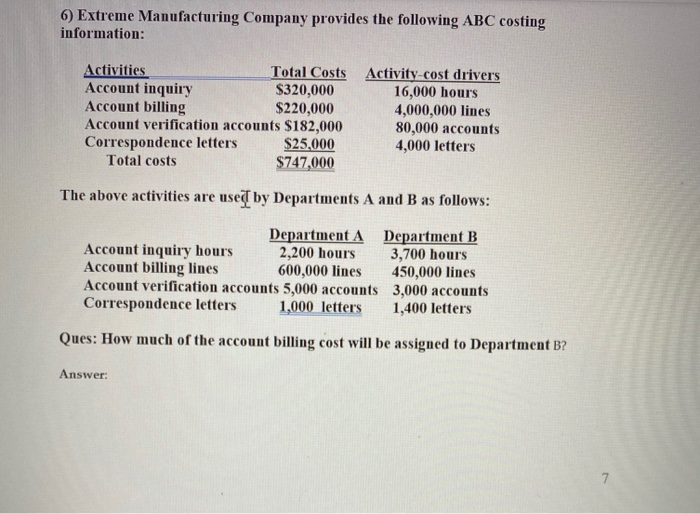

Part II - Problems and Multiple Choice - 2.5 points each. Total 20 points 1) Bauer Manufacturing uses departmental cost driver rates to allocate manufacturing overhead costs to products. Manufacturing overhead costs are allocated on the basis of machine-hours in the Machining Department and on the basis of direct labor-hours in the Assembly Department. At the beginning of 2018, the following estimates were provided for the coming year: Direct labor-hours Machine-hours I Direct labor cost Manufacturing overhead costs Machining 60,000 20,000 $450,000 $300,000 Assembly 70,000 30,000 $750,000 $210,000 The accounting records of the company show the following data for Job #316: Direct labor-hours Machine-hours Direct material cost Direct labor cost Machining 120 60 $350 $350 Assembly 75 5 $100 $450 Required: 1. Compute the manufacturing overhead allocation rate for Machining. 2. Compute the manufacturing overhead allocation rate for Assembly. Required: 1. Compute the manufacturing overhead allocation rate for Machining. I 2. Compute the manufacturing overhead allocation rate for Assembly. 3. Compute the total manufacturing overhead allocation to Job #316. 4. Compute the total cost of Job #1316. 5. Robinson Corporation manufactures automobile parts. Account balances at the end of the year are: Manufacturing overhead allocated $1,400,000 Manufacturing overhead actual $1,495,000 What would be the correct journal entry to close out the overhead accounts assuming that the write of to cost of goods sold approach is used? Credit A) Debit Cost of goods sold I $95,000 Manufacturing overhead allocated $1,400,000 Manufacturing overhead actual Manufacturing overhead actual $1,495,000 Finished goods Manufacturing overhead allocated $1,495,000 B) $95,000 $1,400,000 C) Manufacturing overhead actual $1,495,000 Cost of goods sold Manufacturing overhead allocated $95,000 $1,400,000 6) Extreme Manufacturing Company provides the following ABC costing information: Activities Total Costs Activity-cost drivers Account inquiry $320,000 16,000 hours Account billing $220,000 4,000,000 lines Account verification accounts $182,000 80,000 accounts Correspondence letters $25,000 4,000 letters Total costs $747,000 The above activities are used by Departments A and B as follows: 6) Extreme Manufacturing Company provides the following ABC costing information: Activities Total Costs Account inquiry $320,000 Account billing $220,000 Account verification accounts $182,000 Correspondence letters $25,000 Total costs $747,000 Activity-cost driver's 16,000 hours 4,000,000 lines 80,000 accounts 4,000 letters The above activities are used by Departments A and B as follows: Department A Department B Account inquiry hours 2,200 hours 3,700 hours Account billing lines 600,000 lines 450,000 lines Account verification accounts 5,000 accounts 3,000 accounts Correspondence letters 1,000 letters 1,400 letters Ques: How much of the account billing cost will be assigned to Department B

Step by Step Solution

There are 3 Steps involved in it

Lets solve the problems one by one 1 Compute the Manufacturing Overhead Allocation Rate for Machining Machining Department Overhead Costs 300000 Machi... View full answer

Get step-by-step solutions from verified subject matter experts