Question: Part II: Reverse Engineering Valuation Models 1. At the end of 2018, Dell was trading at $15.75. In its 10-K, Dell reported a book value

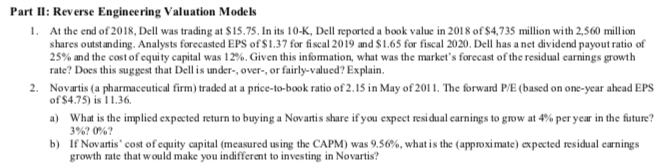

Part II: Reverse Engineering Valuation Models 1. At the end of 2018, Dell was trading at $15.75. In its 10-K, Dell reported a book value in 2018 of $4,735 million with 2,560 million shares outstanding. Analysts forecasted EPS of $1.37 for fiscal 2019 and $1.65 for fiscal 2020. Dell has a net dividend payout ratio of 25% and the cost of equity capital was 12%. Given this information, what was the market's forecast of the residual carnings growth rate? Does this suggest that Dellis under-, over-, or fairly-valued? Explain. 2. Novartis (a pharmaceutical firm) traded at a price-to-book ratio of 2.15 in May of 2011. The forward P/E (based on one-year ahead EPS of $4.75) is 11.36 a) What is the implied expected return to buying a Novartis share if you expect residual carnings to grow at 4% per year in the future? 3% 0%? b) If Novartis' cost of equity capital (measured using the CAPM) was 9.56%, what is the approximate) expected residual carnings growth rate that would make you indifferent to investing in Novartis? Part II: Reverse Engineering Valuation Models 1. At the end of 2018, Dell was trading at $15.75. In its 10-K, Dell reported a book value in 2018 of $4,735 million with 2,560 million shares outstanding. Analysts forecasted EPS of $1.37 for fiscal 2019 and $1.65 for fiscal 2020. Dell has a net dividend payout ratio of 25% and the cost of equity capital was 12%. Given this information, what was the market's forecast of the residual carnings growth rate? Does this suggest that Dellis under-, over-, or fairly-valued? Explain. 2. Novartis (a pharmaceutical firm) traded at a price-to-book ratio of 2.15 in May of 2011. The forward P/E (based on one-year ahead EPS of $4.75) is 11.36 a) What is the implied expected return to buying a Novartis share if you expect residual carnings to grow at 4% per year in the future? 3% 0%? b) If Novartis' cost of equity capital (measured using the CAPM) was 9.56%, what is the approximate) expected residual carnings growth rate that would make you indifferent to investing in Novartis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts