Question: Part II: Short-answer questions (10 points for each question, 10x5=50 points). 1. What is the most important function of the financial markets? (2 points) Please

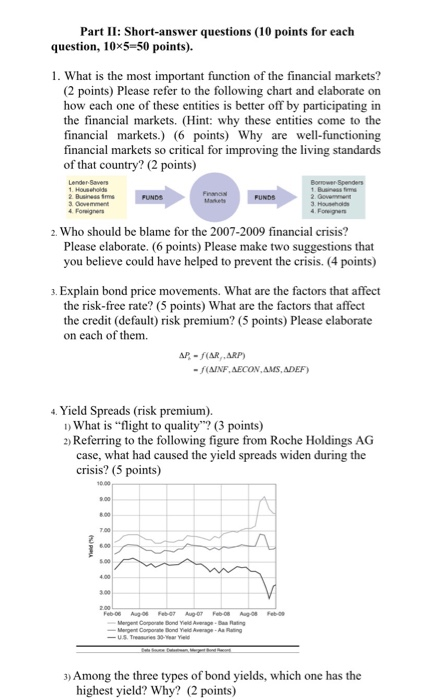

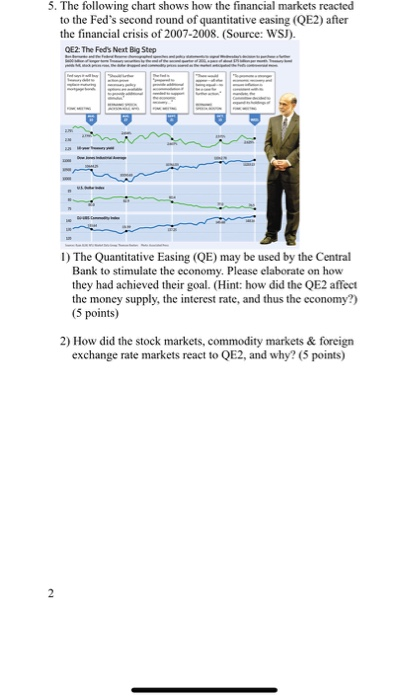

Part II: Short-answer questions (10 points for each question, 10x5=50 points). 1. What is the most important function of the financial markets? (2 points) Please refer to the following chart and elaborate on how each one of these entities is better off by participating in the financial markets. (Hint: why these entities come to the financial markets.) (6 points) Why are well-functioning financial markets so critical for improving the living standards of that country? (2 points) Borrower Spenders Lender Saver 2. Business 3. Clovement FUNDS FUNDS 2. Gent 3. Hoe 2. Who should be blame for the 2007-2009 financial crisis? Please elaborate. (6 points) Please make two suggestions that you believe could have helped to prevent the crisis. (4 points) 3. Explain bond price movements. What are the factors that affect the risk-free rate? (5 points) What are the factors that affect the credit (default) risk premium? (5 points) Please elaborate on each of them. AP - (AR, ARP) - SAINF AECON, AMS, ADEF) 4. Yield Spreads (risk premium). 1) What is "flight to quality"? (3 points) 2) Referring to the following figure from Roche Holdings AG case, what had caused the yield spreads widen during the crisis? (5 points) PA Mergent Corporate Bond Yield -Mergent Corpo Bond Y -USTY age. Bating e - Ang 3) Among the three types of bond yields, which one has the highest yield? Why? (2 points) 5. The following chart shows how the financial markets reacted to the Fed's second round of quantitative easing (QE2) after the financial crisis of 2007-2008. (Source: WSJ). QE2: The Feds Next Big Step 1) The Quantitative Easing (QE) may be used by the Central Bank to stimulate the economy. Please elaborate on how they had achieved their goal. (Hint: how did the QE2 affect the money supply, the interest rate, and thus the economy?) (5 points) 2) How did the stock markets, commodity markets & foreign exchange rate markets react to QE2, and why? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts