Question: Part III Advanced Cash Flow Analysis (30 points) Please round all answers to the closest integer, i.e. CF = $4,000, NPV = $98. Q1. Analysis

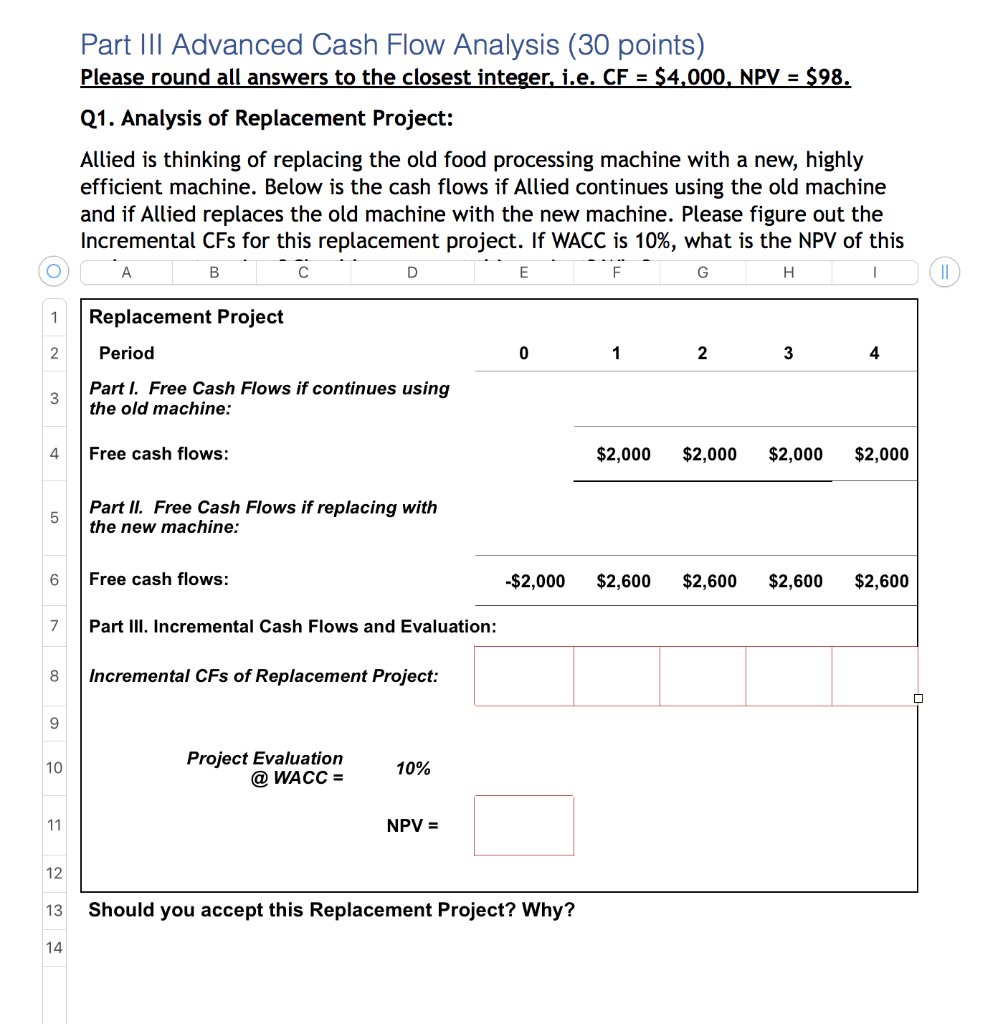

Part III Advanced Cash Flow Analysis (30 points) Please round all answers to the closest integer, i.e. CF = $4,000, NPV = $98. Q1. Analysis of Replacement Project: Allied is thinking of replacing the old food processing machine with a new, highly efficient machine. Below is the cash flows if Allied continues using the old machine and if Allied replaces the old machine with the new machine. Please figure out the Incremental CFs for this replacement project. If WACC is 10%, what is the NPV of this A D G . B F 1 Replacement Project 2 Period 0 1 2 3 4 3 Part I. Free Cash Flows if continues using the old machine: 4 Free cash flows: $2,000 $2,000 $2,000 $2,000 5 Part II. Free Cash Flows if replacing with the new machine: 6 Free cash flows: -$2,000 $2,600 $2,600 $2,600 $2,600 7 Part III. Incremental Cash Flows and Evaluation: 8 Incremental CFs of Replacement Project: 9 10 Project Evaluation @ WACC = 10% 11 11 NPV = 12 13 Should you accept this Replacement Project? Why? 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts