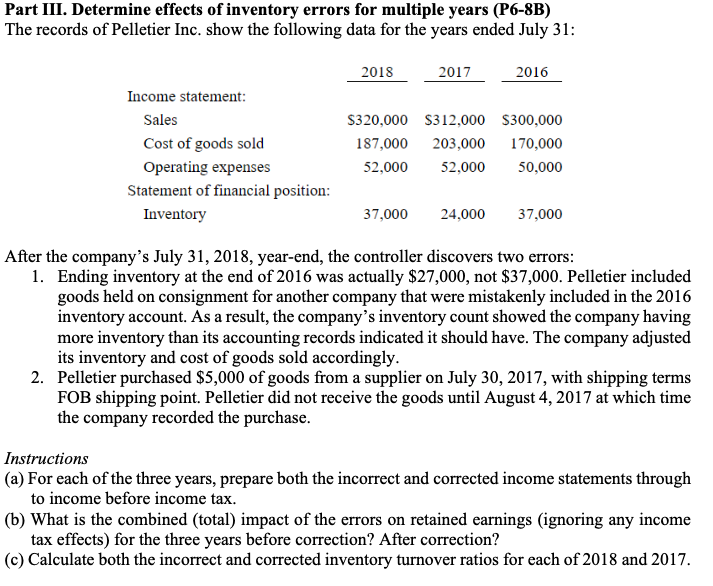

Question: Part III. Determine effects of inventory errors for multiple years (P6-8B) The records of Pelletier Inc. show the following data for the years ended July

Part III. Determine effects of inventory errors for multiple years (P6-8B) The records of Pelletier Inc. show the following data for the years ended July 31 : After the company's July 31, 2018, year-end, the controller discovers two errors: 1. Ending inventory at the end of 2016 was actually $27,000, not $37,000. Pelletier included goods held on consignment for another company that were mistakenly included in the 2016 inventory account. As a result, the company's inventory count showed the company having more inventory than its accounting records indicated it should have. The company adjusted its inventory and cost of goods sold accordingly. 2. Pelletier purchased $5,000 of goods from a supplier on July 30,2017 , with shipping terms FOB shipping point. Pelletier did not receive the goods until August 4, 2017 at which time the company recorded the purchase. Instructions (a) For each of the three years, prepare both the incorrect and corrected income statements through to income before income tax. (b) What is the combined (total) impact of the errors on retained earnings (ignoring any income tax effects) for the three years before correction? After correction? (c) Calculate both the incorrect and corrected inventory turnover ratios for each of 2018 and 2017. Part III. Determine effects of inventory errors for multiple years (P6-8B) The records of Pelletier Inc. show the following data for the years ended July 31 : After the company's July 31, 2018, year-end, the controller discovers two errors: 1. Ending inventory at the end of 2016 was actually $27,000, not $37,000. Pelletier included goods held on consignment for another company that were mistakenly included in the 2016 inventory account. As a result, the company's inventory count showed the company having more inventory than its accounting records indicated it should have. The company adjusted its inventory and cost of goods sold accordingly. 2. Pelletier purchased $5,000 of goods from a supplier on July 30,2017 , with shipping terms FOB shipping point. Pelletier did not receive the goods until August 4, 2017 at which time the company recorded the purchase. Instructions (a) For each of the three years, prepare both the incorrect and corrected income statements through to income before income tax. (b) What is the combined (total) impact of the errors on retained earnings (ignoring any income tax effects) for the three years before correction? After correction? (c) Calculate both the incorrect and corrected inventory turnover ratios for each of 2018 and 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts