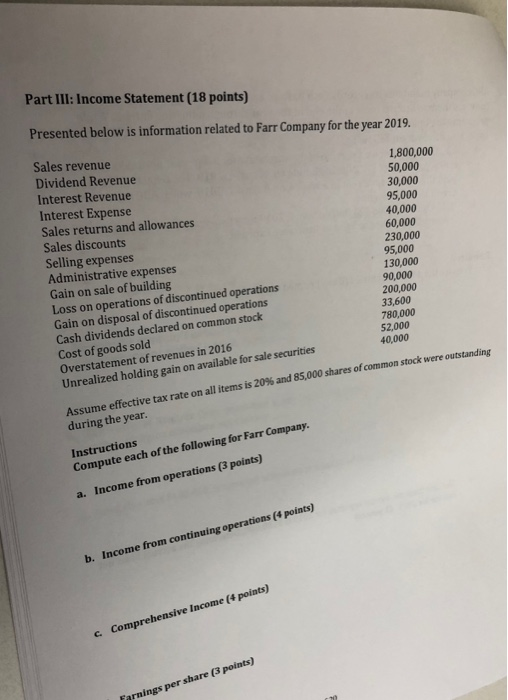

Question: Part III: Income Statement (18 points) Presented below is information related to Farr Company for the year 2019. 1,800,000 50,000 30,000 95,000 40,000 60,000 Sales

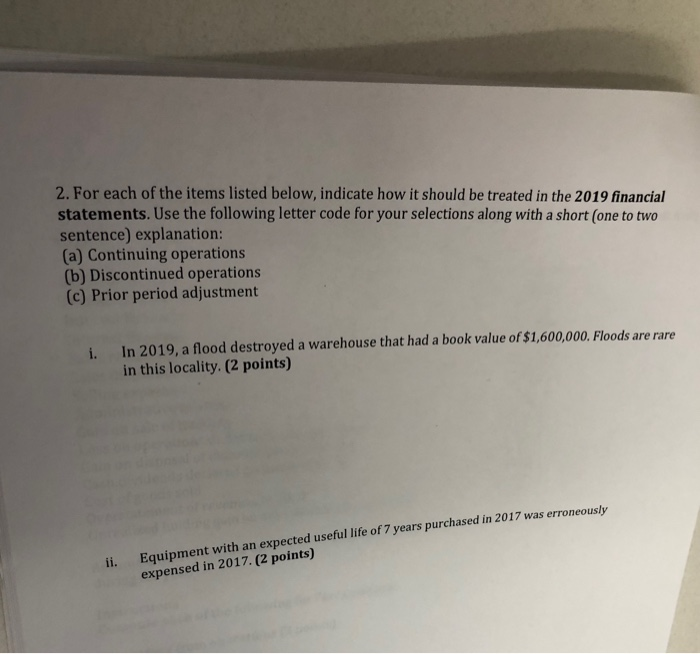

Part III: Income Statement (18 points) Presented below is information related to Farr Company for the year 2019. 1,800,000 50,000 30,000 95,000 40,000 60,000 Sales revenue Dividend Revenue Interest Revenue Interest Expense Sales returns and allowances Sales discounts Selling expenses Administrative expenses Gain on sale of building Loss on operations of discontinued operations Gain on disposal of discontinued operations Cash dividends declared on common stock 230,000 95,000 130,000 90,000 200,000 33,600 780,000 52,000 40,000 Cost of goods sold Overstatement of revenues in 2016 Unrealized holding gain on available for sale securities Assume effective tax rate on all items is 20% and 85,000 shares of common stock were outstanding during the year. Instructions Compute each of the following for Farr Company. a. Income from operations (3 points) b. Income from continuing operations (4 points) c. Comprehensive Income (4 points) Farnings per share (3 points) 2. For each of the items listed below, indicate how it should be treated in the 2019 financial statements. Use the following letter code for your selections along with a short (one to two sentence) explanation: (a) Continuing operations (b) Discontinued operations (c) Prior period adjustment 1. In 2019, a flood destroyed a warehouse that had a book value of $1,600,000. Floods are rare in this locality. (2 points) ii. Equipment with an expected useful life of 7 years purchased in 2017 was erroneously expensed in 2017. (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts