Question: PART III: Longer Open-ended Problems (each question worth 2.4 points) Instructions: Determine a solution for each problem. Enter your final numerical answer on the THPS-2

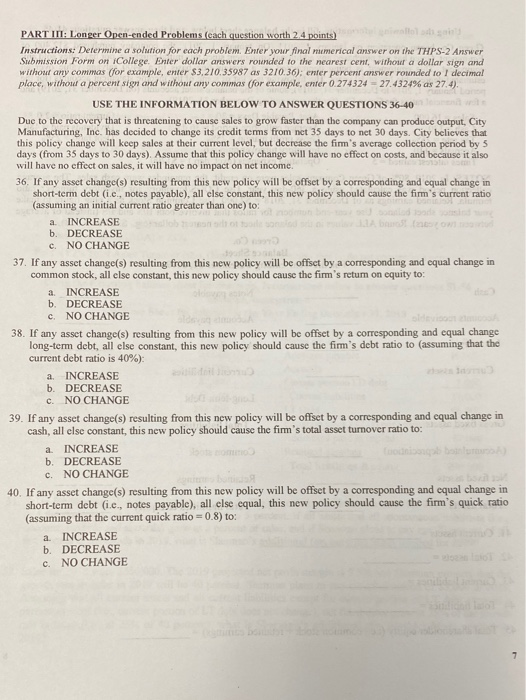

PART III: Longer Open-ended Problems (each question worth 2.4 points) Instructions: Determine a solution for each problem. Enter your final numerical answer on the THPS-2 Answer Submission Form on College. Enter dollar answers rounded to the nearest cent, without a dollar sign and without any commas (for example, enter $3,210.35987 as 3210.36): enter percent answer rounded to / decimal place, without a percent sign and without any commas (for example, enter 0.274324 = 27.4324% as 27.4). USE THE INFORMATION BELOW TO ANSWER QUESTIONS 36-40 Due to the recovery that is threatening to cause sales to grow faster than the company can produce output, City Manufacturing, Inc. has decided to change its credit terms from net 35 days to net 30 days. City believes that this policy change will keep sales at their current level, but decrease the firm's average collection period by 5 days (from 35 days to 30 days). Assume that this policy change will have no effect on costs, and because it also will have no effect on sales, it will have no impact on net income. 36. If any asset change(s) resulting from this new policy will be offset by a corresponding and equal change in short-term debt (i.c., notes payable), all else constant, this new policy should cause the firm's current ratio (assuming an initial current ratio greater than one) to: a INCREASE b. DECREASE c. NO CHANGE 37. If any asset change(s) resulting from this new policy will be offset by a corresponding and cqual change in common stock, all else constant, this new policy should cause the firm's return on equity to: INCREASE b. DECREASE NO CHANGE 38. If any asset chango(s) resulting from this new policy will be offset by a corresponding and equal change long-term debt, all else constant, this new policy should cause the firm's debt ratio to (assuming that the current debt ratio is 40%): a. INCREASE b. DECREASE C. NO CHANGE 39. If any asset change(s) resulting from this new policy will be offset by a corresponding and equal change in cash, all else constant, this new policy should cause the firm's total asset turnover ratio to: a INCREASE redning b. DECREASE c. NO CHANGE 40. If any asset change(s) resulting from this new policy will be offset by a corresponding and equal change in short-term debt (ie, notes payable), all else equal, this new policy should cause the firm's quick ratio (assuming that the current quick ratio=0.8) to: a INCREASE b. DECREASE NO CHANGE c c 7

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts