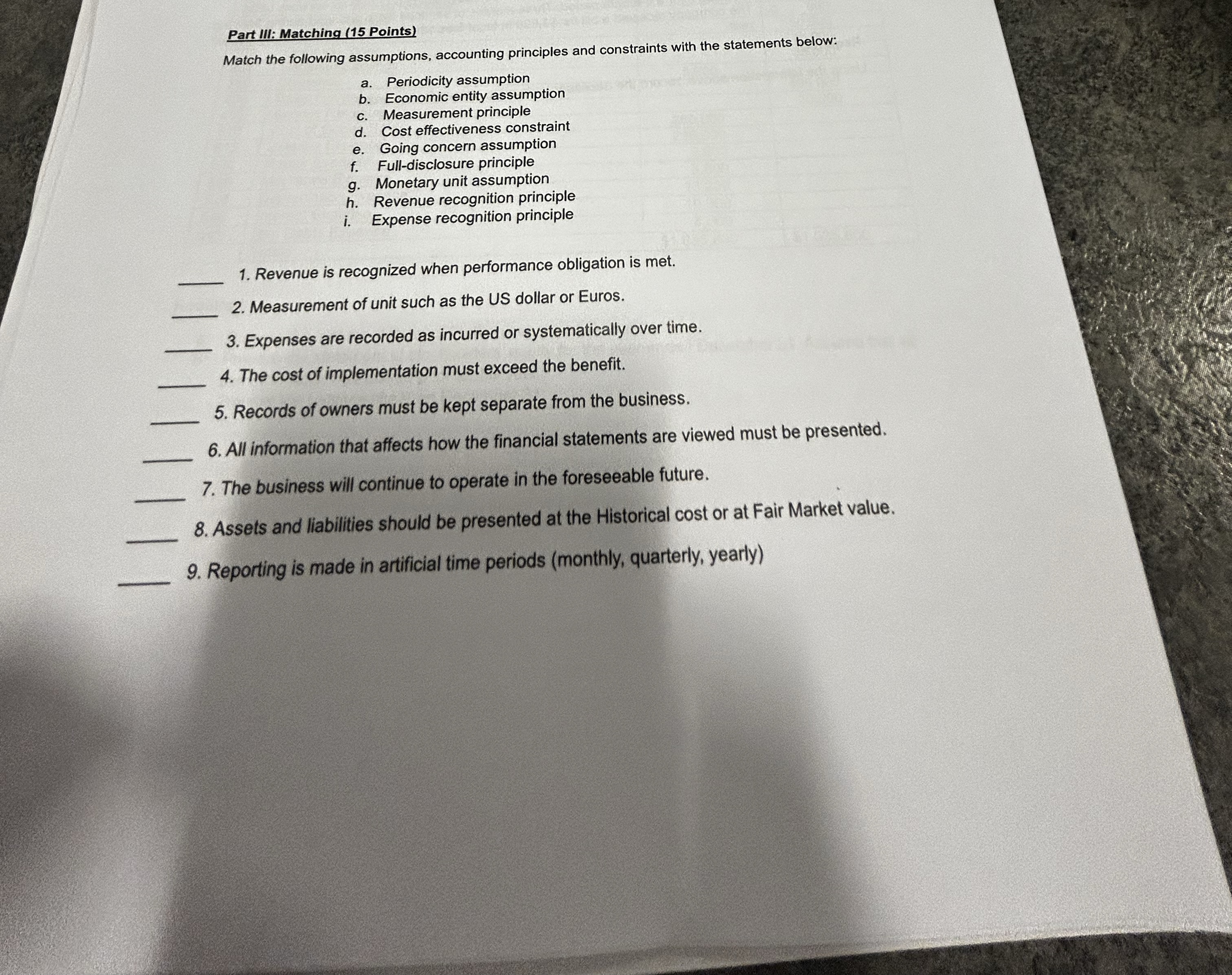

Question: Part III: Matching ( 1 5 Points ) Match the following assumptions, accounting principles and constraints with the statements below: a . Periodicity assumption b

Part III: Matching Points

Match the following assumptions, accounting principles and constraints with the statements below:

a Periodicity assumption

b Economic entity assumption

c Measurement principle

d Cost effectiveness constraint

e Going concern assumption

f Fulldisclosure principle

g Monetary unit assumption

h Revenue recognition principle

i Expense recognition principle

Revenue is recognized when performance obligation is met.

Measurement of unit such as the US dollar or Euros.

Expenses are recorded as incurred or systematically over time.

The cost of implementation must exceed the benefit.

Records of owners must be kept separate from the business.

All information that affects how the financial statements are viewed must be presented.

The business will continue to operate in the foreseeable future.

Assets and liabilities should be presented at the Historical cost or at Fair Market value.

Reporting is made in artificial time periods monthly quarterly, yearly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock