Question: PART IV: CASE STUDY (Total 36 marks, 2 marks each) CASE STUDY: THE BOHO RESTAURANT The difference between well managed restaurants and not so well

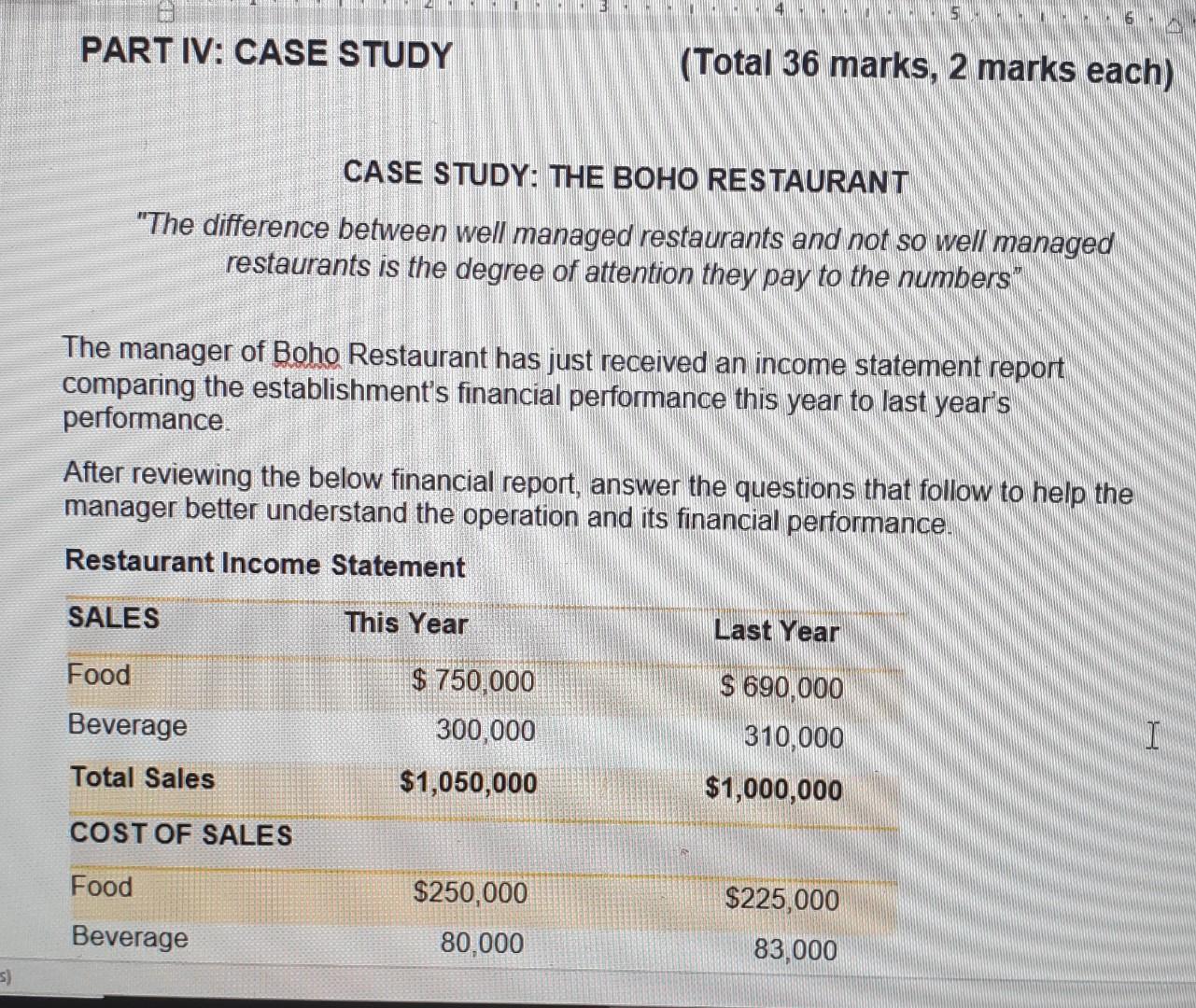

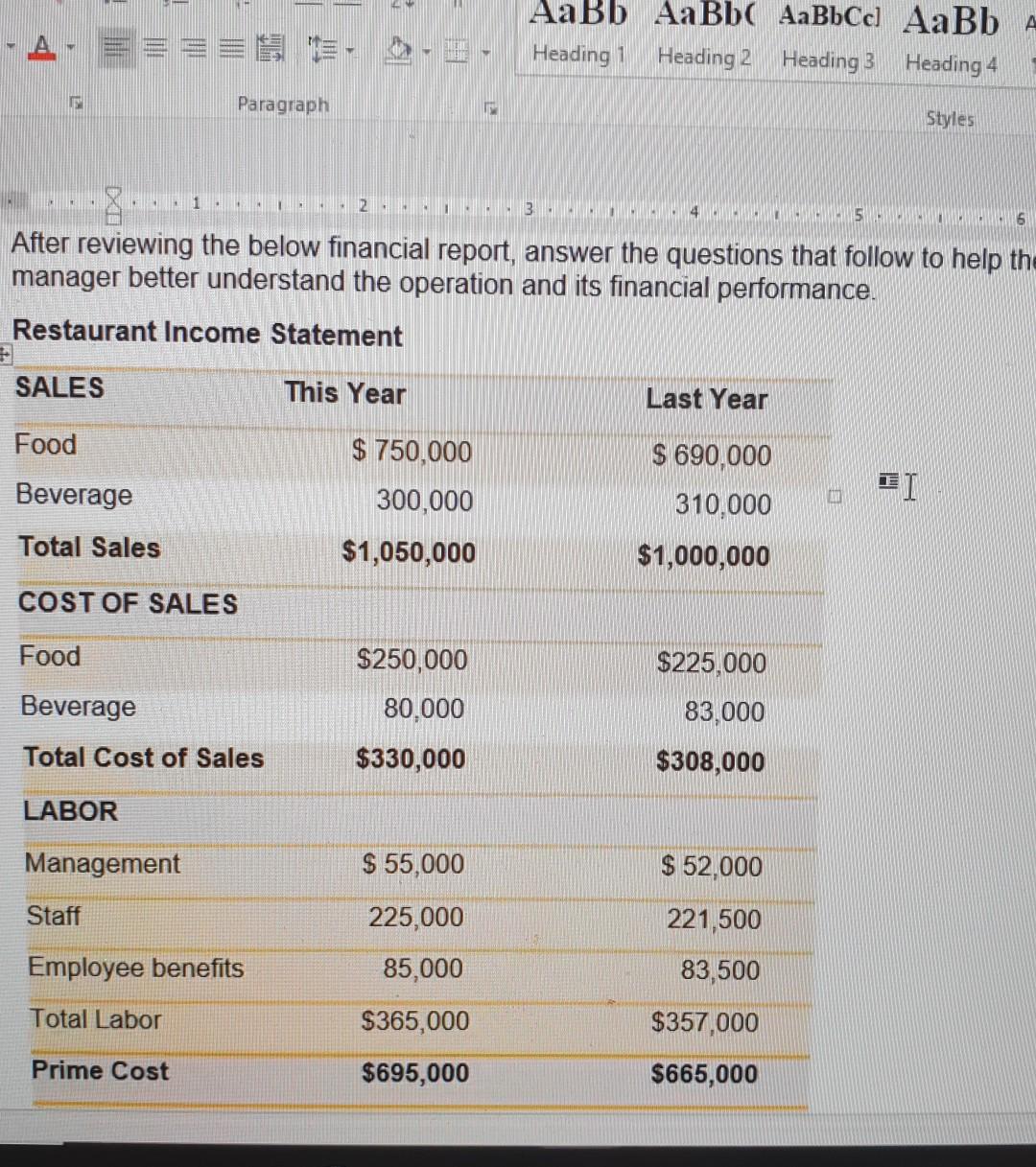

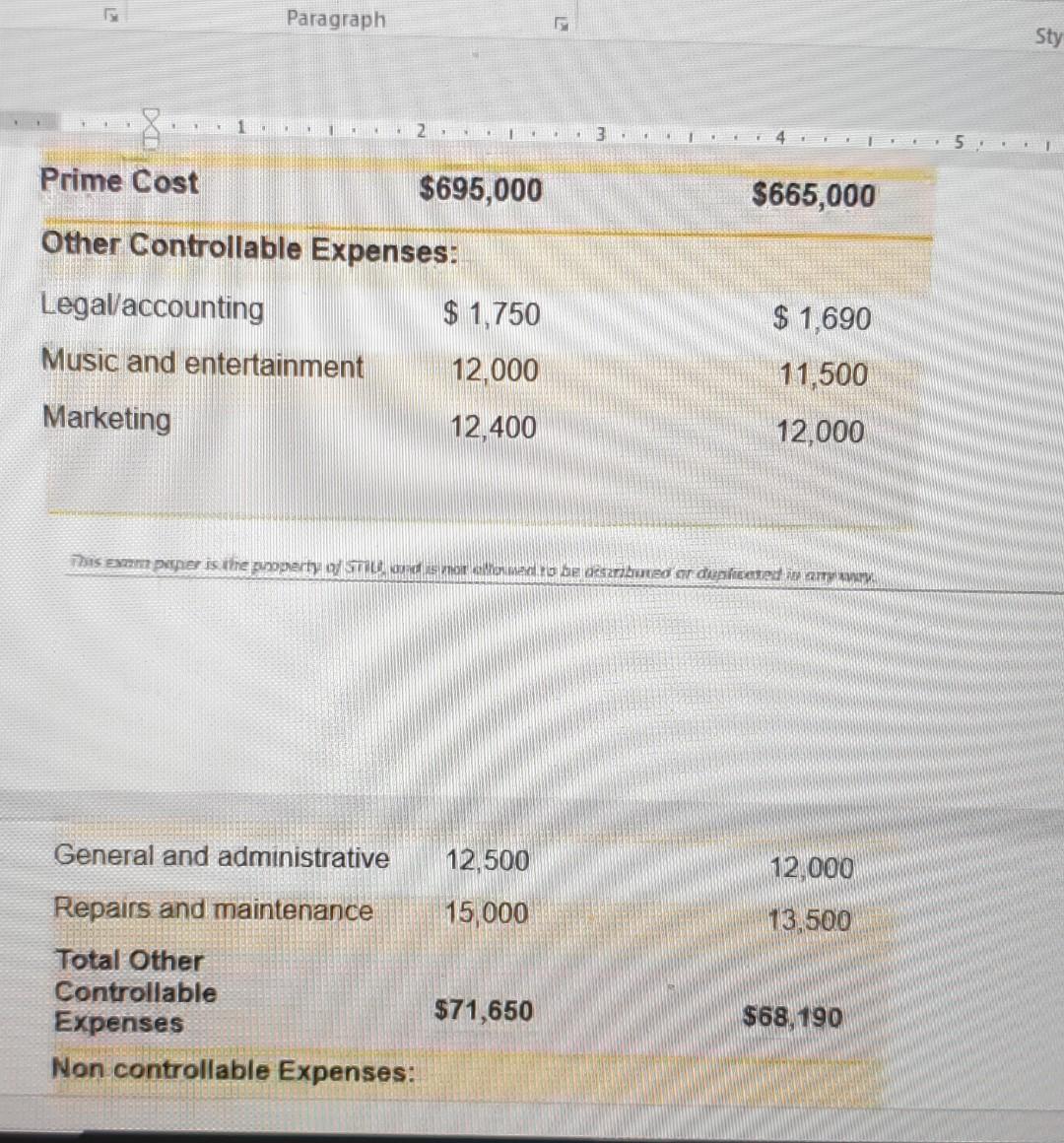

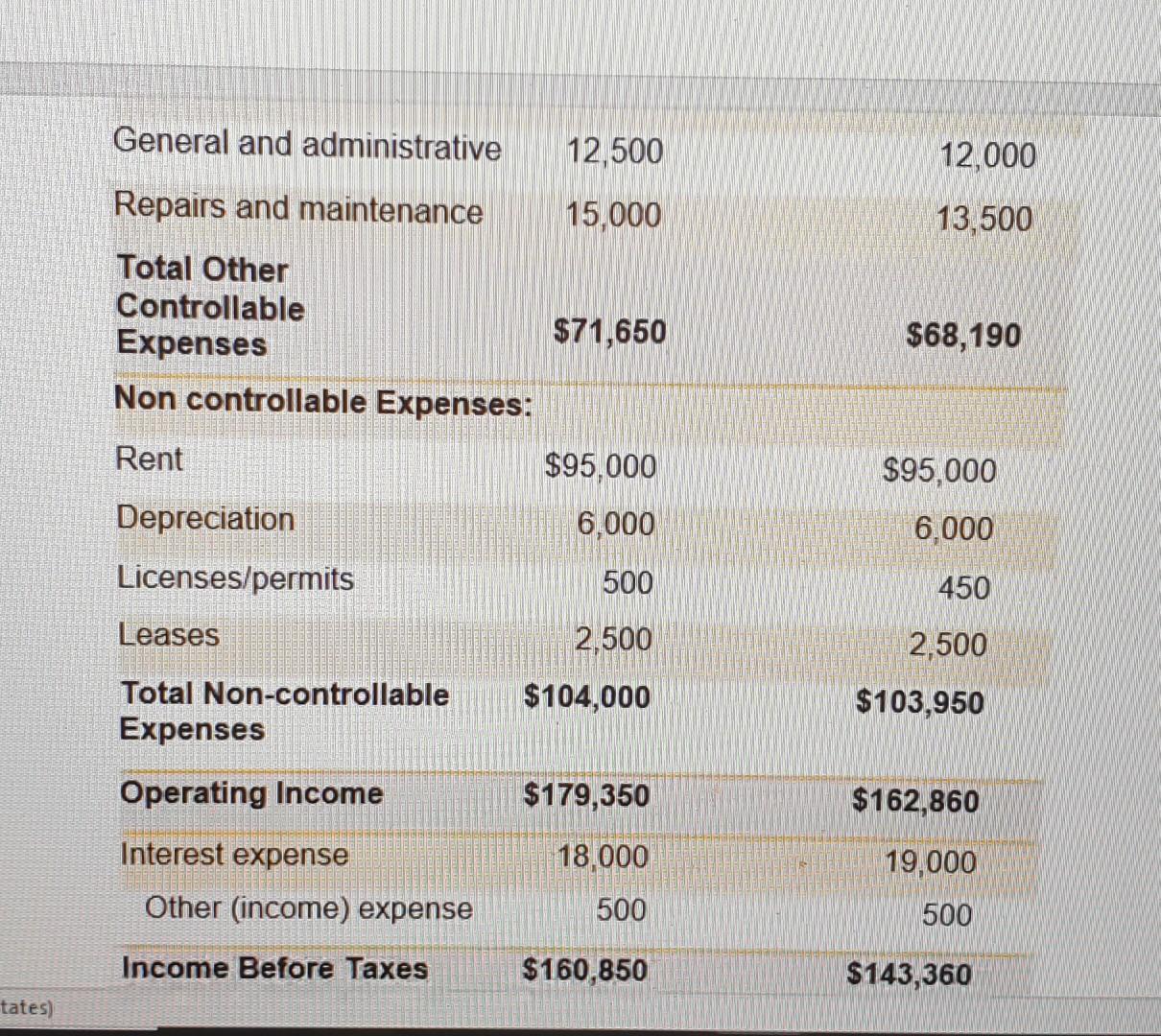

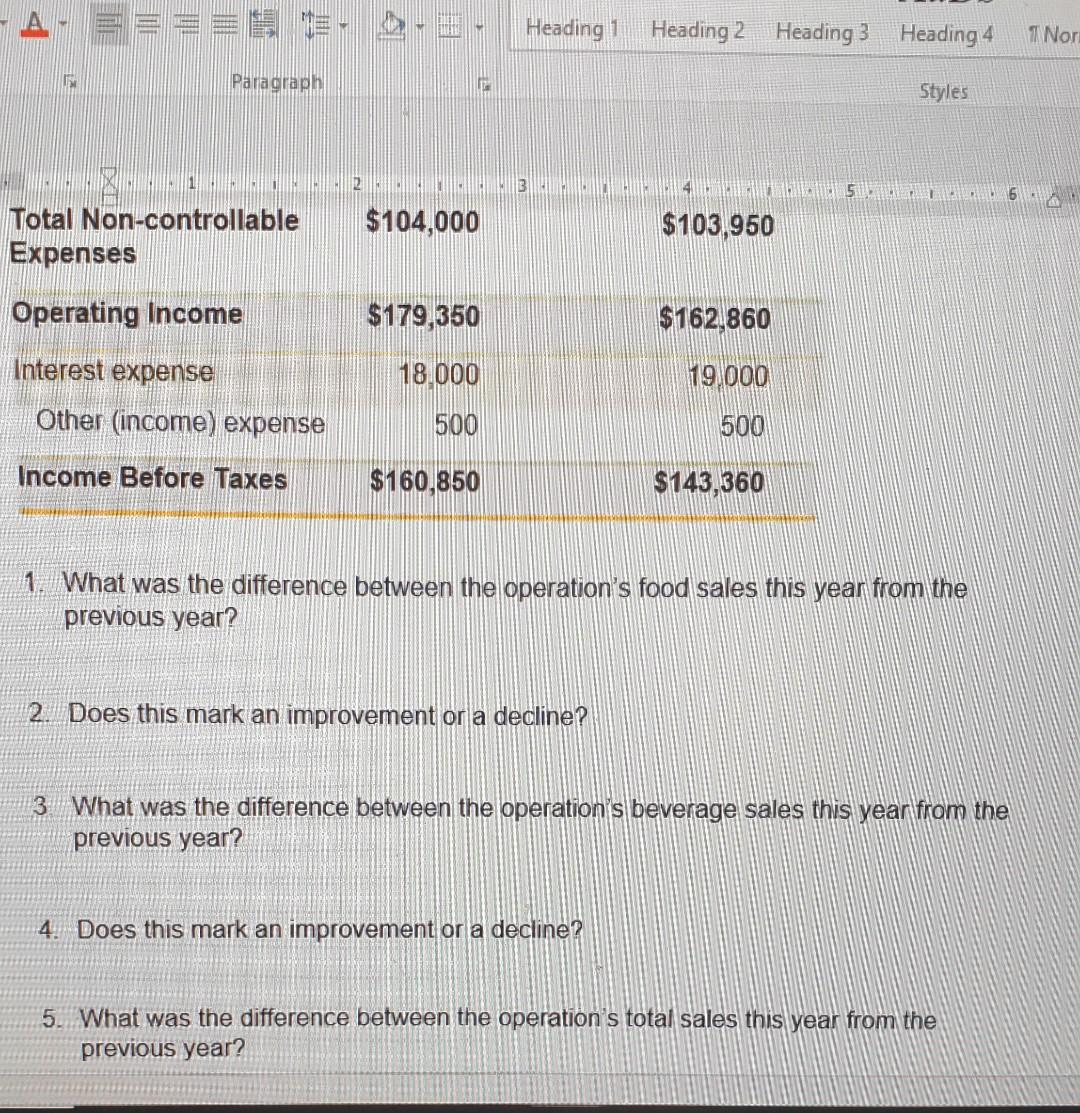

PART IV: CASE STUDY (Total 36 marks, 2 marks each) CASE STUDY: THE BOHO RESTAURANT "The difference between well managed restaurants and not so well managed restaurants is the degree of attention they pay to the numbers The manager of Boho Restaurant has just received an income statement report comparing the establishment's financial performance this year to last year's performance After reviewing the below financial report, answer the questions that follow to help the manager better understand the operation and its financial performance. Restaurant Income Statement SALES This Year Last Year Food $ 750,000 Beverage 300,000 $ 690,000 310,000 $1,000,000 I Total Sales $1,050,000 COST OF SALES Food $250,000 $225,000 Beverage 80,000 83,000 s) - A - E'DE - . AaBb AaBb( AaBbCc AaBbA Heading 1 Heading 2 Heading 3 Heading 4 Paragraph Styles INI 123 5 6 After reviewing the below financial report, answer the questions that follow to help the manager better understand the operation and its financial performance. Restaurant Income Statement SALES This Year Last Year Food $ 750,000 300,000 THE Beverage $ 690,000 310,000 $1,000,000 Total Sales $1,050,000 COST OF SALES Food $250,000 80,000 $330,000 $225,000 83,000 Beverage Total Cost of Sales $308,000 LABOR Management $ 55,000 $ 52,000 Staff 225,000 221,500 Employee benefits 85,000 83,500 Total Labor $365,000 $357,000 Prime Cost $695,000 $665,000 Paragraph Sty 1 2 3 . 41 Prime Cost $695,000 $665,000 Other Controllable Expenses: $ 1,750 Legal/accounting Music and entertainment $ 1,690 12,000 11,500 Marketing 12,400 12,000 THIS EX peper is the property of STILO is more to be described ar duplicated in a General and administrative 12,500 12,000 Repairs and maintenance 15,000 13.500 Total Other Controllable Expenses Non controllable Expenses: $71,650 $68, 190 General and administrative 12,500 12,000 Repairs and maintenance 15,000 13,500 Total Other Controllable Expenses Non controllable Expenses: $71,650 $68,190 Rent $95.000 $95,000 6,000 Depreciation 6,000 500 450 Licenses/permits Leases 2,500 2,500 Total Non-controllable Expenses $104,000 $103,950 Operating Income $179,350 $162,860 18.000 19,000 Interest expense Other (income) expense 500 500 Income Before Taxes $160,850 $143,360 tates) -A- Heading 1 Heading 2 Heading 3 Heading 4 Nor Paragraph Styles 2 3 6 Total Non-controllable Expenses $104,000 $103,950 Operating Income $179,350 $162,860 19.000 Interest expense Other (income) expense 18.000 500 500 Income Before Taxes $160,850 $143,360 1. What was the difference between the operation's food sales this year from the previous year? 2. Does this mark an improvement or a decline? 3. What was the difference between the operation's beverage sales this year from the previous year? 4. Does this mark an improvement or a decline? 5. What was the difference between the operation's total sales this year from the previous year? 5 1. What was the difference between the operation's food sales this year from the previous year? 2. Does this mark an improvement or a decline? 3. What was the difference between the operation's beverage sales this year from the previous yea 4. Does this mark an improvement or a decline? 5. What was the difference between the operation's total sales this year from the previous year? 6. Does this mark an improvement or a decline? 6 10. By how much? 11. What was the amount of increase in management costs this year compared to last year? 12. What was the amount of increase in staff costs this year compared to last year? 13. What was the amount of increase in total labor costs this year compared to last year? 14. In what area or areas were this year's expense less than last year's expense? I 15. What was the amount of profit made in the establishment this year? 16. What was the amount of profit made last year? 17. Why do you think the operation's cost of sales food this year is higher than last year? 16. What was the amount of profit made last year? 17. Why do you think the operation's cost of sales food this year is higher than last year? 18. Why do you think the operation's cost of sales beverage this year is lower than last year

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock