Question: PART IV - COMPLETE THE FOL NUMBERED 1 6 - 2 0 . Show all of your work to receive full and / or partial

PART IV COMPLETE THE FOL

NUMBERED Show all of your work to receive full andor partial credit.

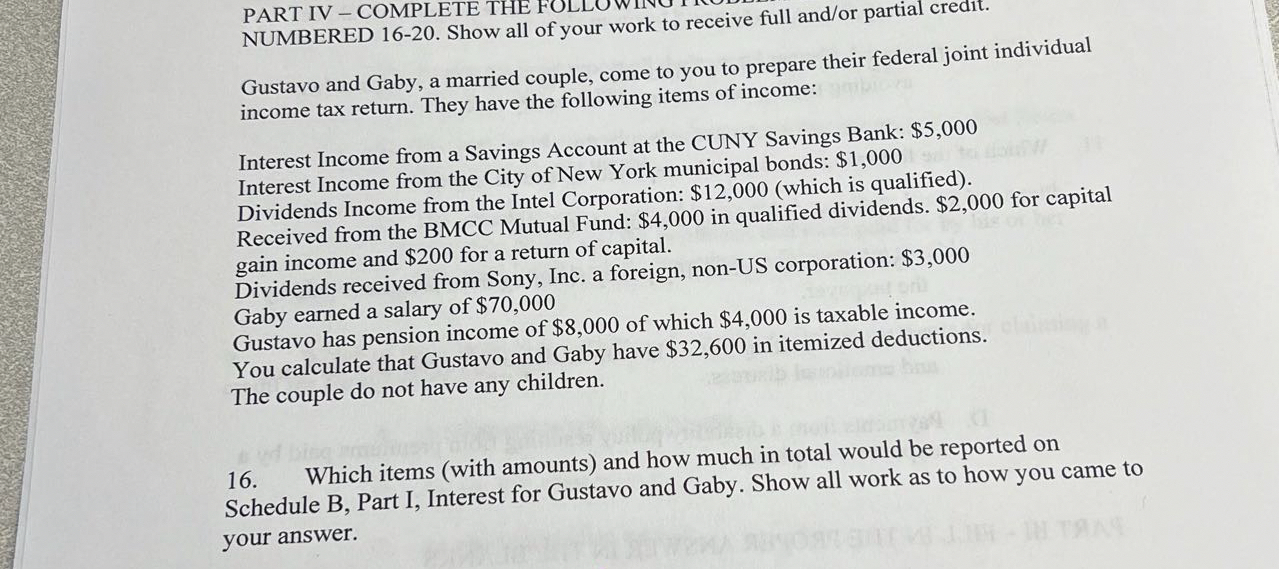

Gustavo and Gaby, a married couple, come to you to prepare their federal joint individual

income tax return. They have the following items of income:

Interest Income from a Savings Account at the CUNY Savings Bank: $

Interest Income from the City of New York municipal bonds: $

Dividends Income from the Intel Corporation: $which is qualified

Received from the BMCC Mutual Fund: $ in qualified dividends. $ for capital

gain income and $ for a return of capital.

Dividends received from Sony, Inc. a foreign, nonUS corporation: $

Gaby earned a salary of $

Gustavo has pension income of $ of which $ is taxable income.

You calculate that Gustavo and Gaby have $ in itemized deductions.

The couple do not have any children.

Which items with amounts and how much in total would be reported on

Schedule B Part I, Interest for Gustavo and Gaby. Show all work as to how you came to

your answer.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock