Question: Part L Multiple choice Clearly write the best answer in the following table. Each problem is worth points for a total of 6 questions. No

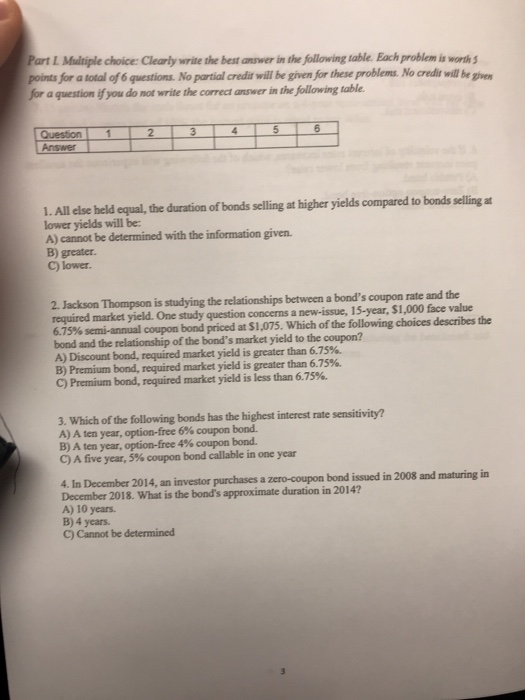

Part L Multiple choice Clearly write the best answer in the following table. Each problem is worth points for a total of 6 questions. No partial credit will be given for these problems. No credit will be give Jor a question ifyou do not write the correct answer in the following table. Answer 1. All else held equal, the duration of bonds selling at higher yields compared to bonds selling at lower yields will be: A) cannot be determined with the information given B) greater. C) lower 2. Jackson Thompson is studying the relationships between a bond's coupon rate and the required market yield. One study question concerns a new-issue, 15-year, $1,000 face value 6.75% semi-annual coupon bond priced at Si 075 which of the following choices describes the bond and the relationship of the bond's market yield to the coupon? A) Discount bond, required market yield is greater than 675%. B) Premium bond, required market yield is greater than 6.75% C) Premium bond, required market yield is less than 6.75% 3. Which of the following bonds has the highest interest rate sensitivity? A) A ten year, option-free 6% coupon bond. B)Aten year, option-free 4% coupon bond. c) A five year, 5% coupon bond callable in one year 4. In December 2014, an investor purchases a zero-coupon bond issued in 2008 and maturing in December 2018. What is the bond's approximate duration in 2014? A) 10 years B) 4 years. C) Cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts