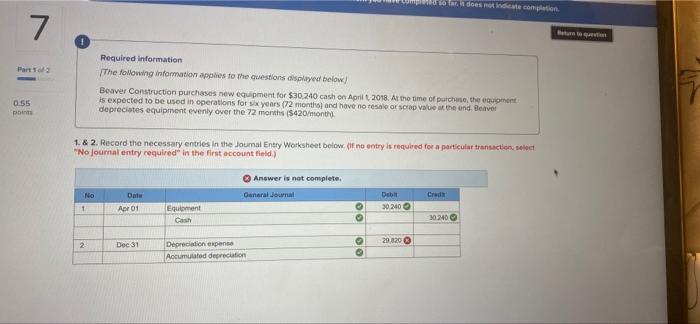

Question: part one and 2 help for does not inte completion 7 ! Part 1 Required information The following information applies to the questions displayed below)

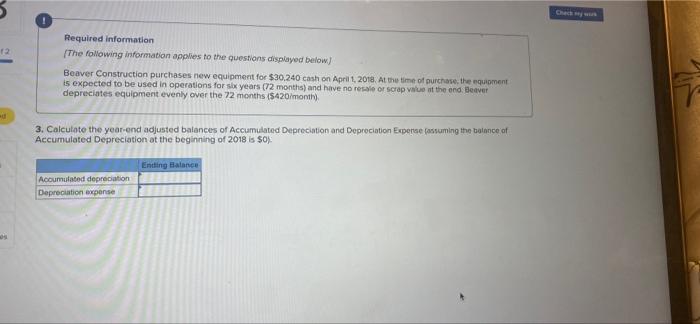

for does not inte completion 7 ! Part 1 Required information The following information applies to the questions displayed below) Beaver Construction purchases new equipment for $30.240 cash on April 2018. At the time of purchase the equipment is expected to be used in operations for six years (72 months and have no resale or scrap Value at the end. Belvet depreciates equipment evenly over the 72 months (5420/month 0.55 po 1. & 2. Record the necessary entries in the Joumal Entry Worksheet below of no entry is required for a particular transactions "No journal entry required in the first account field) Answer is not complete No Date General Journal Debe Cred 1 Apr 01 3020 Equipment Cash 30.240 29.320 2 Dec 31 Depreciation expense Accumulated depreciation 12 Required information The following information applies to the questions displayed below) Beaver Construction purchases new equipment for $30.240 cash on April 1, 2018. At the time of purchase the equament is expected to be used in operations for six years (72 months) and have no resale or scrap value at the end Beaver depreciates equipment evenly over the 72 months (5420/month) 3. Calculate the year and adjusted balances of Accumulated Depreciation and Depreciation Experse assuming the balance of Accumulated Depreciation at the beginning of 2018 is $0): Enting Balance Acumulated depreciation Depreciation expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts